detailed explanation for each SIC code - Biffa

detailed explanation for each SIC code - Biffa

detailed explanation for each SIC code - Biffa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

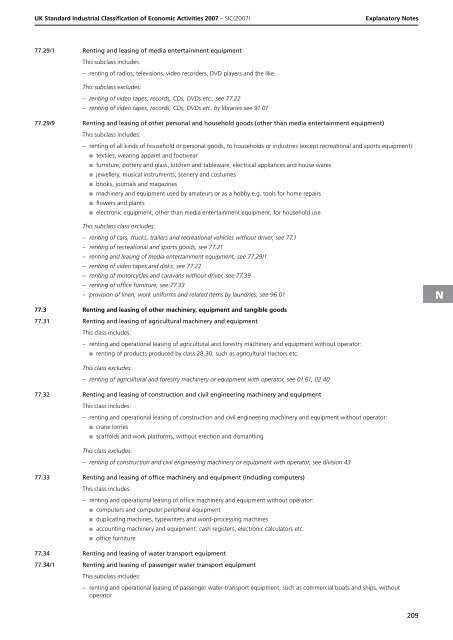

UK Standard Industrial Classification of Economic Activities 2007 – <strong>SIC</strong>(2007)<br />

Explanatory Notes<br />

77.29/1 Renting and leasing of media entertainment equipment<br />

This subclass includes:<br />

–<br />

renting of radios, televisions, video recorders, DVD players and the like<br />

This subclass excludes:<br />

–<br />

–<br />

renting of video tapes, records, CDs, DVDs etc., see 77.22<br />

renting of video tapes, records, CDs, DVDs etc. by libraries see 91.01<br />

77.29/9 Renting and leasing of other personal and household goods (other than media entertainment equipment)<br />

This subclass includes:<br />

–<br />

renting of all kinds of household or personal goods, to households or industries (except recreational and sports equipment):<br />

■ textiles, wearing apparel and footwear<br />

■ furniture, pottery and glass, kitchen and tableware, electrical appliances and house wares<br />

■ jewellery, musical instruments, scenery and costumes<br />

■ books, journals and magazines<br />

■ machinery and equipment used by amateurs or as a hobby e.g. tools <strong>for</strong> home repairs<br />

■ flowers and plants<br />

■ electronic equipment, other than media entertainment equipment, <strong>for</strong> household use<br />

This subclass class excludes:<br />

– renting of cars, trucks, trailers and recreational vehicles without driver, see 77.1<br />

– renting of recreational and sports goods, see 77.21<br />

– renting and leasing of media entertainment equipment, see 77.29/1<br />

– renting of video tapes and disks, see 77.22<br />

– renting of motorcycles and caravans without driver, see 77.39<br />

– renting of office furniture, see 77.33<br />

– provision of linen, work uni<strong>for</strong>ms and related items by laundries, see 96.01<br />

77.3 Renting and leasing of other machinery, equipment and tangible goods<br />

77.31 Renting and leasing of agricultural machinery and equipment<br />

This class includes:<br />

– renting and operational leasing of agricultural and <strong>for</strong>estry machinery and equipment without operator:<br />

■ renting of products produced by class 28.30, such as agricultural tractors etc.<br />

N<br />

This class excludes:<br />

–<br />

renting of agricultural and <strong>for</strong>estry machinery or equipment with operator, see 01.61, 02.40<br />

77.32 Renting and leasing of construction and civil engineering machinery and equipment<br />

This class includes:<br />

–<br />

renting and operational leasing of construction and civil engineering machinery and equipment without operator:<br />

■ crane lorries<br />

■ scaffolds and work plat<strong>for</strong>ms, without erection and dismantling<br />

This class excludes:<br />

–<br />

renting of construction and civil engineering machinery or equipment with operator, see division 43<br />

77.33 Renting and leasing of office machinery and equipment (including computers)<br />

This class includes:<br />

–<br />

renting and operational leasing of office machinery and equipment without operator:<br />

■ computers and computer peripheral equipment<br />

■ duplicating machines, typewriters and word-processing machines<br />

■ accounting machinery and equipment: cash registers, electronic calculators etc.<br />

■ office furniture<br />

77.34 Renting and leasing of water transport equipment<br />

77.34/1 Renting and leasing of passenger water transport equipment<br />

This subclass includes:<br />

– renting and operational leasing of passenger water-transport equipment, such as commercial boats and ships, without<br />

operator<br />

209