WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(f)<br />

(g)<br />

(h)<br />

(i)<br />

(j)<br />

(k)<br />

(l)<br />

(m)<br />

(n)<br />

(o)<br />

(p)<br />

(q)<br />

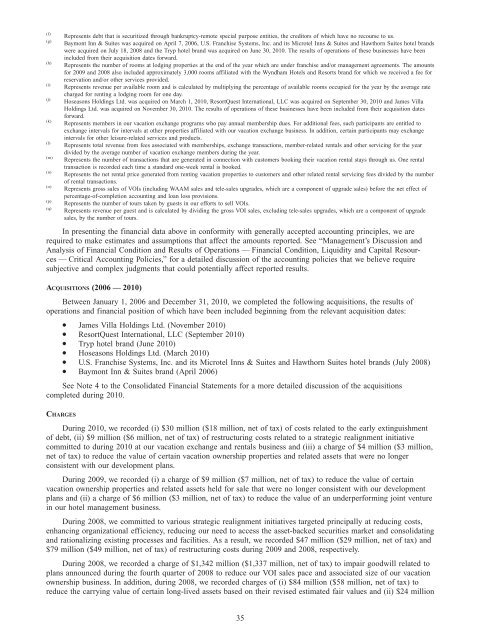

Represents debt that is securitized through bankruptcy-remote special purpose entities, the creditors of which have no recourse to us.<br />

Baymont Inn & Suites was acquired on April 7, 2006, U.S. Franchise Systems, Inc. and its Microtel Inns & Suites and Hawthorn Suites hotel brands<br />

were acquired on July 18, 2008 and the Tryp hotel brand was acquired on June 30, 2010. The results of operations of these businesses have been<br />

included from their acquisition dates forward.<br />

Represents the number of rooms at lodging properties at the end of the year which are under franchise and/or management agreements. The amounts<br />

for 2009 and 2008 also included approximately 3,000 rooms affiliated with the Wyndham Hotels and Resorts brand for which we received a fee for<br />

reservation and/or other services provided.<br />

Represents revenue per available room and is calculated by multiplying the percentage of available rooms occupied for the year by the average rate<br />

charged for renting a lodging room for one day.<br />

Hoseasons Holdings Ltd. was acquired on March 1, 2010, ResortQuest International, LLC was acquired on September 30, 2010 and James Villa<br />

Holdings Ltd. was acquired on November 30, 2010. The results of operations of these businesses have been included from their acquisition dates<br />

forward.<br />

Represents members in our vacation exchange programs who pay annual membership dues. For additional fees, such participants are entitled to<br />

exchange intervals for intervals at other properties affiliated with our vacation exchange business. In addition, certain participants may exchange<br />

intervals for other leisure-related services and products.<br />

Represents total revenue from fees associated with memberships, exchange transactions, member-related rentals and other servicing for the year<br />

divided by the average number of vacation exchange members during the year.<br />

Represents the number of transactions that are generated in connection with customers booking their vacation rental stays through us. One rental<br />

transaction is recorded each time a standard one-week rental is booked.<br />

Represents the net rental price generated from renting vacation properties to customers and other related rental servicing fees divided by the number<br />

of rental transactions.<br />

Represents gross sales of VOIs (including WAAM sales and tele-sales upgrades, which are a component of upgrade sales) before the net effect of<br />

percentage-of-completion accounting and loan loss provisions.<br />

Represents the number of tours taken by guests in our efforts to sell VOIs.<br />

Represents revenue per guest and is calculated by dividing the gross VOI sales, excluding tele-sales upgrades, which are a component of upgrade<br />

sales, by the number of tours.<br />

In presenting the financial data above in conformity with generally accepted accounting principles, we are<br />

required to make estimates and assumptions that affect the amounts reported. See “Management’s Discussion and<br />

Analysis of Financial Condition and Results of Operations — Financial Condition, Liquidity and Capital Resources<br />

— Critical Accounting Policies,” for a detailed discussion of the accounting policies that we believe require<br />

subjective and complex judgments that could potentially affect reported results.<br />

ACQUISITIONS (2006 — 2010)<br />

Between January 1, 2006 and December 31, 2010, we completed the following acquisitions, the results of<br />

operations and financial position of which have been included beginning from the relevant acquisition dates:<br />

k James Villa Holdings Ltd. (November 2010)<br />

k ResortQuest International, LLC (September 2010)<br />

k Tryp hotel brand (June 2010)<br />

k Hoseasons Holdings Ltd. (March 2010)<br />

k U.S. Franchise Systems, Inc. and its Microtel Inns & Suites and Hawthorn Suites hotel brands (July 2008)<br />

k Baymont Inn & Suites brand (April 2006)<br />

See Note 4 to the Consolidated Financial Statements for a more detailed discussion of the acquisitions<br />

completed during 2010.<br />

CHARGES<br />

During 2010, we recorded (i) $30 million ($18 million, net of tax) of costs related to the early extinguishment<br />

of debt, (ii) $9 million ($6 million, net of tax) of restructuring costs related to a strategic realignment initiative<br />

committed to during 2010 at our vacation exchange and rentals business and (iii) a charge of $4 million ($3 million,<br />

net of tax) to reduce the value of certain vacation ownership properties and related assets that were no longer<br />

consistent with our development plans.<br />

During 2009, we recorded (i) a charge of $9 million ($7 million, net of tax) to reduce the value of certain<br />

vacation ownership properties and related assets held for sale that were no longer consistent with our development<br />

plans and (ii) a charge of $6 million ($3 million, net of tax) to reduce the value of an underperforming joint venture<br />

in our hotel management business.<br />

During 2008, we committed to various strategic realignment initiatives targeted principally at reducing costs,<br />

enhancing organizational efficiency, reducing our need to access the asset-backed securities market and consolidating<br />

and rationalizing existing processes and facilities. As a result, we recorded $47 million ($29 million, net of tax) and<br />

$79 million ($49 million, net of tax) of restructuring costs during 2009 and 2008, respectively.<br />

During 2008, we recorded a charge of $1,342 million ($1,337 million, net of tax) to impair goodwill related to<br />

plans announced during the fourth quarter of 2008 to reduce our VOI sales pace and associated size of our vacation<br />

ownership business. In addition, during 2008, we recorded charges of (i) $84 million ($58 million, net of tax) to<br />

reduce the carrying value of certain long-lived assets based on their revised estimated fair values and (ii) $24 million<br />

35