TCTC Catalog - Tri-County Technical College

TCTC Catalog - Tri-County Technical College

TCTC Catalog - Tri-County Technical College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

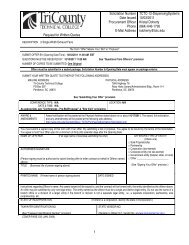

GENERAL<br />

INFORMATION<br />

Financial Information<br />

Length of Eligibility<br />

When evaluating the amount of work a student attempts<br />

and completes, it is necessary to establish a maximum<br />

number of credit hours that can be attempted in each<br />

program. This maximum equates to 150% of the minimum<br />

credit hours required to complete the program of<br />

study in which the student is enrolled. For example, a<br />

student enrolled in a 60-credit-hour program is eligible<br />

to receive financial aid until 90-credit-hours are<br />

attempted. A student who reaches this point without graduating<br />

from the program will no longer be making satisfactory<br />

academic progress and financial aid will cease.<br />

The Financial Aid Office can answer additional questions<br />

regarding the Satisfactory Academic Progress policy.<br />

for Financial Aid” for additional information.<br />

• Before withdrawing, students should contact the<br />

Financial Aid Office in Miller Hall to learn about<br />

their options and how withdrawing will affect their<br />

financial aid.<br />

If a student falls below these criteria, he or she will be<br />

placed on financial aid probation for one term. Financial<br />

Aid suspension will result if the requirements are not<br />

met after the probationary term. Satisfactory Academic<br />

Progress is evaluated at the end of each term.<br />

EARNED AID POLICY<br />

The Federal Title IV Earned Aid Policy is based on the<br />

Higher Education Reauthorization Act of 1998 and states<br />

that students must remain enrolled in college in order to<br />

earn the financial aid awarded for that specific term.<br />

Withdrawing from college can negatively impact all<br />

financial aid eligibility and can cause a student to owe<br />

funds back to those federal programs. Students must<br />

complete at least 60% of the term to earn financial aid<br />

for that term. There are several ways that federal financial<br />

aid eligibility can be affected by withdrawal:<br />

• Students may have to repay some of the financial<br />

aid funds received for that term. These programs<br />

include the Federal Pell Grant and the Supplemental<br />

Educational Opportunity Grant. This may mean<br />

balances due by the student to both the <strong>College</strong><br />

and the Department of Education. Financial Aid<br />

will perform the calculation to determine if repayment<br />

is required. This calculation cannot be<br />

performed while the student is in the office during<br />

the withdrawal process because data from other<br />

areas of the college must be gathered. Students<br />

will be informed by mail in approximately three<br />

weeks from the date of the complete withdrawal.<br />

Students must have a valid permanent address on<br />

file with the Student Records Office. If a student<br />

owes a repayment, he/she cannot receive federal<br />

financial aid funds at any college until that repayment<br />

has been made.<br />

• Students could lose academic eligibility for future<br />

financial aid. Students are required to make “satisfactory<br />

academic progress” to continue receiving<br />

aid. While withdrawals may not hurt a student’s<br />

GPA, they can hurt a student’s completion rate.<br />

See section titled “Satisfactory Academic Progress<br />

19