2007 Annual Report - Sappi

2007 Annual Report - Sappi

2007 Annual Report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

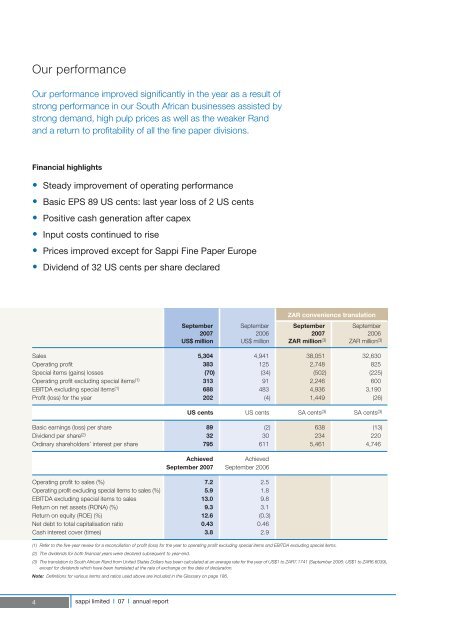

Our performance<br />

Our performance improved significantly in the year as a result of<br />

strong performance in our South African businesses assisted by<br />

strong demand, high pulp prices as well as the weaker Rand<br />

and a return to profitability of all the fine paper divisions.<br />

Financial highlights<br />

• Steady improvement of operating performance<br />

• Basic EPS 89 US cents: last year loss of 2 US cents<br />

• Positive cash generation after capex<br />

• Input costs continued to rise<br />

• Prices improved except for <strong>Sappi</strong> Fine Paper Europe<br />

• Dividend of 32 US cents per share declared<br />

ZAR convenience translation<br />

September September September September<br />

<strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

US$ million US$ million ZAR million (3) ZAR million (3)<br />

Sales 5,304 4,941 38,051 32,630<br />

Operating profit 383 125 2,748 825<br />

Special items (gains) losses (70) (34) (502) (225)<br />

Operating profit excluding special items (1) 313 91 2,246 600<br />

EBITDA excluding special items (1) 688 483 4,936 3,190<br />

Profit (loss) for the year 202 (4) 1,449 (26)<br />

US cents US cents SA cents (3) SA cents (3)<br />

Basic earnings (loss) per share 89 (2) 638 (13)<br />

Dividend per share (2) 32 30 234 220<br />

Ordinary shareholders’ interest per share 795 611 5,461 4,746<br />

Achieved<br />

Achieved<br />

September <strong>2007</strong> September 2006<br />

Operating profit to sales (%) 7.2 2.5<br />

Operating profit excluding special items to sales (%) 5.9 1.8<br />

EBITDA excluding special items to sales 13.0 9.8<br />

Return on net assets (RONA) (%) 9.3 3.1<br />

Return on equity (ROE) (%) 12.6 (0.3)<br />

Net debt to total capitalisation ratio 0.43 0.46<br />

Cash interest cover (times) 3.8 2.9<br />

(1) Refer to the five-year review for a reconciliation of profit (loss) for the year to operating profit excluding special items and EBITDA excluding special items.<br />

(2) The dividends for both financial years were declared subsequent to year-end.<br />

(3) The translation to South African Rand from United States Dollars has been calculated at an average rate for the year of US$1 to ZAR7.1741 (September 2006: US$1 to ZAR6.6039),<br />

except for dividends which have been translated at the rate of exchange on the date of declaration.<br />

Note: Definitions for various terms and ratios used above are included in the Glossary on page 186.<br />

4<br />

sappi limited | 07 | annual report