Download Conference Presentations - Mortgage Lending Industry ...

Download Conference Presentations - Mortgage Lending Industry ...

Download Conference Presentations - Mortgage Lending Industry ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Subprime Rate Loans And The Current <strong>Mortgage</strong><br />

Foreclosure Crisis<br />

“Some 80 percent of outstanding U.S. mortgages are prime,<br />

while 14 percent are subprime and 6 percent fall into the<br />

near-prime category. These numbers, however, mask the<br />

explosive growth of nonprime/subprime mortgages. The<br />

subprime market sector grew from $150 billion in 2000 to<br />

$650 billion in 2007, or roughly 25 percent of the overall<br />

mortgage market. Subprime and near-prime loans increased<br />

dramatically, from 9 percent of newly originated securitized<br />

mortgages in 2001 to 40 percent in 2006.” 11<br />

The relationship between subprime rate loans and defaults<br />

and foreclosures is undeniable. Numerous surveys and<br />

reports point to a strong relationship between subprime rate<br />

loans and the foreclosure crisis. The delinquency Survey of<br />

the mortgage Bankers Association, and two recent reports,<br />

one entitled “Analysis of Subprime mortgage Servicing<br />

Performance” (data Report 1 and 2) by The State Foreclosure<br />

Prevention Working Group (State Working Group) 12 and<br />

another entitled “OCC mortgage metrics Report – Analysis<br />

and disclosure of National Bank mortgage Loan data” by the<br />

Office of the Comptroller of the Currency all point to subprime<br />

rate loans as a major reason for the foreclosure crisis.<br />

11 The Rise and Fall of Subprime mortgages by danielle dimartino and<br />

John V. duca ,Vol. 2, No. 11, November 2007, Economic Letter—Insights<br />

from the Federal Reserve Bank of dallas<br />

12 The State Foreclosure Prevention Working Group, formed in the<br />

summer of 2007, consists of the Attorneys General of 11 states (Arizona,<br />

California, Colorado, Iowa, Illinois, massachusetts, michigan, New York,<br />

North Carolina, Ohio, and Texas), two state bank regulators (New York<br />

and North Carolina), and the <strong>Conference</strong> of State Bank Supervisors.<br />

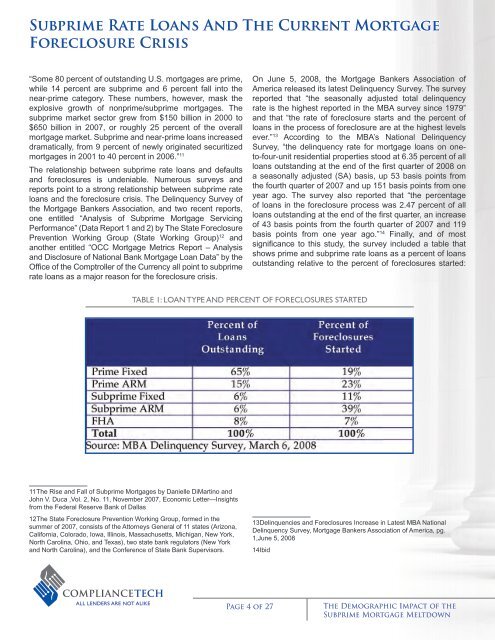

On June 5, 2008, the mortgage Bankers Association of<br />

America released its latest delinquency Survey. The survey<br />

reported that “the seasonally adjusted total delinquency<br />

rate is the highest reported in the mBA survey since 1979”<br />

and that “the rate of foreclosure starts and the percent of<br />

loans in the process of foreclosure are at the highest levels<br />

ever.” 13 According to the mBA’s National delinquency<br />

Survey, “the delinquency rate for mortgage loans on oneto-four-unit<br />

residential properties stood at 6.35 percent of all<br />

loans outstanding at the end of the first quarter of 2008 on<br />

a seasonally adjusted (SA) basis, up 53 basis points from<br />

the fourth quarter of 2007 and up 151 basis points from one<br />

year ago. The survey also reported that “the percentage<br />

of loans in the foreclosure process was 2.47 percent of all<br />

loans outstanding at the end of the first quarter, an increase<br />

of 43 basis points from the fourth quarter of 2007 and 119<br />

basis points from one year ago.” 14 Finally, and of most<br />

significance to this study, the survey included a table that<br />

shows prime and subprime rate loans as a percent of loans<br />

outstanding relative to the percent of foreclosures started:<br />

TABLE 1: LOAN TYPE AND PERCENT OF FORECLOSURES STARTED<br />

13 delinquencies and Foreclosures Increase in Latest mBA National<br />

delinquency Survey, mortgage Bankers Association of America, pg.<br />

1,June 5, 2008<br />

14 Ibid<br />

Page 4 of 27 The Demographic Impact of the<br />

Subprime <strong>Mortgage</strong> Meltdown