Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

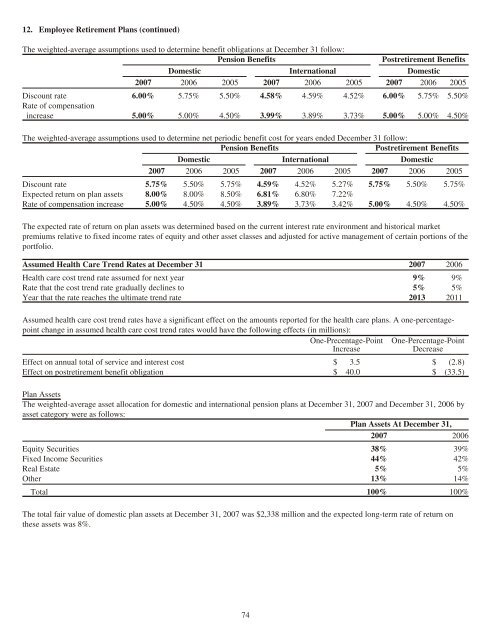

12. Employee Retirement Plans (continued)<br />

The weighted-average assumptions used to determine benefit obligations at December 31 follow:<br />

Pension Benefits Postretirement Benefits<br />

Domestic International Domestic<br />

<strong>2007</strong> 2006 2005 <strong>2007</strong> 2006 2005 <strong>2007</strong> 2006 2005<br />

Discount rate<br />

Rate of compensation<br />

6.00% 5.75% 5.50% 4.58% 4.59% 4.52% 6.00% 5.75% 5.50%<br />

increase 5.00% 5.00% 4.50% 3.99% 3.89% 3.73% 5.00% 5.00% 4.50%<br />

The weighted-average assumptions used to determine net periodic benefit cost for years ended December 31 follow:<br />

Pension Benefits Postretirement Benefits<br />

Domestic International Domestic<br />

<strong>2007</strong> 2006 2005 <strong>2007</strong> 2006 2005 <strong>2007</strong> 2006 2005<br />

Discount rate 5.75% 5.50% 5.75% 4.59% 4.52% 5.27% 5.75% 5.50% 5.75%<br />

Expected return on plan assets 8.00% 8.00% 8.50% 6.81% 6.80% 7.22%<br />

Rate of compensation increase 5.00% 4.50% 4.50% 3.89% 3.73% 3.42% 5.00% 4.50% 4.50%<br />

The expected rate of return on plan assets was determined based on the current interest rate environment and historical market<br />

premiums relative to fixed income rates of equity and other asset classes and adjusted for active management of certain portions of the<br />

portfolio.<br />

Assumed Health Care Trend Rates at December 31 <strong>2007</strong> 2006<br />

Health care cost trend rate assumed for next year 9% 9%<br />

Rate that the cost trend rate gradually declines to 5% 5%<br />

Year that the rate reaches the ultimate trend rate 2013 2011<br />

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A one-percentage-<br />

point change in assumed health care cost trend rates would have the following effects (in millions):<br />

One-Precentage-Point<br />

Increase<br />

One-Percentage-Point<br />

Decrease<br />

Effect on annual total of service and interest cost $ 3.5 $ (2.8)<br />

Effect on postretirement benefit obligation $ 40.0 $ (33.5)<br />

Plan Assets<br />

The weighted-average asset allocation for domestic and international pension plans at December 31, <strong>2007</strong> and December 31, 2006 by<br />

asset category were as follows:<br />

Plan Assets At December 31,<br />

<strong>2007</strong> 2006<br />

Equity Securities 38% 39%<br />

Fixed Income Securities 44% 42%<br />

Real Estate 5% 5%<br />

Other 13% 14%<br />

Total 100% 100%<br />

The total fair value of domestic plan assets at December 31, <strong>2007</strong> was $2,338 million and the expected long-term rate of return on<br />

these assets was 8%.<br />

74