TRS 2011 Comprehensive Annual Financial Report

TRS 2011 Comprehensive Annual Financial Report

TRS 2011 Comprehensive Annual Financial Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TEACHER RETIREMENT SYSTEM OF TEXAS COMPREHENSIVE ANNUAL FINANCIAL REPORT <strong>2011</strong><br />

Actuarial Information Pension Trust Fund<br />

Other Actuarial Information<br />

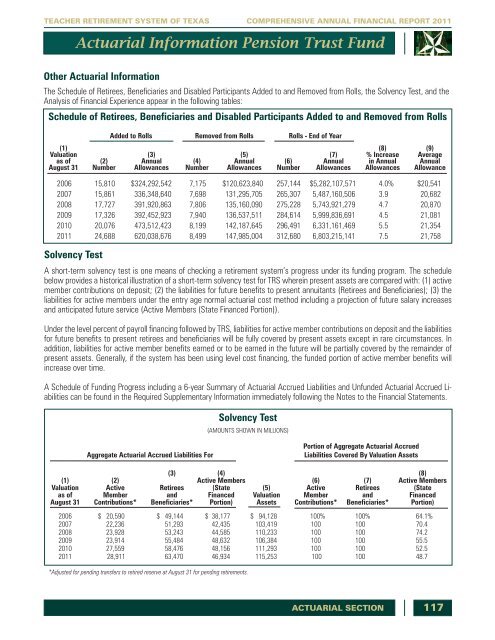

The Schedule of Retirees, Beneficiaries and Disabled Participants Added to and Removed from Rolls, the Solvency Test, and the<br />

Analysis of <strong>Financial</strong> Experience appear in the following tables:<br />

Schedule of Retirees, Beneficiaries and Disabled Participants Added to and Removed from Rolls<br />

Added to Rolls Removed from Rolls Rolls - End of Year<br />

(1) (8) (9)<br />

Valuation (3) (5) (7) % Increase Average<br />

as of (2) <strong>Annual</strong> (4) <strong>Annual</strong> (6) <strong>Annual</strong> in <strong>Annual</strong> <strong>Annual</strong><br />

August 31 Number Allowances Number Allowances Number Allowances Allowances Allowance<br />

2006 15,810 $324,292,542 7,175 $120,623,840 257,144 $5,282,107,571 4.0% $20,541<br />

2007 15,861 336,348,640 7,698 131,295,705 265,307 5,487,160,506 3.9 20,682<br />

2008 17,727 391,920,863 7,806 135,160,090 275,228 5,743,921,279 4.7 20,870<br />

2009 17,326 392,452,923 7,940 136,537,511 284,614 5,999,836,691 4.5 21,081<br />

2010 20,076 473,512,423 8,199 142,187,645 296,491 6,331,161,469 5.5 21,354<br />

<strong>2011</strong> 24,688 620,038,676 8,499 147,985,004 312,680 6,803,215,141 7.5 21,758<br />

Solvency Test<br />

A short-term solvency test is one means of checking a retirement system’s progress under its funding program. The schedule<br />

below provides a historical illustration of a short-term solvency test for <strong>TRS</strong> wherein present assets are compared with: (1) active<br />

member contributions on deposit; (2) the liabilities for future benefits to present annuitants (Retirees and Beneficiaries); (3) the<br />

liabilities for active members under the entry age normal actuarial cost method including a projection of future salary increases<br />

and anticipated future service (Active Members (State Financed Portion)).<br />

Under the level percent of payroll financing followed by <strong>TRS</strong>, liabilities for active member contributions on deposit and the liabilities<br />

for future benefits to present retirees and beneficiaries will be fully covered by present assets except in rare circumstances. In<br />

addition, liabilities for active member benefits earned or to be earned in the future will be partially covered by the remainder of<br />

present assets. Generally, if the system has been using level cost financing, the funded portion of active member benefits will<br />

increase over time.<br />

A Schedule of Funding Progress including a 6-year Summary of Actuarial Accrued Liabilities and Unfunded Actuarial Accrued Liabilities<br />

can be found in the Required Supplementary Information immediately following the Notes to the <strong>Financial</strong> Statements.<br />

Solvency Test<br />

(AMOUNTS SHOWN IN MILLIONS)<br />

Aggregate Actuarial Accrued Liabilities For<br />

Portion of Aggregate Actuarial Accrued<br />

Liabilities Covered By Valuation Assets<br />

(3) (4) (8)<br />

(1) (2) Active Members (6) (7) Active Members<br />

Valuation Active Retirees (State (5) Active Retirees (State<br />

as of Member and Financed Valuation Member and Financed<br />

August 31 Contributions* Beneficiaries* Portion) Assets Contributions* Beneficiaries* Portion)<br />

2006 $ 20,590 $ 49,144 $ 38,177 $ 94,128 100% 100% 64.1%<br />

2007 22,236 51,293 42,435 103,419 100 100 70.4<br />

2008 23,928 53,243 44,585 110,233 100 100 74.2<br />

2009 23,914 55,484 48,632 106,384 100 100 55.5<br />

2010 27,559 58,476 48,156 111,293 100 100 52.5<br />

<strong>2011</strong> 28,911 63,470 46,934 115,253 100 100 48.7<br />

* Adjusted for pending transfers to retired reserve at August 31 for pending retirements.<br />

ACTUARIAL SECTION<br />

117