report

report

report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

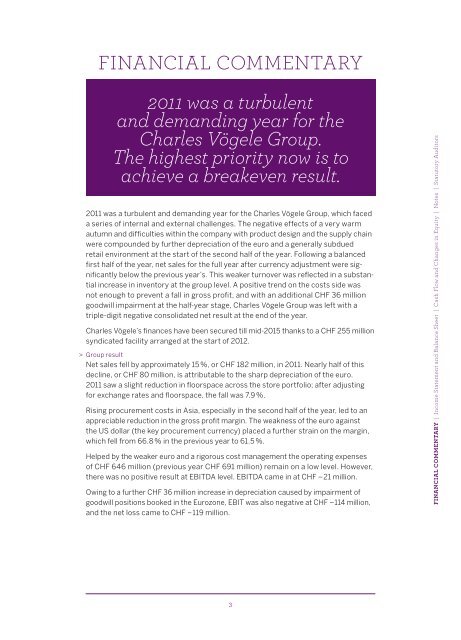

Financial coMMentaRY<br />

2011 was a turbulent<br />

and demanding year for the<br />

Charles Vögele Group.<br />

The highest priority now is to<br />

achieve a breakeven result.<br />

2011 was a turbulent and demanding year for the Charles Vögele Group, which faced<br />

a series of internal and external challenges. The negative effects of a very warm<br />

autumn and difficulties within the company with product design and the supply chain<br />

were compounded by further depreciation of the euro and a generally subdued<br />

retail environment at the start of the second half of the year. Following a balanced<br />

first half of the year, net sales for the full year after currency adjustment were sig-<br />

nificantly below the previous year’s. This weaker turnover was reflected in a substantial<br />

increase in inventory at the group level. A positive trend on the costs side was<br />

not enough to prevent a fall in gross profit, and with an additional CHF 36 million<br />

goodwill impairment at the half-year stage, Charles Vögele Group was left with a<br />

triple-digit negative consolidated net result at the end of the year.<br />

Charles Vögele’s finances have been secured till mid-2015 thanks to a CHF 255 million<br />

syndicated facility arranged at the start of 2012.<br />

> Group result<br />

Net sales fell by approximately 15 %, or CHF 182 million, in 2011. Nearly half of this<br />

decline, or CHF 80 million, is attributable to the sharp depreciation of the euro.<br />

2011 saw a slight reduction in floorspace across the store portfolio; after adjusting<br />

for exchange rates and floorspace, the fall was 7.9 %.<br />

Rising procurement costs in Asia, especially in the second half of the year, led to an<br />

appreciable reduction in the gross profit margin. The weakness of the euro against<br />

the US dollar (the key procurement currency) placed a further strain on the margin,<br />

which fell from 66.8 % in the previous year to 61.5 %.<br />

Helped by the weaker euro and a rigorous cost management the operating expenses<br />

of CHF 646 million (previous year CHF 691 million) remain on a low level. However,<br />

there was no positive result at EBITDA level. EBITDA came in at CHF –21 million.<br />

Owing to a further CHF 36 million increase in depreciation caused by impairment of<br />

goodwill positions booked in the Eurozone, EBIT was also negative at CHF –114 million,<br />

and the net loss came to CHF –119 million.<br />

3<br />

Financial commentary | income Statement and Balance Sheet | cash Flow and changes in equity | notes | Statutory auditors