Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

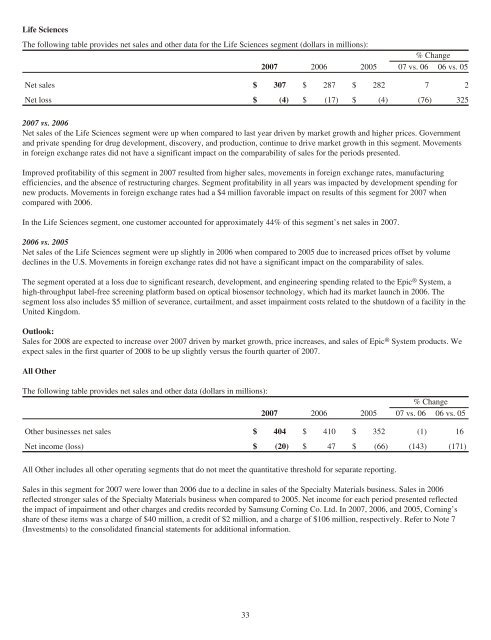

Life Sciences<br />

The following table provides net sales and other data for the Life Sciences segment (dollars in millions):<br />

<strong>2007</strong> 2006 2005<br />

% Change<br />

07 vs. 06 06 vs. 05<br />

Net sales $ 307 $ 287 $ 282 7 2<br />

Net loss $ (4) $ (17) $ (4) (76) 325<br />

<strong>2007</strong> vs. 2006<br />

Net sales of the Life Sciences segment were up when compared to last year driven by market growth and higher prices. Government<br />

and private spending for drug development, discovery, and production, continue to drive market growth in this segment. Movements<br />

in foreign exchange rates did not have a significant impact on the comparability of sales for the periods presented.<br />

Improved profitability of this segment in <strong>2007</strong> resulted from higher sales, movements in foreign exchange rates, manufacturing<br />

efficiencies, and the absence of restructuring charges. Segment profitability in all years was impacted by development spending for<br />

new products. Movements in foreign exchange rates had a $4 million favorable impact on results of this segment for <strong>2007</strong> when<br />

compared with 2006.<br />

In the Life Sciences segment, one customer accounted for approximately 44% of this segment’s net sales in <strong>2007</strong>.<br />

2006 vs. 2005<br />

Net sales of the Life Sciences segment were up slightly in 2006 when compared to 2005 due to increased prices offset by volume<br />

declines in the U.S. Movements in foreign exchange rates did not have a significant impact on the comparability of sales.<br />

The segment operated at a loss due to significant research, development, and engineering spending related to the Epic ® System, a<br />

high-throughput label-free screening platform based on optical biosensor technology, which had its market launch in 2006. The<br />

segment loss also includes $5 million of severance, curtailment, and asset impairment costs related to the shutdown of a facility in the<br />

United Kingdom.<br />

Outlook:<br />

Sales for 2008 are expected to increase over <strong>2007</strong> driven by market growth, price increases, and sales of Epic ® System products. We<br />

expect sales in the first quarter of 2008 to be up slightly versus the fourth quarter of <strong>2007</strong>.<br />

All Other<br />

The following table provides net sales and other data (dollars in millions):<br />

<strong>2007</strong> 2006 2005<br />

% Change<br />

07 vs. 06 06 vs. 05<br />

Other businesses net sales $ 404 $ 410 $ 352 (1) 16<br />

Net income (loss) $ (20) $ 47 $ (66) (143) (171)<br />

All Other includes all other operating segments that do not meet the quantitative threshold for separate reporting.<br />

Sales in this segment for <strong>2007</strong> were lower than 2006 due to a decline in sales of the Specialty Materials business. Sales in 2006<br />

reflected stronger sales of the Specialty Materials business when compared to 2005. Net income for each period presented reflected<br />

the impact of impairment and other charges and credits recorded by Samsung <strong>Corning</strong> Co. Ltd. In <strong>2007</strong>, 2006, and 2005, <strong>Corning</strong>’s<br />

share of these items was a charge of $40 million, a credit of $2 million, and a charge of $106 million, respectively. Refer to Note 7<br />

(Investments) to the consolidated financial statements for additional information.<br />

33