2007 Annual Report - Sappi

2007 Annual Report - Sappi

2007 Annual Report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chief financial officer’s report continued<br />

The 495,000 ton decrease in timber sold to third parties<br />

(US$28 million in monetary terms) was more than off-set<br />

by the 159,000 tons increase in sales of pulp and paper<br />

(US$151 million) at the much higher prices per ton commanded<br />

by pulp and paper products compared to timber. The net<br />

impact of the changes in volume compared to 2006 was<br />

US$123 million.<br />

The Forest Products business has benefited from higher<br />

international pulp prices and better pricing in the local South<br />

African market (US$175 million). This, together with improved<br />

prices in the South African Fine Paper business (US$41 million),<br />

has been offset by lower prices in Europe (US$35 million)<br />

and North America (US$9 million) compared to 2006. The net<br />

impact of price changes was to increase sales in <strong>2007</strong> by<br />

US$172 million.<br />

The Euro strengthened substantially against the US Dollar in<br />

<strong>2007</strong> (from an average of Euro/US Dollar 1.2315 in 2006 to<br />

1.3336 in <strong>2007</strong>) while the Rand weakened on average over the<br />

year against the US Dollar in <strong>2007</strong> (from an average ZAR6.6039<br />

in 2006 to ZAR7.1741 vs the US Dollar) despite ending up<br />

stronger at the end of <strong>2007</strong> compared to the end of 2006. The<br />

net impact of these currency movements was to increase sales<br />

in US Dollars by US$68 million in <strong>2007</strong>.<br />

US$ million <strong>2007</strong> 2006 2005<br />

Operating profit 383 125 (109)<br />

Plantation fair value<br />

price adjustment (54) (34) (60)<br />

Asset impairments/<br />

(reversals) – (31) 231<br />

Restructuring and<br />

closure costs/(reversal) (7) 50 21<br />

Fire, flood, storm and<br />

related events 17 9 –<br />

Pension restructuring gain – (28) –<br />

Sale of fixed assets (26) – –<br />

Special items before tax (70) (34) 192<br />

Operating profit excluding<br />

special items 313 91 83<br />

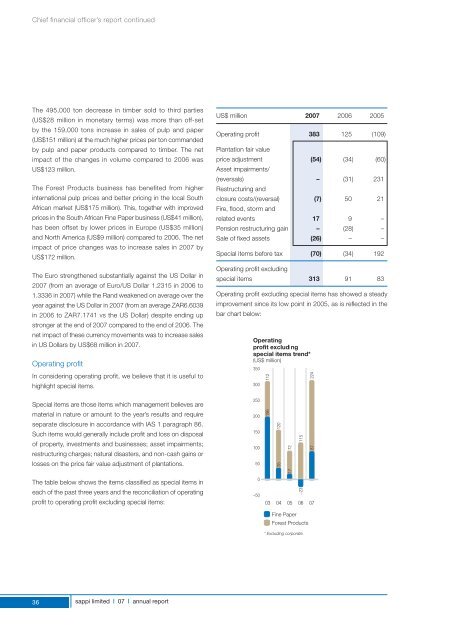

Operating profit excluding special items has showed a steady<br />

improvement since its low point in 2005, as is reflected in the<br />

bar chart below:<br />

Operating profit<br />

In considering operating profit, we believe that it is useful to<br />

highlight special items.<br />

Special items are those items which management believes are<br />

material in nature or amount to the year’s results and require<br />

separate disclosure in accordance with IAS 1 paragraph 86.<br />

Such items would generally include profit and loss on disposal<br />

of property, investments and businesses; asset impairments;<br />

restructuring charges; natural disasters, and non-cash gains or<br />

losses on the price fair value adjustment of plantations.<br />

The table below shows the items classified as special items in<br />

each of the past three years and the reconciliation of operating<br />

profit to operating profit excluding special items:<br />

36<br />

sappi limited | 07 | annual report