Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

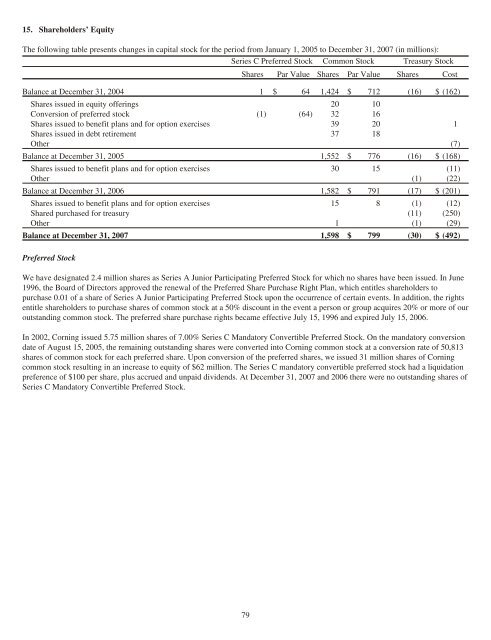

15. Shareholders’ Equity<br />

The following table presents changes in capital stock for the period from January 1, 2005 to December 31, <strong>2007</strong> (in millions):<br />

Series C Preferred Stock Common Stock Treasury Stock<br />

Shares Par Value Shares Par Value Shares Cost<br />

Balance at December 31, 2004 1 $ 64 1,424 $ 712 (16) $ (162)<br />

Shares issued in equity offerings 20 10<br />

Conversion of preferred stock (1) (64) 32 16<br />

Shares issued to benefit plans and for option exercises 39 20 1<br />

Shares issued in debt retirement 37 18<br />

Other (7)<br />

Balance at December 31, 2005 1,552 $ 776 (16) $ (168)<br />

Shares issued to benefit plans and for option exercises 30 15 (11)<br />

Other (1) (22)<br />

Balance at December 31, 2006 1,582 $ 791 (17) $ (201)<br />

Shares issued to benefit plans and for option exercises 15 8 (1) (12)<br />

Shared purchased for treasury (11) (250)<br />

Other 1 (1) (29)<br />

Balance at December 31, <strong>2007</strong> 1,598 $ 799 (30) $ (492)<br />

Preferred Stock<br />

We have designated 2.4 million shares as Series A Junior Participating Preferred Stock for which no shares have been issued. In June<br />

1996, the Board of Directors approved the renewal of the Preferred Share Purchase Right Plan, which entitles shareholders to<br />

purchase 0.01 of a share of Series A Junior Participating Preferred Stock upon the occurrence of certain events. In addition, the rights<br />

entitle shareholders to purchase shares of common stock at a 50% discount in the event a person or group acquires 20% or more of our<br />

outstanding common stock. The preferred share purchase rights became effective July 15, 1996 and expired July 15, 2006.<br />

In 2002, <strong>Corning</strong> issued 5.75 million shares of 7.00% Series C Mandatory Convertible Preferred Stock. On the mandatory conversion<br />

date of August 15, 2005, the remaining outstanding shares were converted into <strong>Corning</strong> common stock at a conversion rate of 50,813<br />

shares of common stock for each preferred share. Upon conversion of the preferred shares, we issued 31 million shares of <strong>Corning</strong><br />

common stock resulting in an increase to equity of $62 million. The Series C mandatory convertible preferred stock had a liquidation<br />

preference of $100 per share, plus accrued and unpaid dividends. At December 31, <strong>2007</strong> and 2006 there were no outstanding shares of<br />

Series C Mandatory Convertible Preferred Stock.<br />

79