detailed explanation for each SIC code - Biffa

detailed explanation for each SIC code - Biffa

detailed explanation for each SIC code - Biffa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

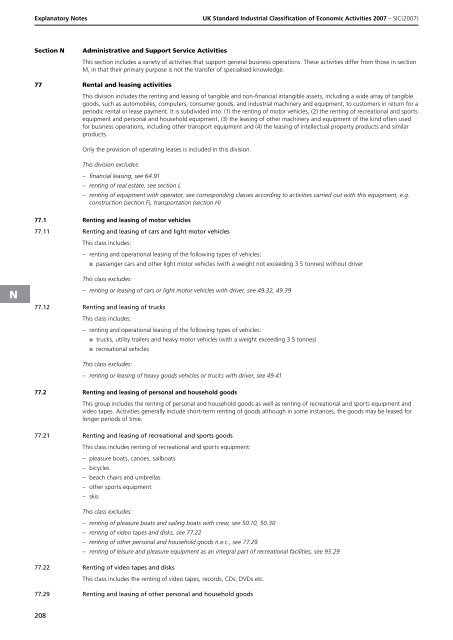

Explanatory Notes<br />

UK Standard Industrial Classification of Economic Activities 2007 – <strong>SIC</strong>(2007)<br />

Section N<br />

Administrative and Support Service Activities<br />

This section includes a variety of activities that support general business operations. These activities differ from those in section<br />

M, in that their primary purpose is not the transfer of specialised knowledge.<br />

77 Rental and leasing activities<br />

This division includes the renting and leasing of tangible and non-financial intangible assets, including a wide array of tangible<br />

goods, such as automobiles, computers, consumer goods, and industrial machinery and equipment, to customers in return <strong>for</strong> a<br />

periodic rental or lease payment. It is subdivided into: (1) the renting of motor vehicles, (2) the renting of recreational and sports<br />

equipment and personal and household equipment, (3) the leasing of other machinery and equipment of the kind often used<br />

<strong>for</strong> business operations, including other transport equipment and (4) the leasing of intellectual property products and similar<br />

products.<br />

Only the provision of operating leases is included in this division.<br />

This division excludes:<br />

–<br />

–<br />

–<br />

financial leasing, see 64.91<br />

renting of real estate, see section L<br />

renting of equipment with operator, see corresponding classes according to activities carried out with this equipment, e.g.<br />

construction (section F), transportation (section H)<br />

77.1 Renting and leasing of motor vehicles<br />

77.11 Renting and leasing of cars and light motor vehicles<br />

This class includes:<br />

–<br />

renting and operational leasing of the following types of vehicles:<br />

■ passenger cars and other light motor vehicles (with a weight not exceeding 3.5 tonnes) without driver<br />

N<br />

This class excludes:<br />

– renting or leasing of cars or light motor vehicles with driver, see 49.32, 49.39<br />

77.12 Renting and leasing of trucks<br />

This class includes:<br />

– renting and operational leasing of the following types of vehicles:<br />

■ trucks, utility trailers and heavy motor vehicles (with a weight exceeding 3.5 tonnes)<br />

■ recreational vehicles<br />

This class excludes:<br />

–<br />

renting or leasing of heavy goods vehicles or trucks with driver, see 49.41<br />

77.2 Renting and leasing of personal and household goods<br />

This group includes the renting of personal and household goods as well as renting of recreational and sports equipment and<br />

video tapes. Activities generally include short-term renting of goods although in some instances, the goods may be leased <strong>for</strong><br />

longer periods of time.<br />

77.21 Renting and leasing of recreational and sports goods<br />

This class includes renting of recreational and sports equipment:<br />

–<br />

–<br />

–<br />

–<br />

–<br />

pleasure boats, canoes, sailboats<br />

bicycles<br />

b<strong>each</strong> chairs and umbrellas<br />

other sports equipment<br />

skis<br />

This class excludes:<br />

–<br />

–<br />

–<br />

–<br />

renting of pleasure boats and sailing boats with crew, see 50.10, 50.30<br />

renting of video tapes and disks, see 77.22<br />

renting of other personal and household goods n.e.c., see 77.29<br />

renting of leisure and pleasure equipment as an integral part of recreational facilities, see 93.29<br />

77.22 Renting of video tapes and disks<br />

This class includes the renting of video tapes, records, CDs, DVDs etc.<br />

77.29 Renting and leasing of other personal and household goods<br />

208