report

report

report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

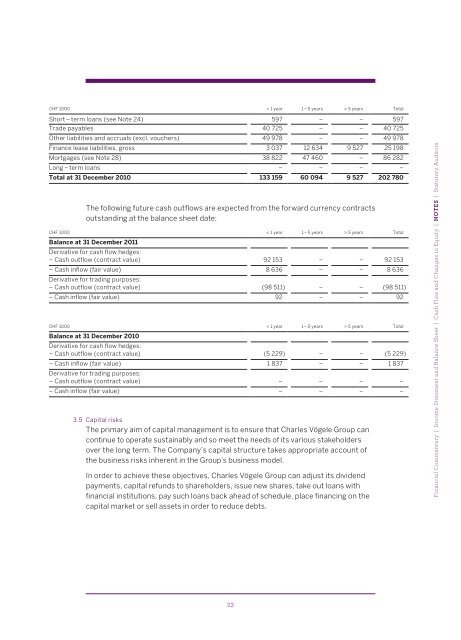

CHF 1000 < 1 year 1 – 5 years > 5 years Total<br />

Short – term loans (see Note 24) 597 – – 597<br />

Trade payables 40 725 – – 40 725<br />

Other liabilities and accruals (excl. vouchers) 49 978 – – 49 978<br />

Finance lease liabilities, gross 3 037 12 634 9 527 25 198<br />

Mortgages (see Note 28) 38 822 47 460 – 86 282<br />

Long – term loans – – – –<br />

Total at 31 December 2010 133 159 60 094 9 527 202 780<br />

The following future cash outflows are expected from the forward currency contracts<br />

outstanding at the balance sheet date:<br />

CHF 1000 < 1 year 1 – 5 years > 5 years Total<br />

Balance at 31 December 2011<br />

Derivative for cash flow hedges:<br />

– Cash outflow (contract value) 92 153 – – 92 153<br />

– Cash inflow (fair value)<br />

Derivative for trading purposes:<br />

8 636 – – 8 636<br />

– Cash outflow (contract value) (98 511) – – (98 511)<br />

– Cash inflow (fair value) 92 – – 92<br />

CHF 1000<br />

Balance at 31 December 2010<br />

Derivative for cash flow hedges:<br />

< 1 year 1 – 5 years > 5 years Total<br />

– Cash outflow (contract value) (5 229) – – (5 229)<br />

– Cash inflow (fair value)<br />

Derivative for trading purposes:<br />

1 837 – – 1 837<br />

– Cash outflow (contract value) – – – –<br />

– Cash inflow (fair value) – – – –<br />

3.5 Capital risks<br />

The primary aim of capital management is to ensure that Charles Vögele Group can<br />

continue to operate sustainably and so meet the needs of its various stakeholders<br />

over the long term. The Company’s capital structure takes appropriate account of<br />

the business risks inherent in the Group’s business model.<br />

In order to achieve these objectives, Charles Vögele Group can adjust its dividend<br />

payments, capital refunds to shareholders, issue new shares, take out loans with<br />

financial institutions, pay such loans back ahead of schedule, place financing on the<br />

capital market or sell assets in order to reduce debts.<br />

23<br />

Financial Commentary | Income Statement and Balance Sheet | Cash Flow and Changes in Equity | Notes | Statutory Auditors