Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LIQUIDITY AND CAPITAL RESOURCES<br />

Financing and Capital Structure<br />

The following items were significant to <strong>Corning</strong>’s financing and capital structure during <strong>2007</strong>:<br />

• In the first quarter, we repurchased $223 million of our 6.25% Euro notes due in 2010. We recognized a $15 million loss upon the<br />

early redemption of these notes.<br />

• In the second quarter, all three of our rating agencies upgraded our debt ratings to BBB+ or the equivalent.<br />

• Operating cash flow for the year was $2.1 billion which was considerably greater than our $1.3 billion of capital spending.<br />

• In the third quarter of <strong>2007</strong>, we began paying a quarterly dividend of $0.05 on the Company’s common stock. Dividend payments<br />

of $79 million were made in both the third and fourth quarter of <strong>2007</strong>.<br />

• On July 18, <strong>2007</strong>, <strong>Corning</strong>’s Board of Directors approved the repurchase of $500 million of common stock between the date of the<br />

announcement and December 31, 2008. We repurchased 10.5 million shares of common stock for $250 million as part of this<br />

repurchase program.<br />

Refer to Note 11 (Debt) to the consolidated financial statements for further information.<br />

In November 2006, we amended our revolving credit facility so that it now provides us access to a $1.1 billion unsecured multicurrency<br />

revolving line of credit through March 2011. The facility includes two financial covenants: a leverage ratio and an interest<br />

coverage ratio. At December 31, <strong>2007</strong>, we were in compliance with both financial covenants.<br />

Capital Spending<br />

Capital spending totaled $1.3 billion, $1.2 billion and $1.6 billion in <strong>2007</strong>, 2006, and 2005, respectively. Capital spending activity in<br />

all three years primarily included expansion of LCD glass capacity in the Display Technologies segment and new capacity for diesel<br />

products in the Environmental Technologies segment. Our 2008 capital spending program is expected to be in the range of $1.5<br />

billion to $1.7 billion, with approximately $800 million to $1.0 billion used to expand manufacturing capacity for LCD glass<br />

substrates in the Display Technologies segment. Additionally, approximately $200 million will be directed toward our Environmental<br />

Technologies segment to support the emerging diesel emissions control products and approximately $70 million will be spent on the<br />

expansion of the Company’s Sullivan Park Research and Development campus.<br />

Short-Term Investments<br />

Included in our $1.3 billion short-term investments at December 31, <strong>2007</strong>, were $301 million of asset-backed securities. Asset-backed<br />

securities are collateralized by credit card loans, auto loans, mortgages, and student loans. At December 31, <strong>2007</strong>, our exposure to<br />

sub-prime mortgages was $17 million. Unrealized losses on securities backed by sub-prime mortgages, which are rated as investment<br />

grade, were approximately $1 million at December 31, <strong>2007</strong>, and are expected to recover in the short-term. Realized losses on these<br />

items amounted to $6 million in <strong>2007</strong>.<br />

Defined Benefit Pension Plans<br />

We have defined benefit pension plans covering certain domestic and international employees. Our funding policy has been to<br />

contribute, as necessary, an amount in excess of the minimum requirements in order to achieve the company’s long-term funding<br />

targets. In <strong>2007</strong>, we made voluntary cash contributions of $131 million to our domestic defined benefit pension plan and $18 million<br />

to our international pension plans. In 2006, we made an incremental cash contribution of $15 million to our domestic and international<br />

pension plans.<br />

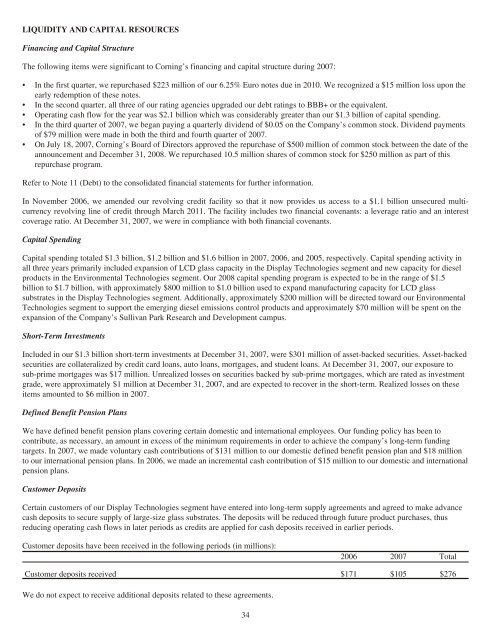

Customer Deposits<br />

Certain customers of our Display Technologies segment have entered into long-term supply agreements and agreed to make advance<br />

cash deposits to secure supply of large-size glass substrates. The deposits will be reduced through future product purchases, thus<br />

reducing operating cash flows in later periods as credits are applied for cash deposits received in earlier periods.<br />

Customer deposits have been received in the following periods (in millions):<br />

2006 <strong>2007</strong> Total<br />

Customer deposits received $171 $105 $276<br />

We do not expect to receive additional deposits related to these agreements.<br />

34