MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

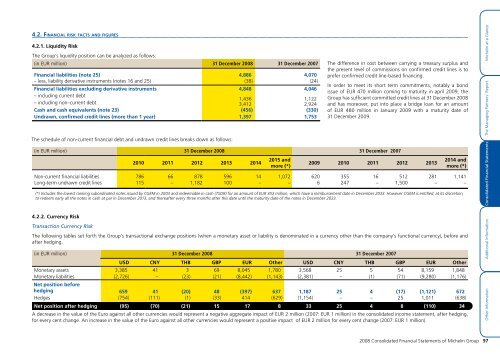

4.2. FINANCIAL RISK FACTS AND FIGURES<br />

4.2.1. Liquidity Risk<br />

The Group’s liquidity position can be analyzed as follows:<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

Financial liabilities (note 25) 4,886 4,070<br />

– less, liability derivative instruments (notes 16 and 25) (38) (24)<br />

Financial liabilities excluding derivative instruments 4,848 4,046<br />

– including current debt<br />

1,436 1,122<br />

– including non–current debt 3,412 2,924<br />

Cash and cash equivalents (note 23) (456) (330)<br />

Undrawn, confirmed credit lines (more than 1 year) 1,397 1,753<br />

The schedule of non-current financial debt and undrawn credit lines breaks down as follows:<br />

The difference in cost between carrying a treasury surplus and<br />

the present level of commissions on confirmed credit lines is to<br />

prefer confirmed credit line-based financing.<br />

In order to meet its short term commitments, notably a bond<br />

issue of EUR 470 million coming to maturity in april 2009, the<br />

Group has sufficient committed credit lines at 31 December <strong>2008</strong><br />

and has moreover, put into place a bridge loan for an amount<br />

of EUR 480 million in January 2009 with a maturity date of<br />

31 December 2009.<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

2015 and<br />

2010 2011 2012 2013 2014<br />

2009 2010 2011 2012 2013<br />

more (*)<br />

2014 and<br />

more (*)<br />

Non-current financial liabilities 786 66 878 596 14 1,072 620 355 16 512 281 1,141<br />

Long-term undrawn credit lines 115 – 1,182 100 – – 6 247 – 1,500 – –<br />

(*) Includes the lowest ranking subordinated notes issued by CGEM in 2003 and redeemable in cash (TSDR) for an amount of EUR 353 million, which have a reimbursement date in December 2033. However CGEM is entitled, at its discretion,<br />

to redeem early all the notes in cash at par in December 2013, and thereafter every three months after this date until the maturity date of the notes in December 2033.<br />

Michelin at a Glance<br />

The Managing Partners’ Report<br />

Consolidated Financial Statements<br />

4.2.2. Currency Risk<br />

Transaction Currency Risk<br />

The following tables set forth the Group’s transactional exchange positions (when a monetary asset or liability is denominated in a currency other than the company’s functional currency), before and<br />

after hedging.<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

USD CNY THB GBP EUR Other USD CNY THB GBP EUR Other<br />

Monetary assets 3,385 41 3 69 8,045 1,780 3,568 25 5 54 8,159 1,848<br />

Monetary liabilities (2,726) – (23) (21) (8,442) (1,143) (2,381) – (1) (71) (9,280) (1,176)<br />

Net position before<br />

hedging 659 41 (20) 48 (397) 637 1,187 25 4 (17) (1,121) 672<br />

Hedges (754) (111) (1) (33) 414 (629) (1,154) – – 25 1,011 (638)<br />

Net position after hedging (95) (70) (21) 15 17 8 33 25 4 8 (110) 34<br />

A decrease in the value of the Euro against all other currencies would represent a negative aggregate impact of EUR 2 million (2007: EUR 1 million) in the consolidated income statement, after hedging,<br />

for every cent change. An increase in the value of the Euro against all other currencies would represent a positive impact of EUR 2 million for every cent change (2007: EUR 1 million).<br />

Additional Information<br />

Other Information<br />

<strong>2008</strong> Consolidated Financial Statements of Michelin Group 97