Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

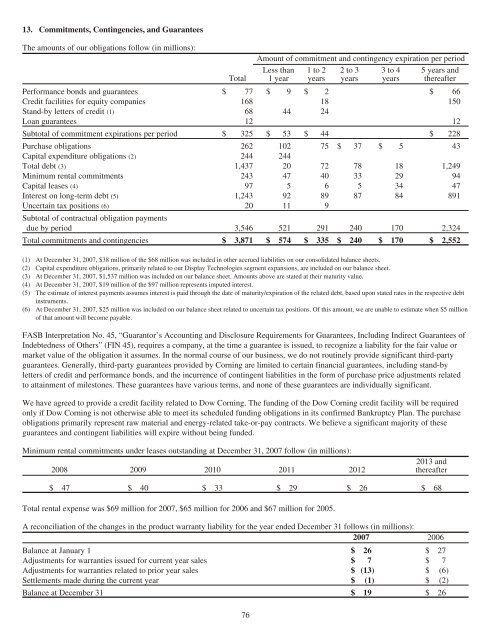

13. Commitments, Contingencies, and Guarantees<br />

The amounts of our obligations follow (in millions):<br />

Total<br />

Amount of commitment and contingency expiration per period<br />

Less than<br />

1 year<br />

1to2<br />

years<br />

2to3<br />

years<br />

3to4<br />

years<br />

5 years and<br />

thereafter<br />

Performance bonds and guarantees $ 77 $ 9 $ 2 $ 66<br />

Credit facilities for equity companies 168 18 150<br />

Stand-by letters of credit (1) 68 44 24<br />

Loan guarantees 12 12<br />

Subtotal of commitment expirations per period $ 325 $ 53 $ 44 $ 228<br />

Purchase obligations 262 102 75 $ 37 $ 5 43<br />

Capital expenditure obligations (2) 244 244<br />

Total debt (3) 1,437 20 72 78 18 1,249<br />

Minimum rental commitments 243 47 40 33 29 94<br />

Capital leases (4) 97 5 6 5 34 47<br />

Interest on long-term debt (5) 1,243 92 89 87 84 891<br />

Uncertain tax positions (6)<br />

Subtotal of contractual obligation payments<br />

20 11 9<br />

due by period 3,546 521 291 240 170 2,324<br />

Total commitments and contingencies $ 3,871 $ 574 $ 335 $ 240 $ 170 $ 2,552<br />

(1) At December 31, <strong>2007</strong>, $38 million of the $68 million was included in other accrued liabilities on our consolidated balance sheets.<br />

(2) Capital expenditure obligations, primarily related to our Display Technologies segment expansions, are included on our balance sheet.<br />

(3) At December 31, <strong>2007</strong>, $1,537 million was included on our balance sheet. Amounts above are stated at their maturity value.<br />

(4) At December 31, <strong>2007</strong>, $19 million of the $97 million represents imputed interest.<br />

(5) The estimate of interest payments assumes interest is paid through the date of maturity/expiration of the related debt, based upon stated rates in the respective debt<br />

instruments.<br />

(6) At December 31, <strong>2007</strong>, $25 million was included on our balance sheet related to uncertain tax positions. Of this amount, we are unable to estimate when $5 million<br />

of that amount will become payable.<br />

FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of<br />

Indebtedness of Others” (FIN 45), requires a company, at the time a guarantee is issued, to recognize a liability for the fair value or<br />

market value of the obligation it assumes. In the normal course of our business, we do not routinely provide significant third-party<br />

guarantees. Generally, third-party guarantees provided by <strong>Corning</strong> are limited to certain financial guarantees, including stand-by<br />

letters of credit and performance bonds, and the incurrence of contingent liabilities in the form of purchase price adjustments related<br />

to attainment of milestones. These guarantees have various terms, and none of these guarantees are individually significant.<br />

We have agreed to provide a credit facility related to Dow <strong>Corning</strong>. The funding of the Dow <strong>Corning</strong> credit facility will be required<br />

only if Dow <strong>Corning</strong> is not otherwise able to meet its scheduled funding obligations in its confirmed Bankruptcy Plan. The purchase<br />

obligations primarily represent raw material and energy-related take-or-pay contracts. We believe a significant majority of these<br />

guarantees and contingent liabilities will expire without being funded.<br />

Minimum rental commitments under leases outstanding at December 31, <strong>2007</strong> follow (in millions):<br />

2008 2009 2010 2011 2012<br />

2013 and<br />

thereafter<br />

$ 47 $ 40 $ 33 $ 29 $ 26 $ 68<br />

Total rental expense was $69 million for <strong>2007</strong>, $65 million for 2006 and $67 million for 2005.<br />

A reconciliation of the changes in the product warranty liability for the year ended December 31 follows (in millions):<br />

<strong>2007</strong> 2006<br />

Balance at January 1 $ 26 $ 27<br />

Adjustments for warranties issued for current year sales $ 7 $ 7<br />

Adjustments for warranties related to prior year sales $ (13) $ (6)<br />

Settlements made during the current year $ (1) $ (2)<br />

Balance at December 31 $ 19 $ 26<br />

76