MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOREIGN CURRENCY TRANSLATION<br />

Presentation and functional currency<br />

The financial statements of the Group’s entities are measured<br />

using their functional currency, which is the currency of the<br />

primary economic environment in which they operate and which<br />

corresponds for most of them to their local currency.<br />

The consolidated financial statements are presented in euros<br />

(EUR), which is the Company’s functional currency.<br />

Transactions<br />

Foreign currency transactions are translated into the functional<br />

currency using the exchange rate prevailing at the date of the<br />

transactions. Foreign exchange gains and losses resulting from the<br />

settlement of such transactions and from the translation at closing<br />

exchange rates of monetary assets and liabilities denominated in<br />

foreign currencies are recognized in the income statement.<br />

Exchange differences on equity investments classified as availablefor-sale<br />

financial assets are included in the fair value reserve in<br />

equity until the investment is sold.<br />

Translation<br />

The financial statements of Group entities that have a functional<br />

currency different from the Group’s presentation currency are<br />

translated into euro as follows: assets and liabilities are translated<br />

at the closing rate at the date of the balance sheet, income and<br />

expenses are translated at the average rate of the period (as it<br />

is considered a reasonable approximation to actual rates), and<br />

all resulting exchange differences are recognized as a separate<br />

component of equity.<br />

Cash flows are also translated at the average rate of the period.<br />

When an entity is disposed, the translation differences<br />

accumulated in equity are recycled in the income statement as<br />

part of the gain or loss on sale.<br />

Goodwill and fair value adjustments arising on the acquisition of<br />

an entity are treated as assets and liabilities of the entity and<br />

translated at the spot rate of the transaction date.<br />

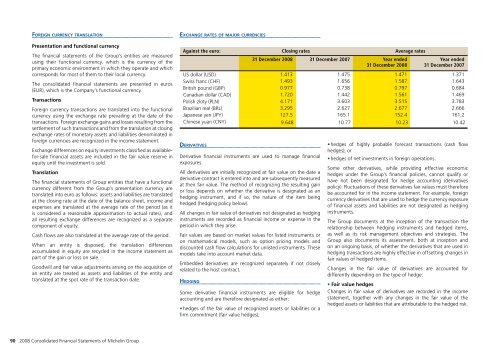

EXCHANGE RATES OF MAJOR CURRENCIES<br />

Against the euro: Closing rates Average rates<br />

31 December <strong>2008</strong> 31 December 2007 Year ended<br />

31 December <strong>2008</strong><br />

Year ended<br />

31 December 2007<br />

US dollar (USD) 1.413 1.475 1.471 1.371<br />

Swiss franc (CHF) 1.493 1.656 1.587 1.643<br />

British pound (GBP) 0.977 0.738 0.797 0.684<br />

Canadian dollar (CAD) 1.720 1.442 1.561 1.469<br />

Polish zloty (PLN) 4.171 3.603 3.515 3.783<br />

Brazilian real (BRL) 3.295 2.627 2.677 2.666<br />

Japanese yen (JPY) 127.5 165.1 152.4 161.2<br />

Chinese yuan (CNY) 9.648 10.77 10.23 10.42<br />

DERIVATIVES<br />

Derivative financial instruments are used to manage financial<br />

exposures.<br />

All derivatives are initially recognized at fair value on the date a<br />

derivative contract is entered into and are subsequently measured<br />

at their fair value. The method of recognizing the resulting gain<br />

or loss depends on whether the derivative is designated as an<br />

hedging instrument, and if so, the nature of the item being<br />

hedged (hedging policy below).<br />

All changes in fair value of derivatives not designated as hedging<br />

instruments are recorded as financial income or expense in the<br />

period in which they arise.<br />

Fair values are based on market values for listed instruments or<br />

on mathematical models, such as option pricing models and<br />

discounted cash flow calculations for unlisted instruments. These<br />

models take into account market data.<br />

Embedded derivatives are recognized separately if not closely<br />

related to the host contract.<br />

HEDGING<br />

Some derivative financial instruments are eligible for hedge<br />

accounting and are therefore designated as either:<br />

hedges of the fair value of recognized assets or liabilities or a<br />

firm commitment (fair value hedges);<br />

hedges of highly probable forecast transactions (cash flow<br />

hedges); or<br />

hedges of net investments in foreign operations.<br />

Some other derivatives, while providing effective economic<br />

hedges under the Group’s financial policies, cannot qualify or<br />

have not been designated for hedge accounting (derivatives<br />

policy). Fluctuations of these derivatives fair values must therefore<br />

be accounted for in the income statement. For example, foreign<br />

currency derivatives that are used to hedge the currency exposure<br />

of financial assets and liabilities are not designated as hedging<br />

instruments.<br />

The Group documents at the inception of the transaction the<br />

relationship between hedging instruments and hedged items,<br />

as well as its risk management objectives and strategies. The<br />

Group also documents its assessment, both at inception and<br />

on an ongoing basis, of whether the derivatives that are used in<br />

hedging transactions are highly effective in offsetting changes in<br />

fair values of hedged items.<br />

Changes in the fair value of derivatives are accounted for<br />

differently depending on the type of hedge:<br />

Fair value hedges<br />

Changes in fair value of derivatives are recorded in the income<br />

statement, together with any changes in the fair value of the<br />

hedged assets or liabilities that are attributable to the hedged risk.<br />

90 <strong>2008</strong> Consolidated Financial Statements of Michelin Group