WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

WYNDHAM WORLDWIDE CORPORATION

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(3) Adjusting the carrying value of debt to the estimated fair value, and<br />

(4) Recalculating deferred income taxes under the guidance for income tax accounting, after considering<br />

the likely tax basis a hypothetical buyer would have in the assets and liabilities.<br />

As a result of the above analysis, during the fourth quarter of 2008 the Company recorded a goodwill<br />

impairment charge of $1,342 million ($1,337 million, net of tax) representing a write-off of the entire amount of the<br />

vacation ownership reporting unit’s previously recorded goodwill. Such impairment was a result of plans that the<br />

Company announced during (i) October 2008, in which it refocused its vacation ownership sales and marketing<br />

efforts on consumers with higher credit quality commencing in the fourth quarter of 2008, which reduced future<br />

revenue and growth rates, and (ii) December 2008, in which it decided to eliminate the vacation ownership reporting<br />

unit’s reliance of the asset-backed securities market by reducing its VOI sales pace from $2.0 billion during 2008 to<br />

$1.3 billion during 2009. As of December 31, 2010, 2009 and 2008, the Company’s accumulated goodwill<br />

impairment loss was $1,342 million ($1,337 million, net of tax).<br />

Other Intangible Assets<br />

During the fourth quarter of 2008, the Company recorded (i) a $16 million non-cash impairment charge<br />

primarily due to a strategic change in direction related to the Company’s Howard Johnson brand that is expected to<br />

adversely impact the ability of the properties associated with the franchise agreements acquired in connection with<br />

the acquisition of the brand during 1990 to maintain compliance with brand standards and (ii) an $8 million noncash<br />

impairment charge to reduce the value of an unamortized trademark due to a strategic change in direction and<br />

reduced future investments in a vacation rentals business. See Note 21 — Restructuring and Impairments for more<br />

information.<br />

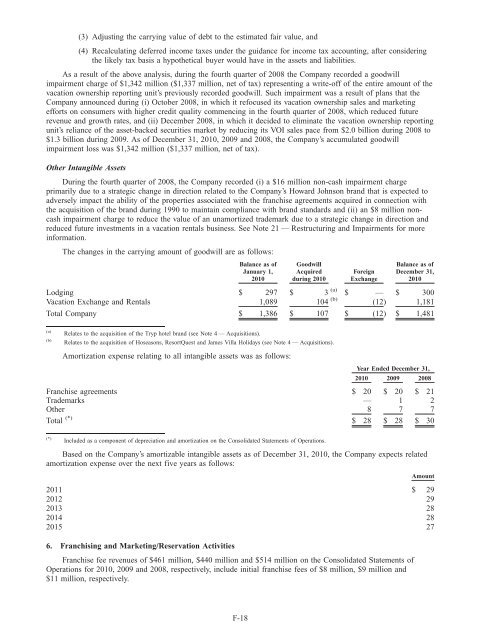

The changes in the carrying amount of goodwill are as follows:<br />

Balance as of<br />

January 1,<br />

2010<br />

Goodwill<br />

Acquired<br />

during 2010<br />

Foreign<br />

Exchange<br />

Balance as of<br />

December 31,<br />

2010<br />

Lodging $ 297 $ 3 (a) $ — $ 300<br />

Vacation Exchange and Rentals 1,089 104 (b)<br />

(12) 1,181<br />

Total Company $ 1,386 $ 107 $ (12) $ 1,481<br />

(a)<br />

(b)<br />

Relates to the acquisition of the Tryp hotel brand (see Note 4 — Acquisitions).<br />

Relates to the acquisition of Hoseasons, ResortQuest and James Villa Holidays (see Note 4 — Acquisitions).<br />

Amortization expense relating to all intangible assets was as follows:<br />

Year Ended December 31,<br />

2010 2009 2008<br />

Franchise agreements $ 20 $ 20 $ 21<br />

Trademarks — 1 2<br />

Other 8 7 7<br />

Total (*)<br />

$ 28 $ 28 $ 30<br />

(*)<br />

Included as a component of depreciation and amortization on the Consolidated Statements of Operations.<br />

Based on the Company’s amortizable intangible assets as of December 31, 2010, the Company expects related<br />

amortization expense over the next five years as follows:<br />

Amount<br />

2011 $ 29<br />

2012 29<br />

2013 28<br />

2014 28<br />

2015 27<br />

6. Franchising and Marketing/Reservation Activities<br />

Franchise fee revenues of $461 million, $440 million and $514 million on the Consolidated Statements of<br />

Operations for 2010, 2009 and 2008, respectively, include initial franchise fees of $8 million, $9 million and<br />

$11 million, respectively.<br />

F-18