As part of ongoing franchise fees, the Company receives marketing and reservation fees from its lodging franchisees, which generally are calculated based on a specified percentage of gross room revenues. Such fees totaled $196 million, $186 million and $218 million during 2010, 2009 and 2008, respectively, and are recorded within the franchise fees line item on the Consolidated Statements of Operations. As provided for in the franchise agreements, all of these fees are to be expended for marketing purposes or the operation of an international, centralized, brand-specific reservation system for the respective franchisees. Additionally, the Company is required to provide certain services to its franchisees, including access to an international, centralized, brand-specific reservations system, advertising, promotional and co-marketing programs, referrals, technology, training and volume purchasing. The number of lodging properties and rooms in operation by market sector is as follows: Economy (a) Midscale (b) Upscale (c) Unmanaged, Affiliated and Managed, Non-Proprietary Hotels (d) (a) (b) (c) (d) 2010 (Unaudited) As of December 31, 2009 2008 Properties Rooms Properties Rooms Properties Rooms 5,482 387,202 5,469 387,357 5,432 389,697 1,623 197,022 1,540 182,251 1,515 177,284 101 28,311 94 24,517 82 21,724 1 200 11 3,549 14 4,175 7,207 612,735 7,114 597,674 7,043 592,880 Comprised of the Days Inn, Super 8, Howard Johnson Inn, Howard Johnson Express, Travelodge, Microtel and Knights Inn lodging brands. Primarily includes Wingate by Wyndham, Hawthorn by Wyndham, Ramada Worldwide, Howard Johnson Plaza, Howard Johnson Hotel, Baymont Inn & Suites, and Tryp by Wyndham lodging brands. Comprised of the Wyndham Hotels and Resorts lodging brand. Represents properties/rooms affiliated with the Wyndham Hotels and Resorts brand for which the Company receives a fee for reservation and/or other services provided and properties managed under a joint venture. These properties are not branded under a Wyndham Hotel Group brand. The number of lodging properties and rooms changed as follows: 2010 (Unaudited) For the Years Ended December 31, 2009 2008 Properties Rooms Properties Rooms Properties Rooms Beginning balance 7,114 597,674 7,043 592,880 6,544 550,576 Additions 492 54,171 486 46,528 538 55,125 Acquisitions 92 (a) 13,236 (a) — — 388 (b) Terminations (491) (52,346) (415) (41,734) (427) (42,368) Ending balance 7,207 612,735 7,114 597,674 7,043 592,880 (a) (b) Relates to the Tryp hotel brand, which was acquired on June 30, 2010. Relates to Microtel and Hawthorn, which were acquired on July 18, 2008. 29,547 (b) The Company may, at its discretion, provide development advances to certain of its franchisees or hotel owners in its managed business in order to assist such franchisees/hotel owners in converting to one of the Company’s brands, building a new hotel to be flagged under one of the Company’s brands or in assisting in other franchisee expansion efforts. Provided the franchisee/hotel owner is in compliance with the terms of the franchise/management agreement, all or a portion of the development advance may be forgiven by the Company over the period of the franchise/management agreement, which typically ranges from 10 to 20 years. Otherwise, the related principal is due and payable to the Company. In certain instances, the Company may earn interest on unpaid franchisee development advances, which was not significant during 2010, 2009 or 2008. The amount of such development advances recorded on the Consolidated Balance Sheets was $55 million and $53 million at December 31, 2010 and 2009, respectively. These amounts are classified within the other non-current assets line item on the Consolidated Balance Sheets. During 2010, 2009 and 2008, the Company recorded $5 million, $5 million and $4 million, respectively, related to the forgiveness of these advances. Such amounts are recorded as a reduction of franchise fees on the Consolidated Statements of Operations. During 2010, 2009 and 2008, the Company recorded $2 million, $4 million and $0, respectively, of bad debt expense on these development advances within its lodging business. Such expense is recorded within operating expenses on the Consolidated Statement of Operations. F-19

