You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In <strong>2007</strong> and 2006, we issued $231 million and $126 million, respectively, in credit memoranda. These credit amounts are not included<br />

in the above amounts and were applied against customer receivables. Customer deposit liabilities were $531 million and $633 million<br />

at December 31, <strong>2007</strong> and 2006, respectively. In 2008, we expect to issue approximately $190 million in credit memoranda.<br />

Restructuring<br />

During <strong>2007</strong>, 2006, and 2005, we made payments of $39 million, $15 million, and $25 million, respectively, related to employee<br />

severance and other exit costs resulting from restructuring actions. Cash payments for employee-related costs will be substantially<br />

completed by the end of 2008, while payments for exit activities will be substantially completed by the end of 2010.<br />

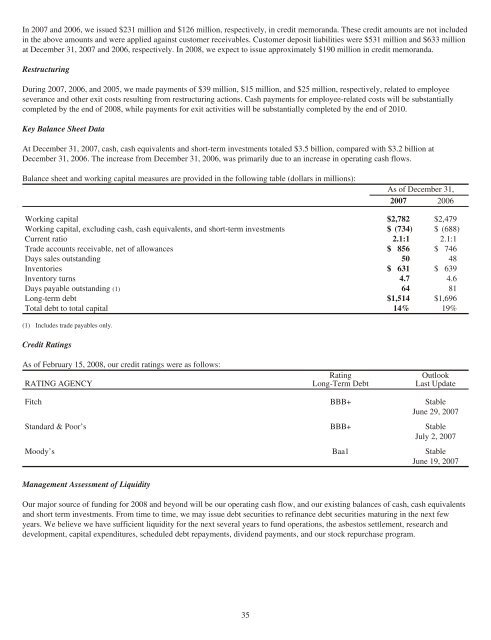

Key Balance Sheet Data<br />

At December 31, <strong>2007</strong>, cash, cash equivalents and short-term investments totaled $3.5 billion, compared with $3.2 billion at<br />

December 31, 2006. The increase from December 31, 2006, was primarily due to an increase in operating cash flows.<br />

Balance sheet and working capital measures are provided in the following table (dollars in millions):<br />

As of December 31,<br />

<strong>2007</strong> 2006<br />

Working capital $2,782 $2,479<br />

Working capital, excluding cash, cash equivalents, and short-term investments $ (734) $ (688)<br />

Current ratio 2.1:1 2.1:1<br />

Trade accounts receivable, net of allowances $ 856 $ 746<br />

Days sales outstanding 50 48<br />

Inventories $ 631 $ 639<br />

Inventory turns 4.7 4.6<br />

Days payable outstanding (1) 64 81<br />

Long-term debt $1,514 $1,696<br />

Total debt to total capital 14% 19%<br />

(1) Includes trade payables only.<br />

Credit Ratings<br />

As of February 15, 2008, our credit ratings were as follows:<br />

RATING AGENCY<br />

Rating<br />

Long-Term Debt<br />

Outlook<br />

Last Update<br />

Fitch BBB+ Stable<br />

June 29, <strong>2007</strong><br />

Standard & Poor’s BBB+ Stable<br />

July 2, <strong>2007</strong><br />

Moody’s Baa1 Stable<br />

June 19, <strong>2007</strong><br />

Management Assessment of Liquidity<br />

Our major source of funding for 2008 and beyond will be our operating cash flow, and our existing balances of cash, cash equivalents<br />

and short term investments. From time to time, we may issue debt securities to refinance debt securities maturing in the next few<br />

years. We believe we have sufficient liquidity for the next several years to fund operations, the asbestos settlement, research and<br />

development, capital expenditures, scheduled debt repayments, dividend payments, and our stock repurchase program.<br />

35