MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

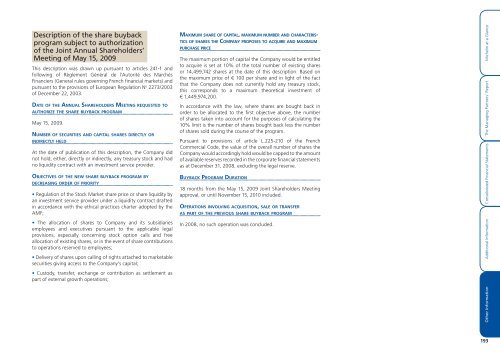

Description of the share buyback<br />

program subject to authorization<br />

of the Joint Annual Shareholders’<br />

Meeting of May 15, 2009<br />

This description was drawn up pursuant to articles 241-1 and<br />

following of Règlement Général de l’Autorité des Marchés<br />

Financiers (General rules governing French financial markets) and<br />

pursuant to the provisions of European Regulation N o 2273/2003<br />

of December 22, 2003.<br />

DATE OF THE <strong>ANNUAL</strong> SHAREHOLDERS MEETING REQUESTED TO<br />

AUTHORIZE THE SHARE BUYBACK PROGRAM<br />

May 15, 2009.<br />

NUMBER OF SECURITIES AND CAPITAL SHARES DIRECTLY OR<br />

INDIRECTLY HELD<br />

At the date of publication of this description, the Company did<br />

not hold, either, directly or indirectly, any treasury stock and had<br />

no liquidity contract with an investment service provider.<br />

OBJECTIVES OF THE NEW SHARE BUYBACK PROGRAM BY<br />

DECREASING ORDER OF PRIORITY<br />

Regulation of the Stock Market share price or share liquidity by<br />

an investment service provider under a liquidity contract drafted<br />

in accordance with the ethical practices charter adopted by the<br />

AMF;<br />

The allocation of shares to Company and its subsidiaries<br />

employees and executives pursuant to the applicable legal<br />

provisions, especially concerning stock option calls and free<br />

allocation of existing shares, or in the event of share contributions<br />

to operations reserved to employees;<br />

Delivery of shares upon calling of rights attached to marketable<br />

securities giving access to the Company’s capital;<br />

Custody, transfer, exchange or contribution as settlement as<br />

part of external growth operations;<br />

MAXIMUM SHARE OF CAPITAL, MAXIMUM NUMBER AND CHARACTERIS-<br />

TICS OF SHARES THE COMPANY PROPOSES TO ACQUIRE AND MAXIMUM<br />

PURCHASE PRICE<br />

The maximum portion of capital the Company would be entitled<br />

to acquire is set at 10% of the total number of existing shares<br />

or 14,499,742 shares at the date of this description. Based on<br />

the maximum price of € 100 per share and in light of the fact<br />

that the Company does not currently hold any treasury stock,<br />

this corresponds to a maximum theoretical investment of<br />

€ 1,449,974,200.<br />

In accordance with the law, where shares are bought back in<br />

order to be allocated to the first objective above, the number<br />

of shares taken into account for the purposes of calculating the<br />

10% limit is the number of shares bought back less the number<br />

of shares sold during the course of the program.<br />

Pursuant to provisions of article L.225-210 of the French<br />

Commercial Code, the value of the overall number of shares the<br />

Company would accordingly hold would be capped to the amount<br />

of available reserves recorded in the corporate financial statements<br />

as at December 31, <strong>2008</strong>, excluding the legal reserve.<br />

BUYBACK PROGRAM DURATION<br />

18 months from the May 15, 2009 Joint Shareholders Meeting<br />

approval, or until November 15, 2010 included.<br />

OPERATIONS INVOLVING ACQUISITION, SALE OR TRANSFER<br />

AS PART OF THE PREVIOUS SHARE BUYBACK PROGRAM<br />

In <strong>2008</strong>, no such operation was concluded.<br />

Other Information<br />

Additional Information Consolidated Financial Statements The Managing Partners’ Report Michelin at a Glance<br />

193