You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

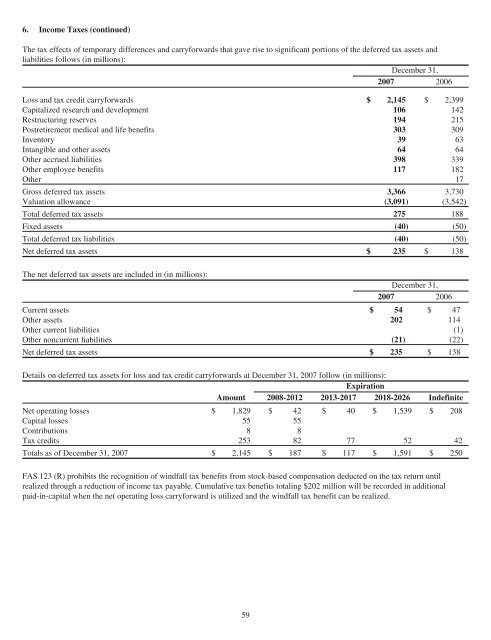

6. Income Taxes (continued)<br />

The tax effects of temporary differences and carryforwards that gave rise to significant portions of the deferred tax assets and<br />

liabilities follows (in millions):<br />

December 31,<br />

<strong>2007</strong> 2006<br />

Loss and tax credit carryforwards $ 2,145 $ 2,399<br />

Capitalized research and development 106 142<br />

Restructuring reserves 194 215<br />

Postretirement medical and life benefits 303 309<br />

Inventory 39 63<br />

Intangible and other assets 64 64<br />

Other accrued liabilities 398 339<br />

Other employee benefits 117 182<br />

Other 17<br />

Gross deferred tax assets 3,366 3,730<br />

Valuation allowance (3,091) (3,542)<br />

Total deferred tax assets 275 188<br />

Fixed assets (40) (50)<br />

Total deferred tax liabilities (40) (50)<br />

Net deferred tax assets $ 235 $ 138<br />

The net deferred tax assets are included in (in millions):<br />

December 31,<br />

<strong>2007</strong> 2006<br />

Current assets $ 54 $ 47<br />

Other assets 202 114<br />

Other current liabilities (1)<br />

Other noncurrent liabilities (21) (22)<br />

Net deferred tax assets $ 235 $ 138<br />

Details on deferred tax assets for loss and tax credit carryforwards at December 31, <strong>2007</strong> follow (in millions):<br />

Expiration<br />

Amount 2008-2012 2013-2017 2018-2026 Indefinite<br />

Net operating losses $ 1,829 $ 42 $ 40 $ 1,539 $ 208<br />

Capital losses 55 55<br />

Contributions 8 8<br />

Tax credits 253 82 77 52 42<br />

Totals as of December 31, <strong>2007</strong> $ 2,145 $ 187 $ 117 $ 1,591 $ 250<br />

FAS 123 (R) prohibits the recognition of windfall tax benefits from stock-based compensation deducted on the tax return until<br />

realized through a reduction of income tax payable. Cumulative tax benefits totaling $202 million will be recorded in additional<br />

paid-in-capital when the net operating loss carryforward is utilized and the windfall tax benefit can be realized.<br />

59