WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Dividend Policy<br />

During 2010 and 2009, we paid a quarterly dividend of $0.12 and $0.04, respectively, per share of Common<br />

Stock issued and outstanding on the record date for the applicable dividend. During February 2011, our Board of<br />

Directors authorized an increase of quarterly dividends to $0.15 per share beginning with the dividend expected to<br />

be declared during the first quarter of 2011. Our dividend payout ratio is now approximately 28% of the midpoint of<br />

our estimated 2011 net income after certain adjustments. We expect our dividend policy for the future to at least<br />

mirror the rate of growth of our business. The declaration and payment of future dividends to holders of our<br />

common stock are at the discretion of our Board of Directors and depend upon many factors, including our financial<br />

condition, earnings, capital requirements of our business, covenants associated with certain debt obligations, legal<br />

requirements, regulatory constraints, industry practice and other factors that our Board deems relevant. There can be<br />

no assurance that a payment of a dividend will occur in the future.<br />

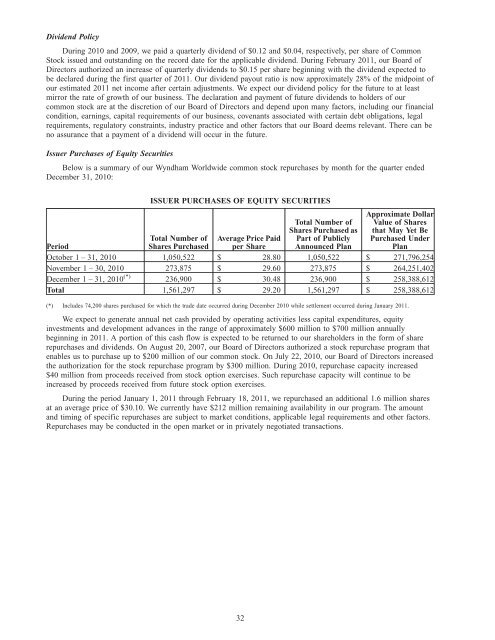

Issuer Purchases of Equity Securities<br />

Below is a summary of our Wyndham Worldwide common stock repurchases by month for the quarter ended<br />

December 31, 2010:<br />

ISSUER PURCHASES OF EQUITY SECURITIES<br />

Total Number of Average Price Paid<br />

Total Number of<br />

Shares Purchased as<br />

Part of Publicly<br />

Approximate Dollar<br />

Value of Shares<br />

that May Yet Be<br />

Purchased Under<br />

Period<br />

Shares Purchased per Share Announced Plan<br />

Plan<br />

October 1 – 31, 2010 1,050,522 $ 28.80 1,050,522 $ 271,796,254<br />

November 1 – 30, 2010 273,875 $ 29.60 273,875 $ 264,251,402<br />

December 1 – 31, 2010 (*)<br />

236,900 $ 30.48 236,900 $ 258,388,612<br />

Total 1,561,297 $ 29.20 1,561,297 $ 258,388,612<br />

(*) Includes 74,200 shares purchased for which the trade date occurred during December 2010 while settlement occurred during January 2011.<br />

We expect to generate annual net cash provided by operating activities less capital expenditures, equity<br />

investments and development advances in the range of approximately $600 million to $700 million annually<br />

beginning in 2011. A portion of this cash flow is expected to be returned to our shareholders in the form of share<br />

repurchases and dividends. On August 20, 2007, our Board of Directors authorized a stock repurchase program that<br />

enables us to purchase up to $200 million of our common stock. On July 22, 2010, our Board of Directors increased<br />

the authorization for the stock repurchase program by $300 million. During 2010, repurchase capacity increased<br />

$40 million from proceeds received from stock option exercises. Such repurchase capacity will continue to be<br />

increased by proceeds received from future stock option exercises.<br />

During the period January 1, 2011 through February 18, 2011, we repurchased an additional 1.6 million shares<br />

at an average price of $30.10. We currently have $212 million remaining availability in our program. The amount<br />

and timing of specific repurchases are subject to market conditions, applicable legal requirements and other factors.<br />

Repurchases may be conducted in the open market or in privately negotiated transactions.<br />

32