“You'll Be Fired if You Refuse†- Human Rights Watch

“You'll Be Fired if You Refuse†- Human Rights Watch

“You'll Be Fired if You Refuse†- Human Rights Watch

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The crash of copper prices in the mid- and late 1970s led to a downward spiral of Zambia’s<br />

economy. By 1994, Zambia had become one of the poorest countries in the world, with per<br />

capita income down 50 percent from 1974. 21 The copper industry’s revenues could no longer<br />

meet the costs of salaries and benefits. Production also collapsed, from 750,000 metric tons<br />

in 1973 to just over 250,000 tons in 2000. 22 By the 1980s, Zambia faced massive debts. With<br />

pressure from the World Bank and the International Monetary Fund, Zambia entered into<br />

structural adjustment programs that sought a reduction in government expenditures and the<br />

privatization of certain state assets. 23 Trade unions, including MUZ, supported the<br />

privatization—as by this time new investment was deemed crucial to revitalize the industry. 24<br />

The copper mines, as the most valuable country asset, were central to privatization. After an<br />

extended fight between the government, union, and financial institutions over whether the<br />

mines would be sold to a single investor or broken up and sold separately, the latter course<br />

was taken. 25 Sales began in 1997 (see text box for current owners of main mining assets).<br />

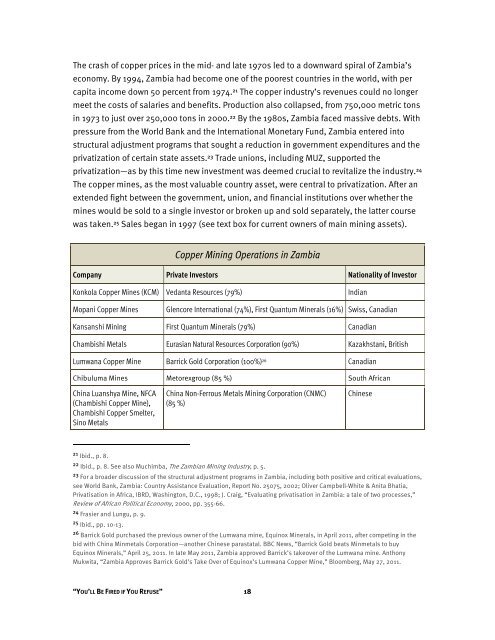

Copper Mining Operations in Zambia<br />

Company Private Investors Nationality of Investor<br />

Konkola Copper Mines (KCM) Vedanta Resources (79%) Indian<br />

Mopani Copper Mines<br />

Glencore International (74%), First Quantum Minerals (16%) Swiss, Canadian<br />

Kansanshi Mining First Quantum Minerals (79%) Canadian<br />

Chambishi Metals Eurasian Natural Resources Corporation (90%) Kazakhstani, British<br />

Lumwana Copper Mine Barrick Gold Corporation (100%) 26 Canadian<br />

Chibuluma Mines Metorexgroup (85 %) South African<br />

China Luanshya Mine, NFCA<br />

(Chambishi Copper Mine),<br />

Chambishi Copper Smelter,<br />

Sino Metals<br />

China Non-Ferrous Metals Mining Corporation (CNMC)<br />

(85 %)<br />

Chinese<br />

21 Ibid., p. 8.<br />

22 Ibid., p. 8. See also Muchimba, The Zambian Mining Industry, p. 5.<br />

23 For a broader discussion of the structural adjustment programs in Zambia, including both positive and critical evaluations,<br />

see World Bank, Zambia: Country Assistance Evaluation, Report No. 25075, 2002; Oliver Campbell-White & Anita Bhatia,<br />

Privatisation in Africa, IBRD, Washington, D.C., 1998; J. Craig, “Evaluating privatisation in Zambia: a tale of two processes,”<br />

Review of African Political Economy, 2000, pp. 355-66.<br />

24 Frasier and Lungu, p. 9.<br />

25 Ibid., pp. 10-13.<br />

26 Barrick Gold purchased the previous owner of the Lumwana mine, Equinox Minerals, in April 2011, after competing in the<br />

bid with China Minmetals Corporation—another Chinese parastatal. BBC News, “Barrick Gold beats Minmetals to buy<br />

Equinox Minerals,” April 25, 2011. In late May 2011, Zambia approved Barrick’s takeover of the Lumwana mine. Anthony<br />

Mukwita, “Zambia Approves Barrick Gold’s Take Over of Equinox’s Lumwana Copper Mine,” Bloomberg, May 27, 2011.<br />

“YOU’LL BE FIRED IF YOU REFUSE” 18