Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1. Summary of Significant Accounting Policies (continued)<br />

Cash and Cash Equivalents<br />

Cash equivalents consist of highly liquid investments that are readily convertible into cash. We consider securities with contractual<br />

maturities of three months or less, when purchased, to be cash equivalents. The carrying amount of these securities approximates fair<br />

value because of the short-term maturity of these instruments.<br />

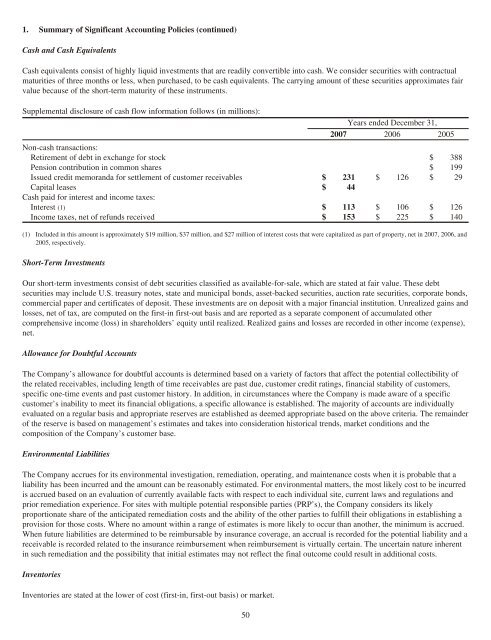

Supplemental disclosure of cash flow information follows (in millions):<br />

<strong>2007</strong><br />

Years ended December 31,<br />

2006 2005<br />

Non-cash transactions:<br />

Retirement of debt in exchange for stock $ 388<br />

Pension contribution in common shares $ 199<br />

Issued credit memoranda for settlement of customer receivables $ 231 $ 126 $ 29<br />

Capital leases<br />

Cash paid for interest and income taxes:<br />

$ 44<br />

Interest (1) $ 113 $ 106 $ 126<br />

Income taxes, net of refunds received $ 153 $ 225 $ 140<br />

(1) Included in this amount is approximately $19 million, $37 million, and $27 million of interest costs that were capitalized as part of property, net in <strong>2007</strong>, 2006, and<br />

2005, respectively.<br />

Short-Term Investments<br />

Our short-term investments consist of debt securities classified as available-for-sale, which are stated at fair value. These debt<br />

securities may include U.S. treasury notes, state and municipal bonds, asset-backed securities, auction rate securities, corporate bonds,<br />

commercial paper and certificates of deposit. These investments are on deposit with a major financial institution. Unrealized gains and<br />

losses, net of tax, are computed on the first-in first-out basis and are reported as a separate component of accumulated other<br />

comprehensive income (loss) in shareholders’ equity until realized. Realized gains and losses are recorded in other income (expense),<br />

net.<br />

Allowance for Doubtful Accounts<br />

The Company’s allowance for doubtful accounts is determined based on a variety of factors that affect the potential collectibility of<br />

the related receivables, including length of time receivables are past due, customer credit ratings, financial stability of customers,<br />

specific one-time events and past customer history. In addition, in circumstances where the Company is made aware of a specific<br />

customer’s inability to meet its financial obligations, a specific allowance is established. The majority of accounts are individually<br />

evaluated on a regular basis and appropriate reserves are established as deemed appropriate based on the above criteria. The remainder<br />

of the reserve is based on management’s estimates and takes into consideration historical trends, market conditions and the<br />

composition of the Company’s customer base.<br />

Environmental Liabilities<br />

The Company accrues for its environmental investigation, remediation, operating, and maintenance costs when it is probable that a<br />

liability has been incurred and the amount can be reasonably estimated. For environmental matters, the most likely cost to be incurred<br />

is accrued based on an evaluation of currently available facts with respect to each individual site, current laws and regulations and<br />

prior remediation experience. For sites with multiple potential responsible parties (PRP’s), the Company considers its likely<br />

proportionate share of the anticipated remediation costs and the ability of the other parties to fulfill their obligations in establishing a<br />

provision for those costs. Where no amount within a range of estimates is more likely to occur than another, the minimum is accrued.<br />

When future liabilities are determined to be reimbursable by insurance coverage, an accrual is recorded for the potential liability and a<br />

receivable is recorded related to the insurance reimbursement when reimbursement is virtually certain. The uncertain nature inherent<br />

in such remediation and the possibility that initial estimates may not reflect the final outcome could result in additional costs.<br />

Inventories<br />

Inventories are stated at the lower of cost (first-in, first-out basis) or market.<br />

50