MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

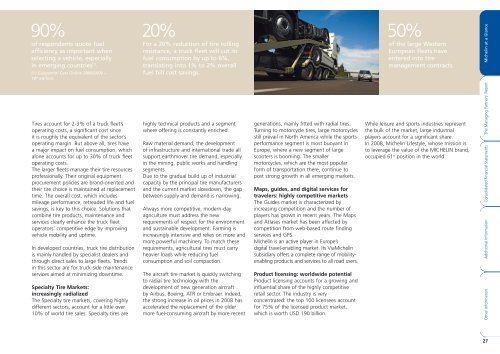

90%<br />

of respondents quote fuel<br />

efficiency as important when<br />

selecting a vehicle, especially<br />

in emerging countries (1) .<br />

(1) Capgemini Cars Online <strong>2008</strong>/2009 –<br />

10 th edition.<br />

20%<br />

For a 20% reduction of tire rolling<br />

resistance, a truck fleet will cut its<br />

fuel consumption by up to 6%,<br />

translating into 1% to 2% overall<br />

fuel bill cost savings.<br />

50%<br />

of the large Western<br />

European fleets have<br />

entered into tire<br />

management contracts.<br />

Michelin at a Glance<br />

Tires account for 2-3% of a truck fleet’s<br />

operating costs, a significant cost since<br />

it is roughly the equivalent of the sector’s<br />

operating margin. But above all, tires have<br />

a major impact on fuel consumption, which<br />

alone accounts for up to 30% of truck fleet<br />

operating costs.<br />

The larger fleets manage their tire resources<br />

professionally. Their original equipment<br />

procurement policies are brand-oriented and<br />

their tire choice is maintained at replacement<br />

time. The overall cost, which includes<br />

mileage performance, retreaded life and fuel<br />

savings, is key to this choice. Solutions that<br />

combine tire products, maintenance and<br />

services clearly enhance the truck fleet<br />

operators’ competitive edge by improving<br />

vehicle mobility and uptime.<br />

In developed countries, truck tire distribution<br />

is mainly handled by specialist dealers and<br />

through direct sales to large fleets. Trends<br />

in this sector are for truck-side maintenance<br />

services aimed at minimizing downtime.<br />

Specialty Tire Markets:<br />

increasingly radialized<br />

The Specialty tire markets, covering highly<br />

different sectors, account for a little over<br />

10% of world tire sales. Specialty tires are<br />

highly technical products and a segment<br />

where offering is constantly enriched.<br />

Raw material demand, the development<br />

of infrastructure and international trade all<br />

support earthmover tire demand, especially<br />

in the mining, public works and handling<br />

segments.<br />

Due to the gradual build up of industrial<br />

capacity by the principal tire manufacturers<br />

and the current market slowdown, the gap<br />

between supply and demand is narrowing.<br />

Always more competitive, modern-day<br />

agriculture must address the new<br />

requirements of respect for the environment<br />

and sustainable development. Farming is<br />

increasingly intensive and relies on more and<br />

more powerful machinery. To match these<br />

requirements, agricultural tires must carry<br />

heavier loads while reducing fuel<br />

consumption and soil compaction.<br />

The aircraft tire market is quickly switching<br />

to radial tire technology with the<br />

development of new generation aircraft<br />

by Airbus, Boeing, ATR or Embraer. Indeed,<br />

the strong increase in oil prices in <strong>2008</strong> has<br />

accelerated the replacement of the older<br />

more fuel-consuming aircraft by more recent<br />

generations, mainly fitted with radial tires.<br />

Turning to motorcycle tires, large motorcycles<br />

still prevail in North America while the sports<br />

performance segment is most buoyant in<br />

Europe, where a new segment of large<br />

scooters is booming. The smaller<br />

motorcycles, which are the most popular<br />

form of transportation there, continue to<br />

post strong growth in all emerging markets.<br />

Maps, guides, and digital services for<br />

travelers: highly competitive markets<br />

The Guides market is characterized by<br />

increasing competition and the number of<br />

players has grown in recent years. The Maps<br />

and Atlases market has been affected by<br />

competition from web-based route finding<br />

services and GPS.<br />

Michelin is an active player in Europe’s<br />

digital travel-enabling market. Its ViaMichelin<br />

subsidiary offers a complete range of mobilityenabling<br />

products and services to all road users.<br />

Product licensing: worldwide potential<br />

Product licensing accounts for a growing and<br />

influential share of the highly competitive<br />

retail sector. The industry is very<br />

concentrated: the top 100 licensees account<br />

for 75% of the licensed product market,<br />

which is worth USD 190 billion.<br />

While leisure and sports industries represent<br />

the bulk of the market, large industrial<br />

players account for a significant share.<br />

In <strong>2008</strong>, Michelin Lifestyle, whose mission is<br />

to leverage the value of the <strong>MICHELIN</strong> brand,<br />

occupied 61 st position in the world.<br />

Other Information<br />

Additional Information Consolidated Financial Statements The Managing Partners’ Report<br />

27