TRS 2011 Comprehensive Annual Financial Report

TRS 2011 Comprehensive Annual Financial Report

TRS 2011 Comprehensive Annual Financial Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TEACHER RETIREMENT SYSTEM OF TEXAS COMPREHENSIVE ANNUAL FINANCIAL REPORT <strong>2011</strong><br />

Notes to the <strong>Financial</strong> Statements<br />

total cost. Until that time, these funds are a deferred revenue.<br />

Compensable absences payable represents the liability that becomes due upon the occurrence of relevant events such as resignation,<br />

retirement and use of leave balances by covered employees. These obligations are normally paid from the same funding source<br />

from which each employee’s salary or wage compensation was paid. Liabilities are reported separately as either current or non-current<br />

in the statement of net assets for enterprise funds, if appropriate.<br />

Deferred rent represents a reduction to rental expenses for the rent abatement and incentives received from the non-cancelable<br />

operating lease that are being amortized over the lease term.<br />

Collateral Obligations represent both collateral associated with securities lending and that associated with derivative instrument<br />

activity.<br />

Interfund/Interagency Transactions And Balances<br />

Transactions between the system’s funds have been classified in accordance with the following criteria that are consistent with<br />

generally accepted accounting principles (GAAP).<br />

The Pension Trust Fund provides various administrative services to other <strong>TRS</strong> programs and accounts for these services as reciprocal<br />

interfund activity. These transactions are reported using the appropriate classification accounts for additions/revenues or deductions/<br />

expenses as if transacted with parties external to the state, i.e., they are not presented as transfers. The interfund receivables and<br />

payables related to reciprocal interfund activity are classified as accounts receivable and accounts payable on the financial statements.<br />

Interagency transactions have been classified using the above criteria for reciprocal interfund activity.<br />

Legal Reserve Accounts<br />

The Pension Trust Fund has five statutorily required reserves. The Member Savings Account reserve represents the accumulation<br />

of active member deposits plus interest. The State Contribution Account consists of reserves available to fund future active member<br />

retirement, death, and survivor benefits. The Retired Reserve Account represents reserves to pay retirement, death, survivor benefits<br />

and post-retirement benefit increases. The Deferred Retirement Option Account consists of the accumulation of participating member<br />

deposits plus interest less benefits paid out. Net investment gains or losses are accumulated in the Interest Account and transferred<br />

to the State Contribution Account together with any other balance remaining in the Interest Account. The Expense Account represents<br />

reserves to pay administrative expenses of the Pension Trust Fund that exceed the state’s appropriations and that are required to perform<br />

the fiduciary duties of the board. The statutory accounts are a requirement of the Texas Government Code, Chapter 825, Sections<br />

307-313.<br />

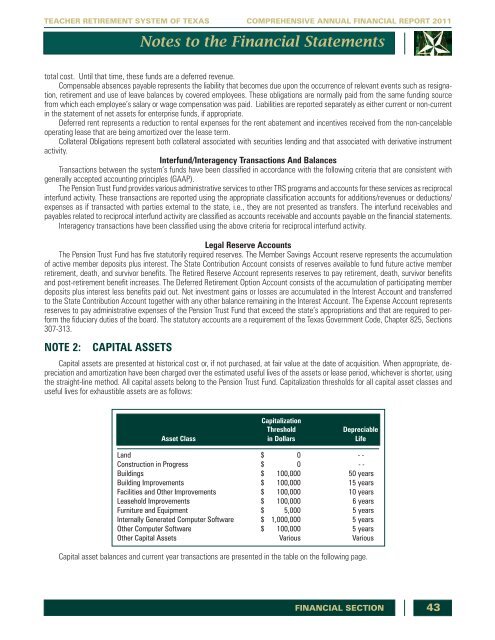

NOTE 2:<br />

CAPITAL ASSETS<br />

Capital assets are presented at historical cost or, if not purchased, at fair value at the date of acquisition. When appropriate, depreciation<br />

and amortization have been charged over the estimated useful lives of the assets or lease period, whichever is shorter, using<br />

the straight-line method. All capital assets belong to the Pension Trust Fund. Capitalization thresholds for all capital asset classes and<br />

useful lives for exhaustible assets are as follows:n<br />

Useful<br />

Capitalization<br />

Threshold<br />

Depreciable<br />

Asset Class in Dollars Life<br />

Land $ 0 - -<br />

Construction in Progress $ 0 - -<br />

Buildings $ 100,000 50 years<br />

Building Improvements $ 100,000 15 years<br />

Facilities and Other Improvements $ 100,000 10 years<br />

Leasehold Improvements $ 100,000 6 years<br />

Furniture and Equipment $ 5,000 5 years<br />

Internally Generated Computer Software $ 1,000,000 5 years<br />

Other Computer Software $ 100,000 5 years<br />

Other Capital Assets Various Various<br />

Capital asset balances and current year transactions are presented in the table on the following page.<br />

FINANCIAL SECTION<br />

43