Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

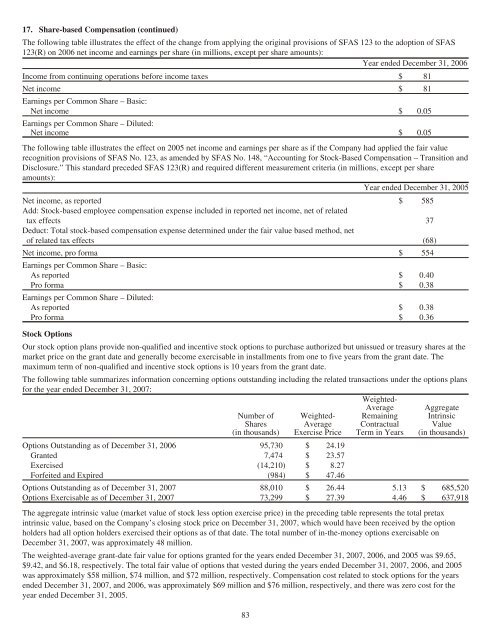

17. Share-based Compensation (continued)<br />

The following table illustrates the effect of the change from applying the original provisions of SFAS 123 to the adoption of SFAS<br />

123(R) on 2006 net income and earnings per share (in millions, except per share amounts):<br />

Year ended December 31, 2006<br />

Income from continuing operations before income taxes $ 81<br />

Net income<br />

Earnings per Common Share – Basic:<br />

$ 81<br />

Net income<br />

Earnings per Common Share – Diluted:<br />

$ 0.05<br />

Net income $ 0.05<br />

The following table illustrates the effect on 2005 net income and earnings per share as if the Company had applied the fair value<br />

recognition provisions of SFAS No. 123, as amended by SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and<br />

Disclosure.” This standard preceded SFAS 123(R) and required different measurement criteria (in millions, except per share<br />

amounts):<br />

Year ended December 31, 2005<br />

Net income, as reported<br />

Add: Stock-based employee compensation expense included in reported net income, net of related<br />

$ 585<br />

tax effects<br />

Deduct: Total stock-based compensation expense determined under the fair value based method, net<br />

37<br />

of related tax effects (68)<br />

Net income, pro forma<br />

Earnings per Common Share – Basic:<br />

$ 554<br />

As reported $ 0.40<br />

Pro forma<br />

Earnings per Common Share – Diluted:<br />

$ 0.38<br />

As reported $ 0.38<br />

Pro forma $ 0.36<br />

Stock Options<br />

Our stock option plans provide non-qualified and incentive stock options to purchase authorized but unissued or treasury shares at the<br />

market price on the grant date and generally become exercisable in installments from one to five years from the grant date. The<br />

maximum term of non-qualified and incentive stock options is 10 years from the grant date.<br />

The following table summarizes information concerning options outstanding including the related transactions under the options plans<br />

for the year ended December 31, <strong>2007</strong>:<br />

Weighted-<br />

Average Aggregate<br />

Number of Weighted- Remaining Intrinsic<br />

Shares Average Contractual Value<br />

(in thousands) Exercise Price Term in Years (in thousands)<br />

Options Outstanding as of December 31, 2006 95,730 $ 24.19<br />

Granted 7,474 $ 23.57<br />

Exercised (14,210) $ 8.27<br />

Forfeited and Expired (984) $ 47.46<br />

Options Outstanding as of December 31, <strong>2007</strong> 88,010 $ 26.44 5.13 $ 685,520<br />

Options Exercisable as of December 31, <strong>2007</strong> 73,299 $ 27.39 4.46 $ 637,918<br />

The aggregate intrinsic value (market value of stock less option exercise price) in the preceding table represents the total pretax<br />

intrinsic value, based on the Company’s closing stock price on December 31, <strong>2007</strong>, which would have been received by the option<br />

holders had all option holders exercised their options as of that date. The total number of in-the-money options exercisable on<br />

December 31, <strong>2007</strong>, was approximately 48 million.<br />

The weighted-average grant-date fair value for options granted for the years ended December 31, <strong>2007</strong>, 2006, and 2005 was $9.65,<br />

$9.42, and $6.18, respectively. The total fair value of options that vested during the years ended December 31, <strong>2007</strong>, 2006, and 2005<br />

was approximately $58 million, $74 million, and $72 million, respectively. Compensation cost related to stock options for the years<br />

ended December 31, <strong>2007</strong>, and 2006, was approximately $69 million and $76 million, respectively, and there was zero cost for the<br />

year ended December 31, 2005.<br />

83