THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8.13. Acquisitions<br />

Cambridge Theranostics Ltd.<br />

In December 2007, we agreed on a co-operation with Cambridge<br />

Theranostics Ltd. A payment of € 2.0 million made in January 2008<br />

is reported in the cash flow statement as a payment for financial<br />

assets.<br />

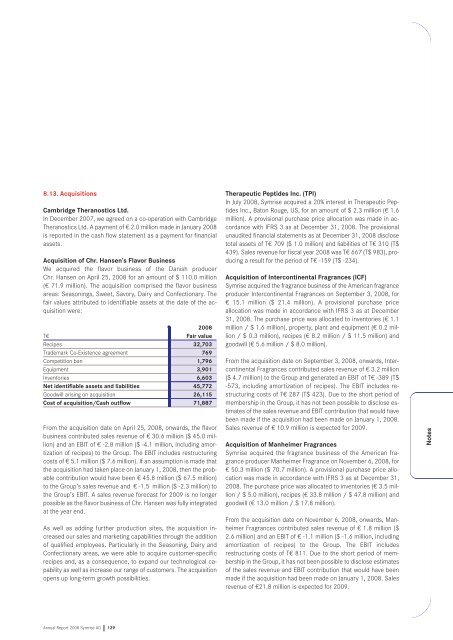

Acquisition of Chr. Hansen’s Flavor Business<br />

We acquired the flavor business of the Danish producer<br />

Chr. Hansen on April 25, 2008 for an amount of $ 110.0 million<br />

(€ 71.9 million). The acquisition comprised the flavor business<br />

areas: Seasonings, Sweet, Savory, Dairy and Confectionary. The<br />

fair values attributed to identifiable assets at the date of the acquisition<br />

were:<br />

T€<br />

Recipes<br />

Trademark Co-Existence agreement<br />

Competition ban<br />

Equipment<br />

Inventories<br />

Net identifiable assets and liabilities<br />

Goodwill arising on acquisition<br />

Cost of acquisition/Cash outflow<br />

From the acquisition date on April 25, 2008, onwards, the flavor<br />

business contributed sales revenue of € 30.6 million ($ 45.0 million)<br />

and an EBIT of € -2.8 million ($ -4.1 million, including amortization<br />

of recipes) to the Group. The EBIT includes restructuring<br />

costs of € 5.1 million ($ 7.6 million). If an assumption is made that<br />

the acquisition had taken place on January 1, 2008, then the probable<br />

contribution would have been € 45.8 million ($ 67.5 million)<br />

to the Group’s sales revenue and € -1.5 million ($ -2.3 million) to<br />

the Group’s EBIT. A sales revenue forecast for 2009 is no longer<br />

possible as the flavor business of Chr. Hansen was fully integrated<br />

at the year end.<br />

As well as adding further production sites, the acquisition increased<br />

our sales and marketing capabilities through the addition<br />

of qualified employees. Particularly in the Seasoning, Dairy and<br />

Confectionary areas, we were able to acquire customer-specific<br />

recipes and, as a consequence, to expand our technological capability<br />

as well as increase our range of customers. The acquisition<br />

opens up long-term growth possibilities.<br />

Annual Report 2008 <strong>Symrise</strong> AG 129<br />

2008<br />

Fair value<br />

32,703<br />

769<br />

1,796<br />

3,901<br />

6,603<br />

45,772<br />

26,115<br />

71,887<br />

Therapeutic Peptides Inc. (TPI)<br />

In July 2008, <strong>Symrise</strong> acquired a 20% interest in Therapeutic Peptides<br />

Inc., Baton Rouge, US, for an amount of $ 2.3 million (€ 1.6<br />

million). A provisional purchase price allocation was made in accordance<br />

with IFRS 3 as at December 31, 2008. The provisional<br />

unaudited financial statements as at December 31, 2008 disclose<br />

total assets of T€ 709 ($ 1.0 million) and liabilities of T€ 310 (T$<br />

439). Sales revenue for fiscal year 2008 was T€ 667 (T$ 983), producing<br />

a result for the period of T€ -159 (T$ -234).<br />

Acquisition of Intercontinental Fragrances (ICF)<br />

<strong>Symrise</strong> acquired the fragrance business of the American fragrance<br />

producer Intercontinental Fragrances on September 3, 2008, for<br />

€ 15.1 million ($ 21.4 million). A provisional purchase price<br />

allocation was made in accordance with IFRS 3 as at December<br />

31, 2008. The purchase price was allocated to inventories (€ 1.1<br />

million / $ 1.6 million), property, plant and equipment (€ 0.2 million<br />

/ $ 0.3 million), recipes (€ 8.2 million / $ 11.5 million) and<br />

goodwill (€ 5.6 million / $ 8.0 million).<br />

From the acquisition date on September 3, 2008, onwards, Intercontinental<br />

Fragrances contributed sales revenue of € 3.2 million<br />

($ 4.7 million) to the Group and generated an EBIT of T€ -389 (T$<br />

-573, including amortization of recipes). The EBIT includes restructuring<br />

costs of T€ 287 (T$ 423). Due to the short period of<br />

membership in the Group, it has not been possible to disclose estimates<br />

of the sales revenue and EBIT contribution that would have<br />

been made if the acquisition had been made on January 1, 2008.<br />

Sales revenue of € 10.9 million is expected for 2009.<br />

Acquisition of Manheimer Fragrances<br />

<strong>Symrise</strong> acquired the fragrance business of the American fragrance<br />

producer Manheimer Fragrance on November 6, 2008, for<br />

€ 50.3 million ($ 70.7 million). A provisional purchase price allocation<br />

was made in accordance with IFRS 3 as at December 31,<br />

2008. The purchase price was allocated to inventories (€ 3.5 million<br />

/ $ 5.0 million), recipes (€ 33.8 million / $ 47.8 million) and<br />

goodwill (€ 13.0 million / $ 17.8 million).<br />

From the acquisition date on November 6, 2008, onwards, Manheimer<br />

Fragrances contributed sales revenue of € 1.8 million ($<br />

2.6 million) and an EBIT of € -1.1 million ($ -1.6 million, including<br />

amortization of recipes) to the Group. The EBIT includes<br />

restructuring costs of T€ 811. Due to the short period of membership<br />

in the Group, it has not been possible to disclose estimates<br />

of the sales revenue and EBIT contribution that would have been<br />

made if the acquisition had been made on January 1, 2008. Sales<br />

revenue of €21.8 million is expected for 2009.<br />

Notes