You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6. Income Taxes (continued)<br />

We do not provide income taxes on the post-1992 earnings of domestic subsidiaries that we expect to recover tax-free without significant<br />

cost. Income taxes have been provided for post-1992 unremitted earnings of domestic corporate joint ventures that we do not expect to<br />

recover tax-free. Unremitted earnings of domestic subsidiaries and corporate joint ventures that arose in fiscal years beginning on or before<br />

December 31, 1992 have been indefinitely reinvested. We currently provide income taxes on the earnings of foreign subsidiaries and<br />

affiliated companies to the extent these earnings are currently taxable or expected to be remitted. As of December 31, <strong>2007</strong>, taxes have not<br />

been provided on approximately $4.0 billion of accumulated foreign unremitted earnings which are expected to remain invested indefinitely.<br />

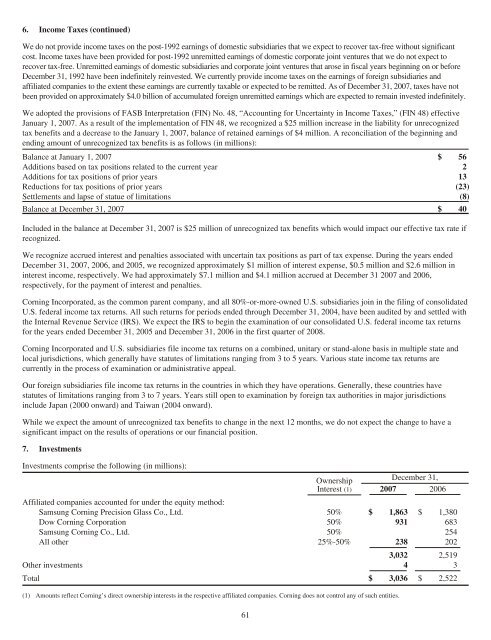

We adopted the provisions of FASB Interpretation (FIN) No. 48, “Accounting for Uncertainty in Income Taxes,” (FIN 48) effective<br />

January 1, <strong>2007</strong>. As a result of the implementation of FIN 48, we recognized a $25 million increase in the liability for unrecognized<br />

tax benefits and a decrease to the January 1, <strong>2007</strong>, balance of retained earnings of $4 million. A reconciliation of the beginning and<br />

ending amount of unrecognized tax benefits is as follows (in millions):<br />

Balance at January 1, <strong>2007</strong> $ 56<br />

Additions based on tax positions related to the current year 2<br />

Additions for tax positions of prior years 13<br />

Reductions for tax positions of prior years (23)<br />

Settlements and lapse of statue of limitations (8)<br />

Balance at December 31, <strong>2007</strong> $ 40<br />

Included in the balance at December 31, <strong>2007</strong> is $25 million of unrecognized tax benefits which would impact our effective tax rate if<br />

recognized.<br />

We recognize accrued interest and penalties associated with uncertain tax positions as part of tax expense. During the years ended<br />

December 31, <strong>2007</strong>, 2006, and 2005, we recognized approximately $1 million of interest expense, $0.5 million and $2.6 million in<br />

interest income, respectively. We had approximately $7.1 million and $4.1 million accrued at December 31 <strong>2007</strong> and 2006,<br />

respectively, for the payment of interest and penalties.<br />

<strong>Corning</strong> Incorporated, as the common parent company, and all 80%-or-more-owned U.S. subsidiaries join in the filing of consolidated<br />

U.S. federal income tax returns. All such returns for periods ended through December 31, 2004, have been audited by and settled with<br />

the Internal Revenue Service (IRS). We expect the IRS to begin the examination of our consolidated U.S. federal income tax returns<br />

for the years ended December 31, 2005 and December 31, 2006 in the first quarter of 2008.<br />

<strong>Corning</strong> Incorporated and U.S. subsidiaries file income tax returns on a combined, unitary or stand-alone basis in multiple state and<br />

local jurisdictions, which generally have statutes of limitations ranging from 3 to 5 years. Various state income tax returns are<br />

currently in the process of examination or administrative appeal.<br />

Our foreign subsidiaries file income tax returns in the countries in which they have operations. Generally, these countries have<br />

statutes of limitations ranging from 3 to 7 years. Years still open to examination by foreign tax authorities in major jurisdictions<br />

include Japan (2000 onward) and Taiwan (2004 onward).<br />

While we expect the amount of unrecognized tax benefits to change in the next 12 months, we do not expect the change to have a<br />

significant impact on the results of operations or our financial position.<br />

7. Investments<br />

Investments comprise the following (in millions):<br />

Ownership<br />

Interest (1)<br />

December 31,<br />

<strong>2007</strong> 2006<br />

Affiliated companies accounted for under the equity method:<br />

Samsung <strong>Corning</strong> Precision Glass Co., Ltd. 50% $ 1,863 $ 1,380<br />

Dow <strong>Corning</strong> Corporation 50% 931 683<br />

Samsung <strong>Corning</strong> Co., Ltd. 50% 254<br />

All other 25%-50% 238 202<br />

3,032 2,519<br />

Other investments 4 3<br />

Total $ 3,036 $ 2,522<br />

(1) Amounts reflect <strong>Corning</strong>’s direct ownership interests in the respective affiliated companies. <strong>Corning</strong> does not control any of such entities.<br />

61