report

report

report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risks can arise from cash at the stores and in transporting these cash takings to<br />

the financial institutions. Cash holdings (takings, change) in the stores are kept in<br />

safes and kept to a minimum through regular or as-needed transfers of the cash<br />

takings. The risk of theft by own personnel or third-parties is reduced by an effective<br />

internal control system. Cash holdings in the safes are insured to an appropriate<br />

level against theft and acts of God, and are replaced if lost. When choosing firms to<br />

transport money and valuables, Charles Vögele Group’s selection criteria are based<br />

on quality, transparency, security and comprehensive insurance protection.<br />

Receivables from tax refunds (value added tax) are secured by regularly verifying<br />

that declarations are formally correct and by submitting the necessary declarations<br />

on time. Prepayments to suppliers and other claims are checked regularly and any<br />

identified credit risk is taken into account through a value adjustment (see Note 2.11).<br />

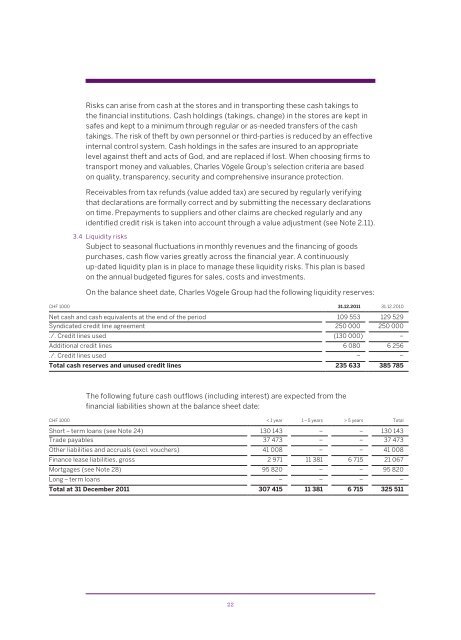

3.4 Liquidity risks<br />

Subject to seasonal fluctuations in monthly revenues and the financing of goods<br />

purchases, cash flow varies greatly across the financial year. A continuously<br />

up-dated liquidity plan is in place to manage these liquidity risks. This plan is based<br />

on the annual budgeted figures for sales, costs and investments.<br />

On the balance sheet date, Charles Vögele Group had the following liquidity reserves:<br />

CHF 1000 31.12.2011 31.12.2010<br />

Net cash and cash equivalents at the end of the period 109 553 129 529<br />

Syndicated credit line agreement 250 000 250 000<br />

./. Credit lines used (130 000) –<br />

Additional credit lines 6 080 6 256<br />

./. Credit lines used – –<br />

Total cash reserves and unused credit lines 235 633 385 785<br />

The following future cash outflows (including interest) are expected from the<br />

financial liabilities shown at the balance sheet date:<br />

CHF 1000 < 1 year 1 – 5 years > 5 years Total<br />

Short – term loans (see Note 24) 130 143 – – 130 143<br />

Trade payables 37 473 – – 37 473<br />

Other liabilities and accruals (excl. vouchers) 41 008 – – 41 008<br />

Finance lease liabilities, gross 2 971 11 381 6 715 21 067<br />

Mortgages (see Note 28) 95 820 – – 95 820<br />

Long – term loans – – – –<br />

Total at 31 December 2011 307 415 11 381 6 715 325 511<br />

22