MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

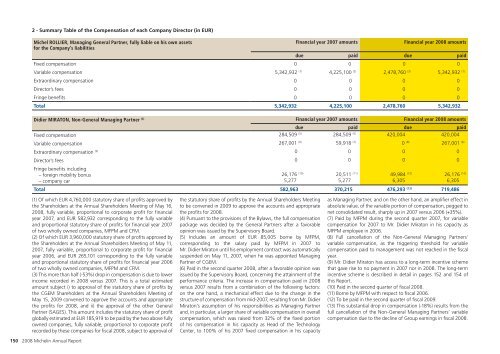

2 - Summary Table of the Compensation of each Company Director (in EUR)<br />

Michel ROLLIER, Managing General Partner, fully liable on his own assets<br />

Financial year 2007 amounts<br />

Financial year <strong>2008</strong> amounts<br />

for the Company’s liabilities<br />

due paid due paid<br />

Fixed compensation 0 0 0 0<br />

Variable compensation 5,342,932 (1) 4,225,100 (2) 2,478,760 (3) 5,342,932 (1)<br />

Extraordinary compensation 0 0 0 0<br />

Director’s fees 0 0 0 0<br />

Fringe benefits 0 0 0 0<br />

Total 5,342,932 4,225,100 2,478,760 5,342,932<br />

Didier MIRATON, Non-General Managing Partner (4) Financial year 2007 amounts Financial year <strong>2008</strong> amounts<br />

due paid due paid<br />

Fixed compensation 284,509 (5) 284,509 (5) 420,004 420,004<br />

Variable compensation 267,001 (6) 59,918 (7) 0 (8) 267,001 (6)<br />

Extraordinary compensation (9) 0 0 0 0<br />

Director’s fees 0 0 0 0<br />

Fringe benefits including<br />

– foreign mobility bonus<br />

– company car<br />

26,176 (10)<br />

5,277<br />

20,511 (11)<br />

5,277<br />

49,984 (12)<br />

6,305<br />

Total 582,963 370,215 476,293 (13) 719,486<br />

26,176 (10)<br />

6,305<br />

(1) Of which EUR 4,760,000 statutory share of profits approved by<br />

the Shareholders at the Annual Shareholders Meeting of May 16,<br />

<strong>2008</strong>, fully variable, proportional to corporate profit for financial<br />

year 2007, and EUR 582,932 corresponding to the fully variable<br />

and proportional statutory share of profits for financial year 2007<br />

of two wholly owned companies, MFPM and CFM.<br />

(2) Of which EUR 3,960,000 statutory share of profits approved by<br />

the Shareholders at the Annual Shareholders Meeting of May 11,<br />

2007, fully variable, proportional to corporate profit for financial<br />

year 2006, and EUR 265,101 corresponding to the fully variable<br />

and proportional statutory share of profits for financial year 2006<br />

of two wholly owned companies, MFPM and CFM.<br />

(3) This more than half (-53%) drop in compensation is due to lower<br />

income recorded in <strong>2008</strong> versus 2007. This is a total estimated<br />

amount subject i) to approval of the statutory share of profits by<br />

the CGEM Shareholders at the Annual Shareholders Meeting of<br />

May 15, 2009 convened to approve the accounts and appropriate<br />

the profits for <strong>2008</strong>, and ii) the approval of the other General<br />

Partner (SAGES). This amount includes the statutory share of profit<br />

globally estimated at EUR 185,919 to be paid by the two above fully<br />

owned companies, fully variable, proportional to corporate profit<br />

recorded by these companies for fiscal <strong>2008</strong>, subject to approval of<br />

150 <strong>2008</strong> Michelin Annual Report<br />

the statutory share of profits by the Annual Shareholders Meeting<br />

to be convened in 2009 to approve the accounts and appropriate<br />

the profits for <strong>2008</strong>.<br />

(4) Pursuant to the provisions of the Bylaws, the full compensation<br />

package was decided by the General Partners after a favorable<br />

opinion was issued by the Supervisory Board.<br />

(5) Includes an amount of EUR 85,005 borne by MFPM,<br />

corresponding to the salary paid by MFPM in 2007 to<br />

Mr. Didier Miraton until his employment contract was automatically<br />

suspended on May 11, 2007, when he was appointed Managing<br />

Partner of CGEM.<br />

(6) Paid in the second quarter <strong>2008</strong>, after a favorable opinion was<br />

issued by the Supervisory Board, concerning the attainment of the<br />

performance criteria. The increase in compensation paid in <strong>2008</strong><br />

versus 2007 results from a combination of the following factors:<br />

on the one hand, a mechanical effect due to the change in the<br />

structure of compensation from mid-2007, resulting from Mr. Didier<br />

Miraton‘s assumption of his responsibilities as Managing Partner<br />

and, in particular, a larger share of variable compensation in overall<br />

compensation, which was raised from 32% of the fixed portion<br />

of his compensation in his capacity as Head of the Technology<br />

Center, to 100% of his 2007 fixed compensation in his capacity<br />

as Managing Partner, and on the other hand, an amplifier effect in<br />

absolute value, of the variable portion of compensation, pegged to<br />

net consolidated result, sharply up in 2007 versus 2006 (+35%).<br />

(7) Paid by MFPM during the second quarter 2007, for variable<br />

compensation for 2007 to Mr. Didier Miraton in his capacity as<br />

MFPM employee in 2006.<br />

(8) Full cancellation of the Non-General Managing Partners‘<br />

variable compensation, as the triggering threshold for variable<br />

compensation paid to management was not reached in the fiscal<br />

year.<br />

(9) Mr. Didier Miraton has access to a long-term incentive scheme<br />

that gave rise to no payment in 2007 nor in <strong>2008</strong>. The long-term<br />

incentive scheme is described in detail in pages 152 and 154 of<br />

this Report.<br />

(10) Paid in the second quarter of fiscal <strong>2008</strong>.<br />

(11) Borne by MFPM with respect to fiscal 2006.<br />

(12) To be paid in the second quarter of fiscal 2009.<br />

(13) This substantial drop in compensation (-18%) results from the<br />

full cancellation of the Non-General Managing Partners‘ variable<br />

compensation due to the decline of Group earnings in fiscal <strong>2008</strong>.