You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7. Investments (continued)<br />

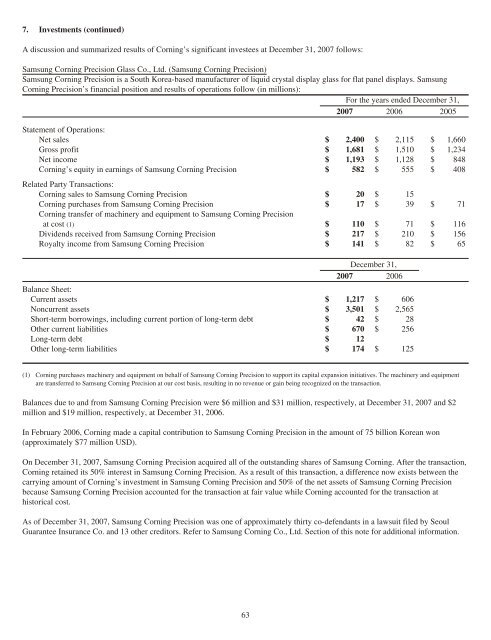

A discussion and summarized results of <strong>Corning</strong>’s significant investees at December 31, <strong>2007</strong> follows:<br />

Samsung <strong>Corning</strong> Precision Glass Co., Ltd. (Samsung <strong>Corning</strong> Precision)<br />

Samsung <strong>Corning</strong> Precision is a South Korea-based manufacturer of liquid crystal display glass for flat panel displays. Samsung<br />

<strong>Corning</strong> Precision’s financial position and results of operations follow (in millions):<br />

For the years ended December 31,<br />

<strong>2007</strong> 2006 2005<br />

Statement of Operations:<br />

Net sales $ 2,400 $ 2,115 $ 1,660<br />

Gross profit $ 1,681 $ 1,510 $ 1,234<br />

Net income $ 1,193 $ 1,128 $ 848<br />

<strong>Corning</strong>’s equity in earnings of Samsung <strong>Corning</strong> Precision $ 582 $ 555 $ 408<br />

Related Party Transactions:<br />

<strong>Corning</strong> sales to Samsung <strong>Corning</strong> Precision $ 20 $ 15<br />

<strong>Corning</strong> purchases from Samsung <strong>Corning</strong> Precision $ 17 $ 39 $ 71<br />

<strong>Corning</strong> transfer of machinery and equipment to Samsung <strong>Corning</strong> Precision<br />

at cost (1) $ 110 $ 71 $ 116<br />

Dividends received from Samsung <strong>Corning</strong> Precision $ 217 $ 210 $ 156<br />

Royalty income from Samsung <strong>Corning</strong> Precision $ 141 $ 82 $ 65<br />

December 31,<br />

<strong>2007</strong> 2006<br />

Balance Sheet:<br />

Current assets $ 1,217 $ 606<br />

Noncurrent assets $ 3,501 $ 2,565<br />

Short-term borrowings, including current portion of long-term debt $ 42 $ 28<br />

Other current liabilities $ 670 $ 256<br />

Long-term debt $ 12<br />

Other long-term liabilities $ 174 $ 125<br />

(1) <strong>Corning</strong> purchases machinery and equipment on behalf of Samsung <strong>Corning</strong> Precision to support its capital expansion initiatives. The machinery and equipment<br />

are transferred to Samsung <strong>Corning</strong> Precision at our cost basis, resulting in no revenue or gain being recognized on the transaction.<br />

Balances due to and from Samsung <strong>Corning</strong> Precision were $6 million and $31 million, respectively, at December 31, <strong>2007</strong> and $2<br />

million and $19 million, respectively, at December 31, 2006.<br />

In February 2006, <strong>Corning</strong> made a capital contribution to Samsung <strong>Corning</strong> Precision in the amount of 75 billion Korean won<br />

(approximately $77 million USD).<br />

On December 31, <strong>2007</strong>, Samsung <strong>Corning</strong> Precision acquired all of the outstanding shares of Samsung <strong>Corning</strong>. After the transaction,<br />

<strong>Corning</strong> retained its 50% interest in Samsung <strong>Corning</strong> Precision. As a result of this transaction, a difference now exists between the<br />

carrying amount of <strong>Corning</strong>’s investment in Samsung <strong>Corning</strong> Precision and 50% of the net assets of Samsung <strong>Corning</strong> Precision<br />

because Samsung <strong>Corning</strong> Precision accounted for the transaction at fair value while <strong>Corning</strong> accounted for the transaction at<br />

historical cost.<br />

As of December 31, <strong>2007</strong>, Samsung <strong>Corning</strong> Precision was one of approximately thirty co-defendants in a lawsuit filed by Seoul<br />

Guarantee Insurance Co. and 13 other creditors. Refer to Samsung <strong>Corning</strong> Co., Ltd. Section of this note for additional information.<br />

63