MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

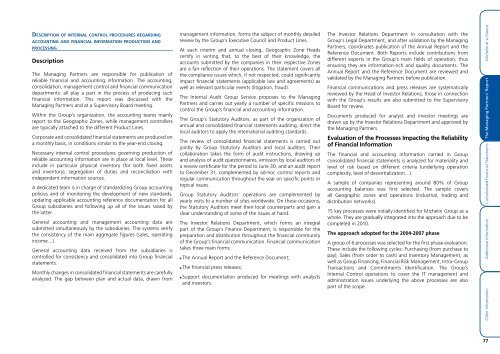

DESCRIPTION OF INTERNAL CONTROL PROCEDURES REGARDING<br />

ACCOUNTING AND FINANCIAL INFORMATION PRODUCTION AND<br />

PROCESSING<br />

Description<br />

The Managing Partners are responsible for publication of<br />

reliable financial and accounting information. The accounting,<br />

consolidation, management control and financial communication<br />

departments: all play a part in the process of producing such<br />

financial information. This report was discussed with the<br />

Managing Partners and at a Supervisory Board meeting.<br />

Within the Group’s organization, the accounting teams mainly<br />

report to the Geographic Zones, while management controllers<br />

are typically attached to the different Product Lines.<br />

Corporate and consolidated financial statements are produced on<br />

a monthly basis, in conditions similar to the year-end closing.<br />

Necessary internal control procedures governing production of<br />

reliable accounting information are in place at local level. These<br />

include in particular physical inventory (for both fixed assets<br />

and inventory), segregation of duties and reconciliation with<br />

independent information sources.<br />

A dedicated team is in charge of standardizing Group accounting<br />

policies and of monitoring the development of new standards,<br />

updating applicable accounting reference documentation for all<br />

Group subsidiaries and following up all of the issues raised by<br />

the latter.<br />

General accounting and management accounting data are<br />

submitted simultaneously by the subsidiaries. The systems verify<br />

the consistency of the main aggregate figures (sales, operating<br />

income…).<br />

General accounting data received from the subsidiaries is<br />

controlled for consistency and consolidated into Group financial<br />

statements.<br />

Monthly changes in consolidated financial statements are carefully<br />

analyzed. The gap between plan and actual data, drawn from<br />

management information, forms the subject of monthly detailed<br />

review by the Group’s Executive Council and Product Lines.<br />

At each interim and annual closing, Geographic Zone Heads<br />

certify in writing that, to the best of their knowledge, the<br />

accounts submitted by the companies in their respective Zones<br />

are a fair reflection of their operations. The statement covers all<br />

the compliance issues which, if not respected, could significantly<br />

impact financial statements (applicable law and agreements) as<br />

well as relevant particular events (litigation, fraud).<br />

The Internal Audit Group Service proposes to the Managing<br />

Partners and carries out yearly a number of specific missions to<br />

control the Group’s financial and accounting information.<br />

The Group’s Statutory Auditors, as part of the organization of<br />

annual and consolidated financial statements auditing, direct the<br />

local auditors to apply the international auditing standards.<br />

The review of consolidated financial statements is carried out<br />

jointly by Group Statutory Auditors and local auditors. Their<br />

collaboration takes the form of audit instructions, drawing up<br />

and analysis of audit questionnaires, emission by local auditors of<br />

a review certificate for the period to June 30, and an audit report<br />

to December 31, complemented by ad-hoc control reports and<br />

regular communication throughout the year on specific points or<br />

topical issues.<br />

Group Statutory Auditors’ operations are complemented by<br />

yearly visits to a number of sites worldwide. On these occasions,<br />

the Statutory Auditors meet their local counterparts and gain a<br />

clear understanding of some of the issues at hand.<br />

The Investor Relations Department, which forms an integral<br />

part of the Group’s Finance Department, is responsible for the<br />

preparation and distribution throughout the financial community<br />

of the Group’s financial communication. Financial communication<br />

takes three main forms:<br />

● The Annual Report and the Reference Document;<br />

● The financial press releases;<br />

● Support documentation produced for meetings with analysts<br />

and investors.<br />

The Investor Relations Department in consultation with the<br />

Group’s Legal Department, and after validation by the Managing<br />

Partners, coordinates publication of the Annual Report and the<br />

Reference Document. Both Reports include contributions from<br />

different experts in the Group’s main fields of operation, thus<br />

ensuring they are information-rich and quality documents. The<br />

Annual Report and the Reference Document are reviewed and<br />

validated by the Managing Partners before publication.<br />

Financial communications and press releases are systematically<br />

reviewed by the Head of Investor Relations; those in connection<br />

with the Group’s results are also submitted to the Supervisory<br />

Board for review.<br />

Documents produced for analyst and investor meetings are<br />

drawn up by the Investor Relations Department and approved by<br />

the Managing Partners.<br />

Evaluation of the Processes Impacting the Reliability<br />

of Financial Information<br />

The financial and accounting information carried in Group<br />

consolidated financial statements is analyzed for materiality and<br />

level of risk based on different criteria (underlying operation<br />

complexity, level of decentralization…).<br />

A sample of companies representing around 80% of Group<br />

accounting balances was first selected. The sample covers<br />

all Geographic zones and operations (industrial, trading and<br />

distribution networks).<br />

15 key processes were initially identified for Michelin Group as a<br />

whole. They are gradually integrated into the approach due to be<br />

completed in 2010.<br />

The approach adopted for the 2004-2007 phase<br />

A group of 6 processes was selected for the first phase evaluation.<br />

These include the following cycles: Purchasing (from purchase to<br />

pay), Sales (from order to cash) and Inventory Management, as<br />

well as Group Financing, Financial Risk Management, Intra-Group<br />

Transactions and Commitments Identification. The Group’s<br />

Internal Control operations to cover the IT management and<br />

administration issues underlying the above processes are also<br />

part of the scope.<br />

Other Information<br />

Additional Information Consolidated Financial Statements The Managing Partners’ Report Michelin at a Glance<br />

77