2007 Annual Report - Sappi

2007 Annual Report - Sappi

2007 Annual Report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chief financial officer’s report continued<br />

The group has exercised options to acquire the assets currently<br />

leased in terms of the Somerset PM3 and the Westbrook<br />

biomass boiler leases shown above. We expect to finance these<br />

acquisitions (together costing approximately US$95 million)<br />

with debt and to bring these assets onto the balance sheet<br />

during fiscal 2008.<br />

by a <strong>Sappi</strong> Limited guarantee. For this reason the first two of<br />

the three covenants mentioned below are measured on a<br />

consolidated group level.<br />

• Net debt to adjusted total capitalisation (on a basis agreed<br />

with our lenders) should not exceed 65%.<br />

The Forest Products securitisation programme involves the<br />

outright sale of receivables to a financing vehicle and we expect<br />

this funding to remain off-balance sheet for the foreseeable<br />

future. For more information on this programme, please refer<br />

to Note 17 to the Financial Statements.<br />

Interest on borrowings<br />

To compare our borrowing costs with market rates, we convert<br />

interest rates on all debt to US Dollar equivalent rates. The<br />

resulting interest rate is currently 5.38% before taking account<br />

of interest rate swaps taken up to swap US$857 million of<br />

borrowings from fixed to floating interest rates.<br />

The average tenure of our debt is 6.6 years. Compared with<br />

the current seven-year US Dollar swap rate (a benchmark rate<br />

at which blue chip credits transact in longer term maturities) of<br />

4.84%, our average interest cost is 54 basis points above the<br />

swap rate.<br />

The fixed to floating interest rate swaps increase the total<br />

interest cost to 5.64%, which is 80 basis points above the<br />

seven-year US Dollar swap rate.<br />

We expect that in current market circumstances, and based on<br />

our current credit ratings, raising new debt or replacing existing<br />

debt would be at higher margins than we are currently paying.<br />

Interest rate risk<br />

The group has a policy of maintaining a balance between fixed<br />

and variable rate loans which we believe minimises the impact<br />

of borrowing costs on reported earnings. At present hedging<br />

activity in relation to borrowings is restricted to interest rate<br />

swaps and where appropriate, cross-currency swaps.<br />

In the financial year no further interest rate swaps were concluded<br />

and, at year end, the ratio of gross debt at fixed and floating<br />

interest rates was 45:55 respectively.<br />

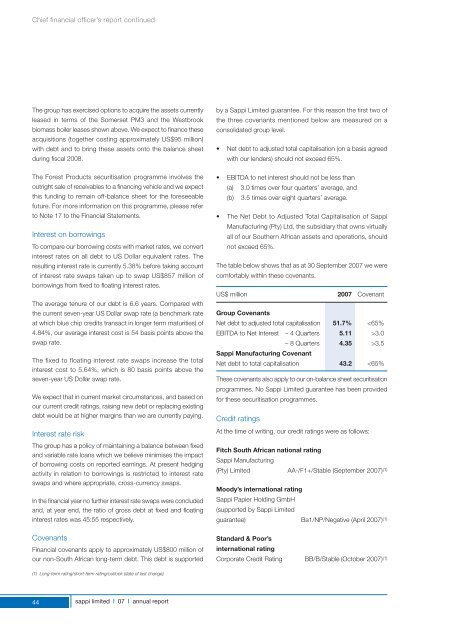

Covenants<br />

Financial covenants apply to approximately US$800 million of<br />

our non-South African long-term debt. This debt is supported<br />

• EBITDA to net interest should not be less than<br />

(a) 3.0 times over four quarters’ average, and<br />

(b) 3.5 times over eight quarters’ average.<br />

• The Net Debt to Adjusted Total Capitalisation of <strong>Sappi</strong><br />

Manufacturing (Pty) Ltd, the subsidiary that owns virtually<br />

all of our Southern African assets and operations, should<br />

not exceed 65%.<br />

The table below shows that as at 30 September <strong>2007</strong> we were<br />

comfortably within these covenants.<br />

US$ million <strong>2007</strong> Covenant<br />

Group Covenants<br />

Net debt to adjusted total capitalisation 51.7% 3.0<br />

– 8 Quarters 4.35 >3.5<br />

<strong>Sappi</strong> Manufacturing Covenant<br />

Net debt to total capitalisation 43.2