You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Probability of litigation outcomes<br />

SFAS No. 5, “Accounting for Contingencies,” (SFAS 5) requires us to make judgments about future events that are inherently<br />

uncertain. In making determinations of likely outcomes of litigation matters, we consider the evaluation of legal counsel<br />

knowledgeable about each matter, case law, and other case-specific issues. See Legal Proceedings for a discussion of the material<br />

litigation matters we face. The most significant matter involving judgment is the PCC asbestos liability. There are a number of factors<br />

bearing upon our potential liability, including the inherent complexity of a Chapter 11 filing, our history of success in defending<br />

asbestos claims, our assessment of the strength of our corporate veil defenses, our continuing dialogue with our insurance carriers and<br />

the claimants’ representatives. We have reached a tentative plan of settlement on PCC as disclosed in Legal Proceedings and Note 7<br />

(Investments) to the Consolidated Financial Statements. The settlement is subject to a number of contingencies, including approval by<br />

the bankruptcy court and resolution of any appeals. On December 21, 2006, the bankruptcy court denied confirmation of the PCC Plan<br />

of Reorganization due to the scope of the channeling injunction proposed of the two shareholders with respect to other asbestos claims<br />

not deriving directly from PCC’s products or operations. Several parties, including <strong>Corning</strong>, have moved for reconsideration of the<br />

ruling. We continue to exercise judgment in assessing the likelihood that reconsideration will lead to a revised ruling, or that an<br />

alternative plan of reorganization will emerge to address the claims deriving from PCC. It is possible that actual results will differ<br />

from assumptions and require adjustments to accruals.<br />

Other possible liabilities<br />

SFAS 5 and other similarly focused accounting literature require us to make judgments about future events that are inherently<br />

uncertain. In making determinations of likely outcomes of certain matters, including certain tax planning matters and environmental<br />

matters, these judgments require us to consider events and actions that are outside our control in determining whether probable or<br />

possible liabilities require accrual or disclosure. It is possible that actual results will differ from assumptions and require adjustments<br />

to accruals.<br />

Pension and other postretirement employee benefits (OPEB)<br />

Pension and OPEB costs and obligations are dependent on assumptions used in calculating such amounts. These assumptions include<br />

discount rates, health care cost trend rates, benefits earned, interest cost, expected return on plan assets, mortality rates, and other<br />

factors. In accordance with GAAP, actual results that differ from the assumptions are accumulated and amortized over future periods<br />

and, therefore, generally affect recognized expense and the recorded obligation in future periods. While management believes that the<br />

assumptions used are appropriate, differences in actual experience or changes in assumptions may affect <strong>Corning</strong>’s pension and other<br />

postretirement obligations and future expense.<br />

As of December 31, <strong>2007</strong>, the Projected Benefit Obligation (PBO) for U.S. pension plans was $2,246 million.<br />

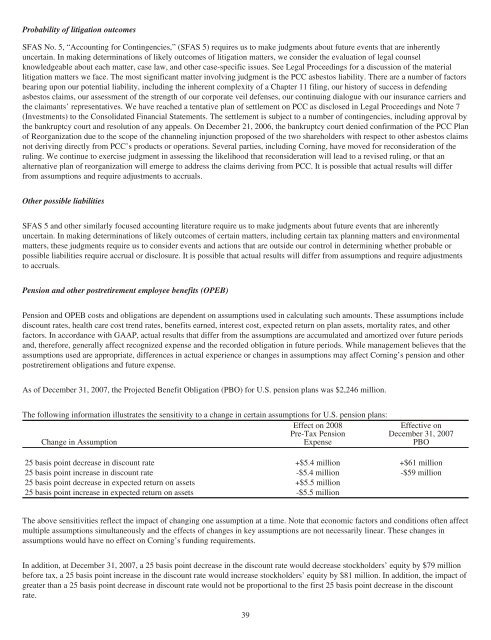

The following information illustrates the sensitivity to a change in certain assumptions for U.S. pension plans:<br />

Change in Assumption<br />

Effect on 2008<br />

Pre-Tax Pension<br />

Expense<br />

Effective on<br />

December 31, <strong>2007</strong><br />

PBO<br />

25 basis point decrease in discount rate +$5.4 million +$61 million<br />

25 basis point increase in discount rate -$5.4 million -$59 million<br />

25 basis point decrease in expected return on assets +$5.5 million<br />

25 basis point increase in expected return on assets -$5.5 million<br />

The above sensitivities reflect the impact of changing one assumption at a time. Note that economic factors and conditions often affect<br />

multiple assumptions simultaneously and the effects of changes in key assumptions are not necessarily linear. These changes in<br />

assumptions would have no effect on <strong>Corning</strong>’s funding requirements.<br />

In addition, at December 31, <strong>2007</strong>, a 25 basis point decrease in the discount rate would decrease stockholders’ equity by $79 million<br />

before tax, a 25 basis point increase in the discount rate would increase stockholders’ equity by $81 million. In addition, the impact of<br />

greater than a 25 basis point decrease in discount rate would not be proportional to the first 25 basis point decrease in the discount<br />

rate.<br />

39