THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ability of achieving these targets was made based on a “Black-<br />

Scholes” formula using a share price of € 9.50 and an anticipated<br />

volatility of 43.5%. A dividend yield is not factored into the required<br />

performance of the share component.<br />

The “<strong>Symrise</strong> Value Added” is a value-oriented assessment basis<br />

which is calculated independently from the share price and which<br />

comprises an absolute earnings value less an interest yield on capital<br />

employed. The cumulative target value for the three year period<br />

of the plan is € 233.8 million.<br />

The legally binding specifications for the long-term incentive program<br />

are defined in the “Legal Terms and Conditions for Tranche<br />

2008,” which was also approved by the Supervisory Board.<br />

No other members of senior management have been included in<br />

the program.<br />

Strategic Share Bonus<br />

With effect from January 1, 2008, the Executive Board launched a<br />

global share-based bonus program for a total of 24 strategically<br />

important employees and senior managers for the first time. For<br />

all 24 of these employees, a monetary bonus has been defined.<br />

55,905 virtual shares were “issued” based on a share price of €<br />

20.39.<br />

The cash payment is to be made at the end of a term of two years<br />

(term to the end of 2009) based on the quoted average share price<br />

for the last 20 trading days on the stock exchange. Thus, the bonus<br />

is tied to the development of the share price. The fair value was<br />

calculated at T€ 466 based on the closing share price of € 9.50 at<br />

the balance sheet reporting date.<br />

Any dividends were not considered in determining the fair value.<br />

In order to retain the commitment of the strategically important<br />

employees to the organization if the share price falls, a virtual<br />

hedge was fixed for 50% of the share price relevant for bonus purposes.<br />

Furthermore, to exclude non-performance-related share<br />

price impacts, a maximum share price was fixed as being 200% of<br />

the share price relevant for bonus purposes.<br />

6.4. Selling and Marketing Expenses<br />

In addition to the costs of the marketing departments and the field<br />

sales forces, selling and marketing expenses include costs for advertising,<br />

logistics and commissions.<br />

6.5. Research and Development Costs<br />

In addition to the costs of research departments, this item also includes<br />

costs for external services and costs related to trials.<br />

Activities in this area include basic research as well as development<br />

of products to generate sales revenues and also development<br />

of new or improved processes to reduce the cost of sales.<br />

Information regarding allocation of research and development cost<br />

by geographical region is available under the segment reporting<br />

disclosures in note 5 above.<br />

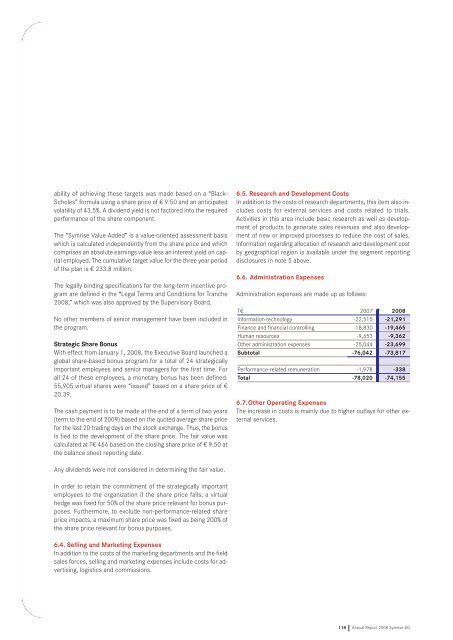

6.6. Administration Expenses<br />

Administration expenses are made up as follows:<br />

T€<br />

Information technology<br />

Finance and financial controlling<br />

Human resources<br />

Other administration expenses<br />

Subtotal<br />

Performance-related remuneration<br />

Total<br />

2007<br />

-22,515<br />

-18,830<br />

-9,653<br />

-25,044<br />

-76,042<br />

-1,978<br />

-78,020<br />

2008<br />

-21,291<br />

-19,465<br />

-9,362<br />

-23,699<br />

-73,817<br />

-338<br />

-74,155<br />

6.7.Other Operating Expenses<br />

The increase in costs is mainly due to higher outlays for other external<br />

services.<br />

118 Annual Report 2008 <strong>Symrise</strong> AG