THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The deferred tax assets and liabilities include foreign currency<br />

translation effects amounting to € 0.2 million (2007:<br />

€ 0.6 million). A deferred tax asset amounting to € 7.0 million<br />

derived from interest hedges. In accordance with<br />

hedge accounting requirements, the contra booking was<br />

recognized directly in equity.<br />

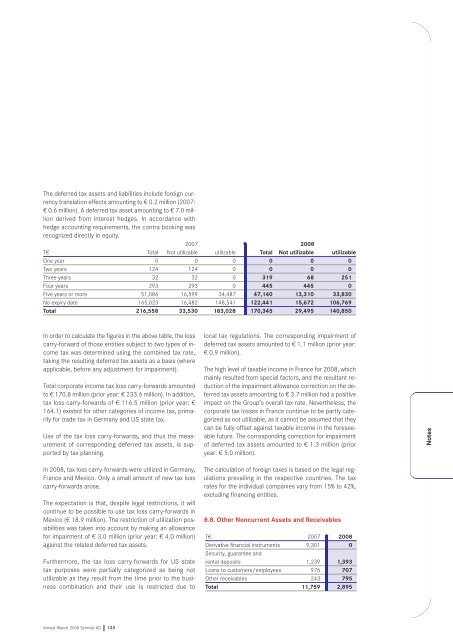

2007 2008<br />

T€<br />

One year<br />

Two years<br />

Three years<br />

Four years<br />

Five years or more<br />

No expiry date<br />

Total<br />

In order to calculate the figures in the above table, the loss<br />

carry-forward of those entities subject to two types of income<br />

tax was determined using the combined tax rate,<br />

taking the resulting deferred tax assets as a basis (where<br />

applicable, before any adjustment for impairment).<br />

Total corporate income tax loss carry-forwards amounted<br />

to € 170.8 million (prior year: € 233.6 million). In addition,<br />

tax loss carry-forwards of € 116.5 million (prior year: €<br />

164.1) existed for other categories of income tax, primarily<br />

for trade tax in Germany and US state tax.<br />

Use of the tax loss carry-forwards, and thus the measurement<br />

of corresponding deferred tax assets, is supported<br />

by tax planning.<br />

In 2008, tax loss carry-forwards were utilized in Germany,<br />

France and Mexico. Only a small amount of new tax loss<br />

carry-forwards arose.<br />

The expectation is that, despite legal restrictions, it will<br />

continue to be possible to use tax loss carry-forwards in<br />

Mexico (€ 18.9 million). The restriction of utilization possibilities<br />

was taken into account by making an allowance<br />

for impairment of € 3.0 million (prior year: € 4.0 million)<br />

against the related deferred tax assets.<br />

Furthermore, the tax loss carry-forwards for US state<br />

tax purposes were partially categorized as being not<br />

utilizable as they result from the time prior to the business<br />

combination and their use is restricted due to<br />

Annual Report 2008 <strong>Symrise</strong> AG 123<br />

Total<br />

0<br />

124<br />

32<br />

293<br />

51,086<br />

165,023<br />

216,558<br />

Not utilizable<br />

0<br />

124<br />

32<br />

293<br />

16,599<br />

16,482<br />

33,530<br />

utilizable<br />

0<br />

0<br />

0<br />

0<br />

34,487<br />

148,541<br />

183,028<br />

Total<br />

0<br />

0<br />

319<br />

445<br />

47,140<br />

122,441<br />

170,345<br />

local tax regulations. The corresponding impairment of<br />

deferred tax assets amounted to € 1.1 million (prior year:<br />

€ 0.9 million).<br />

The high level of taxable income in France for 2008, which<br />

mainly resulted from special factors, and the resultant reduction<br />

of the impairment allowance correction on the deferred<br />

tax assets amounting to € 3.7 million had a positive<br />

impact on the Group’s overall tax rate. Nevertheless, the<br />

corporate tax losses in France continue to be partly categorized<br />

as not utilizable, as it cannot be assumed that they<br />

can be fully offset against taxable income in the foreseeable<br />

future. The corresponding correction for impairment<br />

of deferred tax assets amounted to € 1.3 million (prior<br />

year: € 5.0 million).<br />

The calculation of foreign taxes is based on the legal regulations<br />

prevailing in the respective countries. The tax<br />

rates for the individual companies vary from 15% to 42%,<br />

excluding financing entities.<br />

8.8. Other Noncurrent Assets and Receivables<br />

T€<br />

Derivative financial instruments<br />

Security, guarantee and<br />

rental deposits<br />

Loans to customers/employees<br />

Other receivables<br />

Total<br />

Not utilizable<br />

0<br />

0<br />

68<br />

445<br />

13,310<br />

15,672<br />

29,495<br />

2007<br />

9,301<br />

1,239<br />

976<br />

243<br />

11,759<br />

utilizable<br />

0<br />

0<br />

251<br />

0<br />

33,830<br />

106,769<br />

140,850<br />

2008<br />

0<br />

1,393<br />

707<br />

795<br />

2,895<br />

Notes