Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

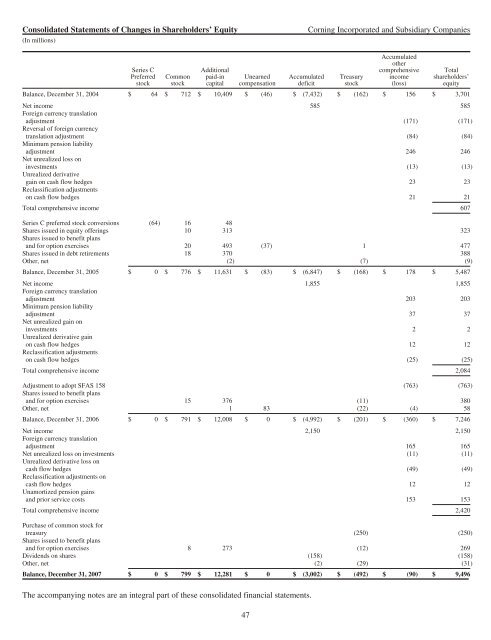

Consolidated Statements of Changes in Shareholders’ Equity <strong>Corning</strong> Incorporated and Subsidiary Companies<br />

(In millions)<br />

Series C<br />

Preferred<br />

stock<br />

Common<br />

stock<br />

Additional<br />

paid-in<br />

capital<br />

Unearned<br />

compensation<br />

Accumulated<br />

deficit<br />

Treasury<br />

stock<br />

Accumulated<br />

other<br />

comprehensive<br />

income<br />

(loss)<br />

Total<br />

shareholders’<br />

equity<br />

Balance, December 31, 2004 $ 64 $ 712 $ 10,409 $ (46) $ (7,432) $ (162) $ 156 $ 3,701<br />

Net income<br />

Foreign currency translation<br />

585 585<br />

adjustment<br />

Reversal of foreign currency<br />

(171) (171)<br />

translation adjustment<br />

Minimum pension liability<br />

(84) (84)<br />

adjustment<br />

Net unrealized loss on<br />

246 246<br />

investments<br />

Unrealized derivative<br />

(13) (13)<br />

gain on cash flow hedges<br />

Reclassification adjustments<br />

23 23<br />

on cash flow hedges 21 21<br />

Total comprehensive income 607<br />

Series C preferred stock conversions (64) 16 48<br />

Shares issued in equity offerings<br />

Shares issued to benefit plans<br />

10 313 323<br />

and for option exercises 20 493 (37) 1 477<br />

Shares issued in debt retirements 18 370 388<br />

Other, net (2) (7) (9)<br />

Balance, December 31, 2005 $ 0 $ 776 $ 11,631 $ (83) $ (6,847) $ (168) $ 178 $ 5,487<br />

Net income<br />

Foreign currency translation<br />

1,855 1,855<br />

adjustment<br />

Minimum pension liability<br />

203 203<br />

adjustment<br />

Net unrealized gain on<br />

37 37<br />

investments<br />

Unrealized derivative gain<br />

2 2<br />

on cash flow hedges<br />

Reclassification adjustments<br />

12 12<br />

on cash flow hedges (25) (25)<br />

Total comprehensive income 2,084<br />

Adjustment to adopt SFAS 158<br />

Shares issued to benefit plans<br />

(763) (763)<br />

and for option exercises 15 376 (11) 380<br />

Other, net 1 83 (22) (4) 58<br />

Balance, December 31, 2006 $ 0 $ 791 $ 12,008 $ 0 $ (4,992) $ (201) $ (360) $ 7,246<br />

Net income<br />

Foreign currency translation<br />

2,150 2,150<br />

adjustment 165 165<br />

Net unrealized loss on investments<br />

Unrealized derivative loss on<br />

(11) (11)<br />

cash flow hedges<br />

Reclassification adjustments on<br />

(49) (49)<br />

cash flow hedges<br />

Unamortized pension gains<br />

12 12<br />

and prior service costs 153 153<br />

Total comprehensive income 2,420<br />

Purchase of common stock for<br />

treasury<br />

Shares issued to benefit plans<br />

(250) (250)<br />

and for option exercises 8 273 (12) 269<br />

Dividends on shares (158) (158)<br />

Other, net (2) (29) (31)<br />

Balance, December 31, <strong>2007</strong> $ 0 $ 799 $ 12,281 $ 0 $ (3,002) $ (492) $ (90) $ 9,496<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

47