You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

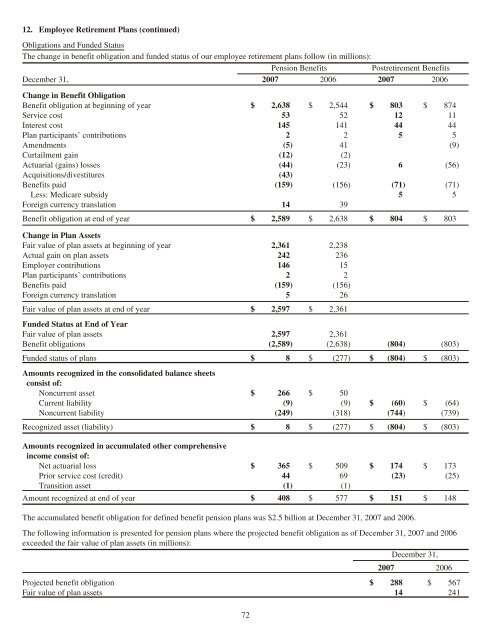

12. Employee Retirement Plans (continued)<br />

Obligations and Funded Status<br />

The change in benefit obligation and funded status of our employee retirement plans follow (in millions):<br />

Pension Benefits Postretirement Benefits<br />

December 31, <strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

Change in Benefit Obligation<br />

Benefit obligation at beginning of year $ 2,638 $ 2,544 $ 803 $ 874<br />

Service cost 53 52 12 11<br />

Interest cost 145 141 44 44<br />

Plan participants’ contributions 2 2 5 5<br />

Amendments (5) 41 (9)<br />

Curtailment gain (12) (2)<br />

Actuarial (gains) losses (44) (23) 6 (56)<br />

Acquisitions/divestitures (43)<br />

Benefits paid (159) (156) (71) (71)<br />

Less: Medicare subsidy 5 5<br />

Foreign currency translation 14 39<br />

Benefit obligation at end of year $ 2,589 $ 2,638 $ 804 $ 803<br />

Change in Plan Assets<br />

Fair value of plan assets at beginning of year 2,361 2,238<br />

Actual gain on plan assets 242 236<br />

Employer contributions 146 15<br />

Plan participants’ contributions 2 2<br />

Benefits paid (159) (156)<br />

Foreign currency translation 5 26<br />

Fair value of plan assets at end of year $ 2,597 $ 2,361<br />

Funded Status at End of Year<br />

Fair value of plan assets 2,597 2,361<br />

Benefit obligations (2,589) (2,638) (804) (803)<br />

Funded status of plans $ 8 $ (277) $ (804) $ (803)<br />

Amounts recognized in the consolidated balance sheets<br />

consist of:<br />

Noncurrent asset $ 266 $ 50<br />

Current liability (9) (9) $ (60) $ (64)<br />

Noncurrent liability (249) (318) (744) (739)<br />

Recognized asset (liability) $ 8 $ (277) $ (804) $ (803)<br />

Amounts recognized in accumulated other comprehensive<br />

income consist of:<br />

Net actuarial loss $ 365 $ 509 $ 174 $ 173<br />

Prior service cost (credit) 44 69 (23) (25)<br />

Transition asset (1) (1)<br />

Amount recognized at end of year $ 408 $ 577 $ 151 $ 148<br />

The accumulated benefit obligation for defined benefit pension plans was $2.5 billion at December 31, <strong>2007</strong> and 2006.<br />

The following information is presented for pension plans where the projected benefit obligation as of December 31, <strong>2007</strong> and 2006<br />

exceeded the fair value of plan assets (in millions):<br />

December 31,<br />

<strong>2007</strong> 2006<br />

Projected benefit obligation $ 288 $ 567<br />

Fair value of plan assets 14 241<br />

72