MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

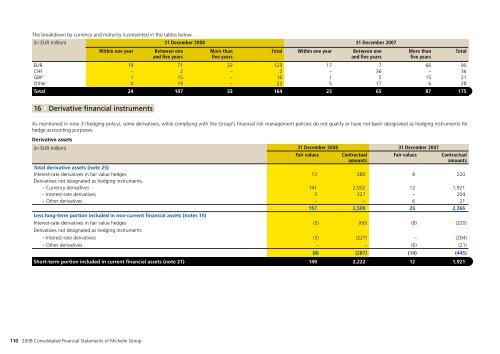

The breakdown by currency and maturity is presented in the tables below.<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

EUR<br />

CHF<br />

GBP<br />

Other<br />

Within one year<br />

19<br />

–<br />

1<br />

4<br />

Between one<br />

and five years<br />

71<br />

2<br />

15<br />

19<br />

More than<br />

five years<br />

33<br />

–<br />

–<br />

–<br />

Total Within one year Between one<br />

and five years<br />

123<br />

2<br />

16<br />

23<br />

17<br />

–<br />

1<br />

5<br />

7<br />

36<br />

5<br />

17<br />

More than<br />

five years<br />

66<br />

–<br />

15<br />

6<br />

Total 24 107 33 164 23 65 87 175<br />

Total<br />

90<br />

36<br />

21<br />

28<br />

16 Derivative financial instruments<br />

As mentioned in note 3 (hedging policy), some derivatives, while complying with the Group’s financial risk management policies do not qualify or have not been designated as hedging instruments for<br />

hedge accounting purposes.<br />

Derivative assets<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

Total derivative assets (note 25)<br />

Interest-rate derivatives in fair value hedges<br />

Derivatives not designated as hedging instruments<br />

– Currency derivatives<br />

– Interest-rate derivatives<br />

– Other derivatives<br />

Fair values<br />

13<br />

141<br />

3<br />

–<br />

Contractual<br />

amounts<br />

280<br />

2,002<br />

227<br />

–<br />

Fair values<br />

8<br />

12<br />

–<br />

6<br />

Contractual<br />

amounts<br />

157 2,509 26 2,366<br />

Less long-term portion included in non-current financial assets (notes 15)<br />

Interest-rate derivatives in fair value hedges<br />

Derivatives not designated as hedging instruments<br />

– Interest-rate derivatives<br />

– Other derivatives<br />

(5)<br />

(3)<br />

–<br />

(60)<br />

(227)<br />

–<br />

(8)<br />

–<br />

(6)<br />

(220)<br />

(204)<br />

(21)<br />

(8) (287) (14) (445)<br />

Short-term portion included in current financial assets (note 21) 149 2,222 12 1,921<br />

220<br />

1,921<br />

204<br />

21<br />

110 <strong>2008</strong> Consolidated Financial Statements of Michelin Group