MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

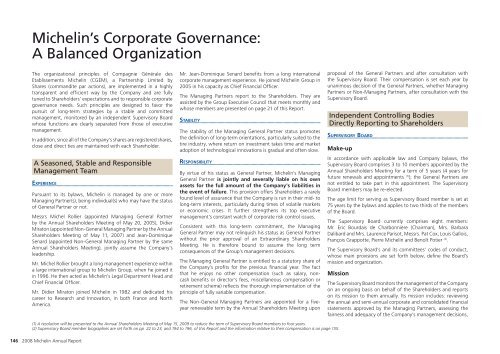

Michelin’s Corporate Governance:<br />

A Balanced Organization<br />

The organizational principles of Compagnie Générale des<br />

Etablissements Michelin (CGEM), a Partnership Limited by<br />

Shares (commandite par actions), are implemented in a highly<br />

transparent and efficient way by the Company and are fully<br />

tuned to Shareholders’ expectations and to responsible corporate<br />

governance needs. Such principles are designed to favor the<br />

pursuit of long-term strategies by a stable and committed<br />

management, monitored by an independent Supervisory Board<br />

whose functions are clearly separated from those of executive<br />

management.<br />

In addition, since all of the Company’s shares are registered shares,<br />

close and direct ties are maintained with each Shareholder.<br />

A Seasoned, Stable and Responsible<br />

Management Team<br />

EXPERIENCE<br />

Pursuant to its bylaws, Michelin is managed by one or more<br />

Managing Partner(s), being individual(s) who may have the status<br />

of General Partner or not.<br />

Messrs Michel Rollier (appointed Managing General Partner<br />

by the Annual Shareholders Meeting of May 20, 2005), Didier<br />

Miraton (appointed Non-General Managing Partner by the Annual<br />

Shareholders Meeting of May 11, 2007) and Jean-Dominique<br />

Senard (appointed Non-General Managing Partner by the same<br />

Annual Shareholders Meeting), jointly assume the Company’s<br />

leadership.<br />

Mr. Michel Rollier brought a long management experience within<br />

a large international group to Michelin Group, when he joined it<br />

in 1996. He then acted as Michelin’s Legal Department Head and<br />

Chief Financial Officer.<br />

Mr. Didier Miraton joined Michelin in 1982 and dedicated his<br />

career to Research and Innovation, in both France and North<br />

America.<br />

Mr. Jean-Dominique Senard benefits from a long international<br />

corporate management experience. He joined Michelin Group in<br />

2005 in his capacity as Chief Financial Officer.<br />

The Managing Partners report to the Shareholders. They are<br />

assisted by the Group Executive Council that meets monthly and<br />

whose members are presented on page 21 of this Report.<br />

STABILITY<br />

The stability of the Managing General Partner status promotes<br />

the definition of long-term orientations, particularly suited to the<br />

tire industry, where return on investment takes time and market<br />

adoption of technological innovations is gradual and often slow.<br />

RESPONSIBILITY<br />

By virtue of his status as General Partner, Michelin’s Managing<br />

General Partner is jointly and severally liable on his own<br />

assets for the full amount of the Company’s liabilities in<br />

the event of failure. This provision offers Shareholders a rarely<br />

found level of assurance that the Company is run in their mid- to<br />

long-term interests, particularly during times of volatile markets<br />

or economic crises. It further strengthens its top executive<br />

management’s constant watch of corporate risk control issues.<br />

Consistent with this long-term commitment, the Managing<br />

General Partner may not relinquish his status as General Partner<br />

without the prior approval of an Extraordinary Shareholders<br />

Meeting. He is therefore bound to assume the long term<br />

consequences of the Group’s management decisions.<br />

The Managing General Partner is entitled to a statutory share of<br />

the Company’s profits for the previous financial year. The fact<br />

that he enjoys no other compensation (such as salary, noncash<br />

benefits or director’s fees, miscellaneous compensation or<br />

retirement scheme) reflects the thorough implementation of the<br />

principle of fully variable compensation.<br />

The Non-General Managing Partners are appointed for a fiveyear<br />

renewable term by the Annual Shareholders Meeting upon<br />

proposal of the General Partners and after consultation with<br />

the Supervisory Board. Their compensation is set each year by<br />

unanimous decision of the General Partners, whether Managing<br />

Partners or Non-Managing Partners, after consultation with the<br />

Supervisory Board.<br />

Independent Controlling Bodies<br />

Directly Reporting to Shareholders<br />

SUPERVISORY BOARD<br />

Make-up<br />

In accordance with applicable law and Company bylaws, the<br />

Supervisory Board comprises 3 to 10 members appointed by the<br />

Annual Shareholders Meeting for a term of 5 years (4 years for<br />

future renewals and appointments (1) ); the General Partners are<br />

not entitled to take part in this appointment. The Supervisory<br />

Board members may be re-elected.<br />

The age limit for serving as Supervisory Board member is set at<br />

75 years by the bylaws and applies to two thirds of the members<br />

of the Board.<br />

The Supervisory Board currently comprises eight members:<br />

Mr. Eric Bourdais de Charbonnière (Chairman), Mrs. Barbara<br />

Dalibard and Mrs. Laurence Parisot, Messrs. Pat Cox, Louis Gallois,<br />

François Grappotte, Pierre Michelin and Benoît Potier (2) .<br />

The Supervisory Board’s and its committees’ codes of conduct,<br />

whose main provisions are set forth below, define the Board’s<br />

mission and organization.<br />

Mission<br />

The Supervisory Board monitors the management of the Company<br />

on an ongoing basis on behalf of the Shareholders and reports<br />

on its mission to them annually. Its mission includes: reviewing<br />

the annual and semi-annual corporate and consolidated financial<br />

statements approved by the Managing Partners, assessing the<br />

fairness and adequacy of the Company’s management decisions,<br />

(1) A resolution will be presented to the Annual Shareholders Meeting of May 15, 2009 to reduce the term of Supervisory Board members to four years.<br />

(2) Supervisory Board member biographies are set forth on pp 22 to 23, and 194 to 196, of this Report and the information relative to their compensation is on page 155.<br />

146 <strong>2008</strong> Michelin Annual Report