THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

THE NATURE OF OUR BUSINESS – STABLE GROWTH - Symrise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

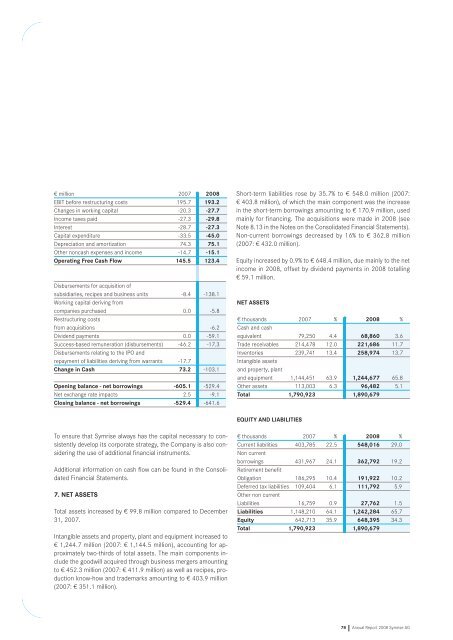

€ million<br />

EBIT before restructuring costs<br />

Changes in working capital<br />

Income taxes paid<br />

Interest<br />

Capital expenditure<br />

Depreciation and amortization<br />

Other noncash expenses and income<br />

Operating Free Cash Flow<br />

Disbursements for acquisition of<br />

subsidiaries, recipes and business units<br />

Working capital deriving from<br />

companies purchased<br />

Restructuring costs<br />

from acquisitions<br />

Dividend payments<br />

Success-based remuneration (disbursements)<br />

Disbursements relating to the IPO and<br />

repayment of liabilities deriving from warrants<br />

Change in Cash<br />

Opening balance - net borrowings<br />

Net exchange rate impacts<br />

Closing balance - net borrowings<br />

To ensure that <strong>Symrise</strong> always has the capital necessary to consistently<br />

develop its corporate strategy, the Company is also considering<br />

the use of additional financial instruments.<br />

Additional information on cash flow can be found in the Consolidated<br />

Financial Statements.<br />

7. NET ASSETS<br />

2007<br />

195.7<br />

-20.3<br />

-27.3<br />

-28.7<br />

-33.5<br />

74.3<br />

-14.7<br />

145.5<br />

-8.4<br />

Total assets increased by € 99.8 million compared to December<br />

31, 2007.<br />

Intangible assets and property, plant and equipment increased to<br />

€ 1,244.7 million (2007: € 1,144.5 million), accounting for approximately<br />

two-thirds of total assets. The main components include<br />

the goodwill acquired through business mergers amounting<br />

to € 452.3 million (2007: € 411.9 million) as well as recipes, production<br />

know-how and trademarks amounting to € 403.9 million<br />

(2007: € 351.1 million).<br />

0.0<br />

0.0<br />

-46.2<br />

-17.7<br />

73.2<br />

-605.1<br />

2.5<br />

-529.4<br />

2008<br />

193.2<br />

-27.7<br />

-29.8<br />

-27.3<br />

-45.0<br />

75.1<br />

-15.1<br />

123.4<br />

-138.1<br />

-5.8<br />

-6.2<br />

-59.1<br />

-17.3<br />

-103.1<br />

-529.4<br />

-9.1<br />

-641.6<br />

Short-term liabilities rose by 35.7% to € 548.0 million (2007:<br />

€ 403.8 million), of which the main component was the increase<br />

in the short-term borrowings amounting to € 170.9 million, used<br />

mainly for financing. The acquisitions were made in 2008 (see<br />

Note 8.13 in the Notes on the Consolidated Financial Statements).<br />

Non-current borrowings decreased by 16% to € 362.8 million<br />

(2007: € 432.0 million).<br />

Equity increased by 0.9% to € 648.4 million, due mainly to the net<br />

income in 2008, offset by dividend payments in 2008 totalling<br />

€ 59.1 million.<br />

NET ASSETS<br />

€ thousands<br />

Cash and cash<br />

equivalent<br />

Trade receivables<br />

Inventories<br />

Intangible assets<br />

and property, plant<br />

and equipment<br />

Other assets<br />

Total<br />

€ thousands<br />

Current liabilities<br />

Non current<br />

borrowings<br />

Retirement benefit<br />

Obligation<br />

Deferred tax liabilities<br />

Other non current<br />

Liabilities<br />

Liabilities<br />

Equity<br />

Total<br />

2007<br />

79,250<br />

214,478<br />

239,741<br />

1,144,451<br />

113,003<br />

1,790,923<br />

EQUITY AND LIABILITIES<br />

2007<br />

403,785<br />

431,967<br />

186,295<br />

109,404<br />

16,759<br />

1,148,210<br />

642,713<br />

1,790,923<br />

%<br />

4.4<br />

12.0<br />

13.4<br />

63.9<br />

6.3<br />

%<br />

22.5<br />

24.1<br />

10.4<br />

6.1<br />

0.9<br />

64.1<br />

35.9<br />

2008<br />

68,860<br />

221,686<br />

258,974<br />

1,244,677<br />

96,482<br />

1,890,679<br />

2008<br />

548,016<br />

362,792<br />

191,922<br />

111,792<br />

27,762<br />

1,242,284<br />

648,395<br />

1,890,679<br />

%<br />

3.6<br />

11.7<br />

13.7<br />

65.8<br />

5.1<br />

%<br />

29.0<br />

19.2<br />

10.2<br />

5.9<br />

1.5<br />

65.7<br />

34.3<br />

78 Annual Report 2008 <strong>Symrise</strong> AG