report

report

report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

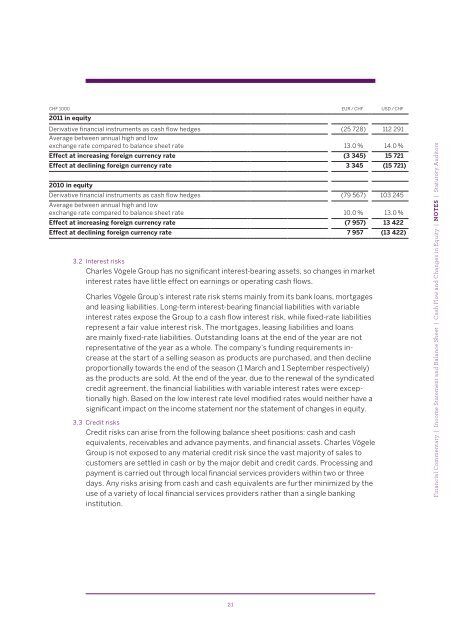

CHF 1000 EUR / CHF USD / CHF<br />

2011 in equity<br />

Derivative financial instruments as cash flow hedges<br />

Average between annual high and low<br />

(25 728) 112 291<br />

exchange rate compared to balance sheet rate 13.0 % 14.0 %<br />

Effect at increasing foreign currency rate (3 345) 15 721<br />

Effect at declining foreign currency rate 3 345 (15 721)<br />

2010 in equity<br />

Derivative financial instruments as cash flow hedges<br />

Average between annual high and low<br />

(79 567) 103 245<br />

exchange rate compared to balance sheet rate 10.0 % 13.0 %<br />

Effect at increasing foreign currency rate (7 957) 13 422<br />

Effect at declining foreign currency rate 7 957 (13 422)<br />

3.2 Interest risks<br />

Charles Vögele Group has no significant interest-bearing assets, so changes in market<br />

interest rates have little effect on earnings or operating cash flows.<br />

Charles Vögele Group’s interest rate risk stems mainly from its bank loans, mortgages<br />

and leasing liabilities. Long-term interest-bearing financial liabilities with variable<br />

interest rates expose the Group to a cash flow interest risk, while fixed-rate liabilities<br />

represent a fair value interest risk. The mortgages, leasing liabilities and loans<br />

are mainly fixed-rate liabilities. Outstanding loans at the end of the year are not<br />

representative of the year as a whole. The company’s funding requirements increase<br />

at the start of a selling season as products are purchased, and then decline<br />

proportionally towards the end of the season (1 March and 1 September respectively)<br />

as the products are sold. At the end of the year, due to the renewal of the syndicated<br />

credit agreement, the financial liabilities with variable interest rates were exceptionally<br />

high. Based on the low interest rate level modified rates would neither have a<br />

significant impact on the income statement nor the statement of changes in equity.<br />

3.3 Credit risks<br />

Credit risks can arise from the following balance sheet positions: cash and cash<br />

equivalents, receivables and advance payments, and financial assets. Charles Vögele<br />

Group is not exposed to any material credit risk since the vast majority of sales to<br />

customers are settled in cash or by the major debit and credit cards. Processing and<br />

payment is carried out through local financial services providers within two or three<br />

days. Any risks arising from cash and cash equivalents are further minimized by the<br />

use of a variety of local financial services providers rather than a single banking<br />

institution.<br />

21<br />

Financial Commentary | Income Statement and Balance Sheet | Cash Flow and Changes in Equity | Notes | Statutory Auditors