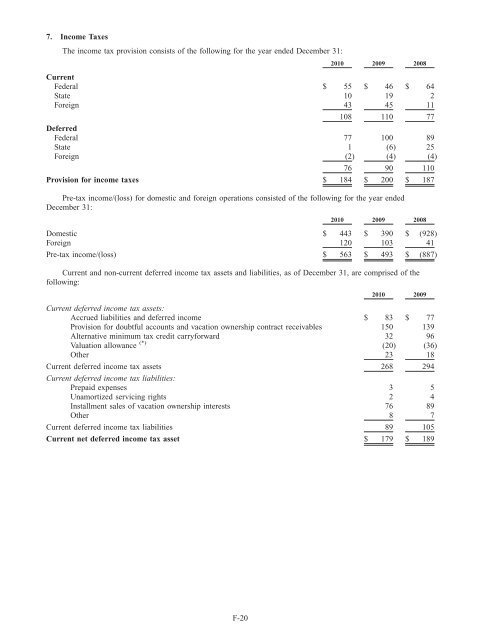

7. Income Taxes The income tax provision consists of the following for the year ended December 31: 2010 2009 2008 Current Federal $ 55 $ 46 $ 64 State 10 19 2 Foreign 43 45 11 Deferred 108 110 77 Federal 77 100 89 State 1 (6) 25 Foreign (2) (4) (4) 76 90 110 Provision for income taxes $ 184 $ 200 $ 187 Pre-tax income/(loss) for domestic and foreign operations consisted of the following for the year ended December 31: 2010 2009 2008 Domestic $ 443 $ 390 $ (928) Foreign 120 103 41 Pre-tax income/(loss) $ 563 $ 493 $ (887) Current and non-current deferred income tax assets and liabilities, as of December 31, are comprised of the following: 2010 2009 Current deferred income tax assets: Accrued liabilities and deferred income $ 83 $ 77 Provision for doubtful accounts and vacation ownership contract receivables 150 139 Alternative minimum tax credit carryforward 32 96 Valuation allowance (*) (20) (36) Other 23 18 Current deferred income tax assets Current deferred income tax liabilities: 268 294 Prepaid expenses 3 5 Unamortized servicing rights 2 4 Installment sales of vacation ownership interests 76 89 Other 8 7 Current deferred income tax liabilities 89 105 Current net deferred income tax asset $ 179 $ 189 F-20

- Page 1 and 2:

UNITED STATES SECURITIES AND EXCHAN

- Page 3 and 4:

PART I FORWARD LOOKING STATEMENTS T

- Page 5 and 6:

Our portfolio of well-known hospita

- Page 7 and 8:

The following table sets forth the

- Page 9 and 10:

free access to a gym facility and t

- Page 11 and 12:

as annual budget preparation, finan

- Page 13 and 14:

Our field services team, strategica

- Page 15 and 16:

Competition Competition is robust a

- Page 17 and 18:

we offer property owners marketing

- Page 19 and 20:

Internet Given the increasing inter

- Page 21 and 22:

According to information compiled b

- Page 23 and 24:

Owners who participate in Club Wynd

- Page 25 and 26:

Purchaser Financing Wyndham Vacatio

- Page 27 and 28:

EMPLOYEES As of December 31, 2010,

- Page 29 and 30:

that we will be able to achieve the

- Page 31 and 32:

Our inability to adequately protect

- Page 33 and 34:

2014; Atlanta, Georgia expiring in

- Page 35 and 36:

Stock Performance Graph The Stock P

- Page 37 and 38:

(f) (g) (h) (i) (j) (k) (l) (m) (n)

- Page 39 and 40:

We enter into agreements to franchi

- Page 41 and 42:

eal estate inventory costs incurred

- Page 43 and 44:

Year Ended December 31, 2010 vs. Ye

- Page 45 and 46:

Arrangements), (ii) $16 million of

- Page 47 and 48: at our U.K. and France destinations

- Page 49 and 50: In addition, EBITDA was negatively

- Page 51 and 52: OPERATING STATISTICS The following

- Page 53 and 54: k $29 million of losses from foreig

- Page 55 and 56: and $9 million of lower volume-rela

- Page 57 and 58: k $25 million of increased costs re

- Page 59 and 60: k a $49 million increase in franchi

- Page 61 and 62: Operating Activities During 2010, n

- Page 63 and 64: Capital Deployment We are focusing

- Page 65 and 66: Capacity As of December 31, 2010, a

- Page 67 and 68: We believe that our bank conduit fa

- Page 69 and 70: on the matter. As a result of settl

- Page 71 and 72: was approximately $373 million as o

- Page 73 and 74: performance for a five-year period.

- Page 75 and 76: cash flow model in determining the

- Page 77 and 78: Cendant’s Vacation Network Group

- Page 79 and 80: SIGNATURES Pursuant to the requirem

- Page 81 and 82: REPORT OF INDEPENDENT REGISTERED PU

- Page 83 and 84: WYNDHAM WORLDWIDE CORPORATION CONSO

- Page 85 and 86: WYNDHAM WORLDWIDE CORPORATION CONSO

- Page 87 and 88: The Company’s franchise agreement

- Page 89 and 90: manages paid Wyndham Exchange & Ren

- Page 91 and 92: expenses amounted to $48 million, $

- Page 93 and 94: average exchange rates during the p

- Page 95 and 96: integrated the operations of its ac

- Page 97: (3) Adjusting the carrying value of

- Page 101 and 102: The following table summarizes the

- Page 103 and 104: Credit Quality for Financed Receiva

- Page 105 and 106: 10. Property and Equipment, net Pro

- Page 107 and 108: measurement date and a maximum cons

- Page 109 and 110: As of December 31, 2010, the Compan

- Page 111 and 112: Vacation Rental Capital Leases. The

- Page 113 and 114: The following table presents additi

- Page 115 and 116: Consolidated Statement of Operation

- Page 117 and 118: capacity and the Company’s corpor

- Page 119 and 120: shareholders and further amended as

- Page 121 and 122: comprehensive income on the Consoli

- Page 123 and 124: Total restructuring costs by segmen

- Page 125 and 126: and Avis Budget Group to satisfy th

- Page 127 and 128: (a) (b) (c) (d) (e) (f) (g) (h) (i)

- Page 129 and 130: 10.4 Employment Agreement with Fran

- Page 131 and 132: 14.1 101.INS XBRL Instance document

- Page 133 and 134: Name WYNDHAM WORLDWIDE CORPORATION

- Page 135 and 136: Exhibit 23.1 CONSENT OF INDEPENDENT

- Page 137 and 138: CERTIFICATION Exhibit 31.2 I, Thoma