You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

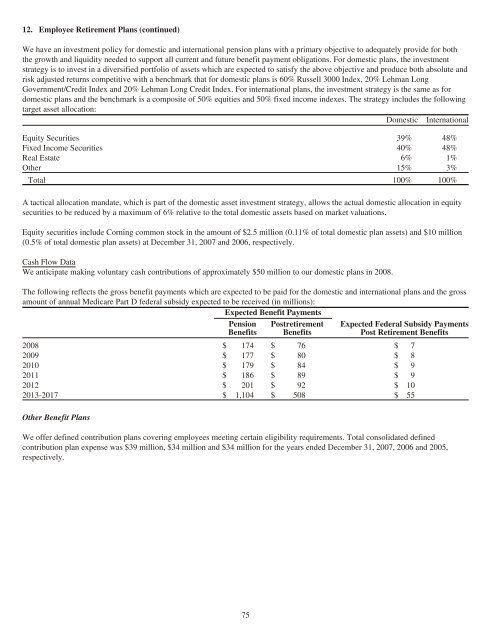

12. Employee Retirement Plans (continued)<br />

We have an investment policy for domestic and international pension plans with a primary objective to adequately provide for both<br />

the growth and liquidity needed to support all current and future benefit payment obligations. For domestic plans, the investment<br />

strategy is to invest in a diversified portfolio of assets which are expected to satisfy the above objective and produce both absolute and<br />

risk adjusted returns competitive with a benchmark that for domestic plans is 60% Russell 3000 Index, 20% Lehman Long<br />

Government/Credit Index and 20% Lehman Long Credit Index. For international plans, the investment strategy is the same as for<br />

domestic plans and the benchmark is a composite of 50% equities and 50% fixed income indexes. The strategy includes the following<br />

target asset allocation:<br />

Domestic International<br />

Equity Securities 39% 48%<br />

Fixed Income Securities 40% 48%<br />

Real Estate 6% 1%<br />

Other 15% 3%<br />

Total 100% 100%<br />

A tactical allocation mandate, which is part of the domestic asset investment strategy, allows the actual domestic allocation in equity<br />

securities to be reduced by a maximum of 6% relative to the total domestic assets based on market valuations.<br />

Equity securities include <strong>Corning</strong> common stock in the amount of $2.5 million (0.11% of total domestic plan assets) and $10 million<br />

(0.5% of total domestic plan assets) at December 31, <strong>2007</strong> and 2006, respectively.<br />

Cash Flow Data<br />

We anticipate making voluntary cash contributions of approximately $50 million to our domestic plans in 2008.<br />

The following reflects the gross benefit payments which are expected to be paid for the domestic and international plans and the gross<br />

amount of annual Medicare Part D federal subsidy expected to be received (in millions):<br />

Expected Benefit Payments<br />

Pension<br />

Benefits<br />

Postretirement<br />

Benefits<br />

Expected Federal Subsidy Payments<br />

Post Retirement Benefits<br />

2008 $ 174 $ 76 $ 7<br />

2009 $ 177 $ 80 $ 8<br />

2010 $ 179 $ 84 $ 9<br />

2011 $ 186 $ 89 $ 9<br />

2012 $ 201 $ 92 $ 10<br />

2013-2017 $ 1,104 $ 508 $ 55<br />

Other Benefit Plans<br />

We offer defined contribution plans covering employees meeting certain eligibility requirements. Total consolidated defined<br />

contribution plan expense was $39 million, $34 million and $34 million for the years ended December 31, <strong>2007</strong>, 2006 and 2005,<br />

respectively.<br />

75