MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

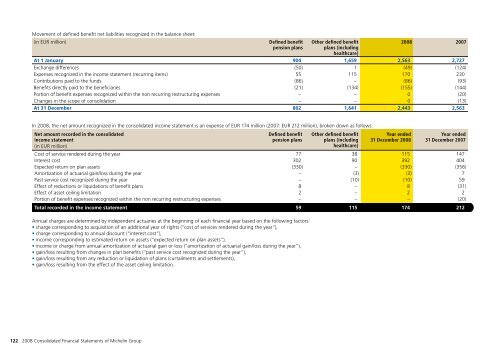

Movement of defined benefit net liabilities recognized in the balance sheet:<br />

(in EUR million)<br />

Defined benefit<br />

pension plans<br />

Other defined benefit<br />

plans (including<br />

healthcare)<br />

<strong>2008</strong> 2007<br />

At 1 January 904 1,659 2,563 2,727<br />

Exchange differences<br />

Expenses recognized in the income statement (recurring items)<br />

Contributions paid to the funds<br />

Benefits directly paid to the beneficiaries<br />

Portion of benefit expenses recognized within the non recurring restructuring expenses<br />

Changes in the scope of consolidation<br />

At 31 December 802 1,641 2,443 2,563<br />

(50)<br />

55<br />

(86)<br />

(21)<br />

–<br />

–<br />

1<br />

115<br />

–<br />

(134)<br />

–<br />

–<br />

(49)<br />

170<br />

(86)<br />

(155)<br />

0<br />

0<br />

(124)<br />

230<br />

(93)<br />

(144)<br />

(20)<br />

(13)<br />

In <strong>2008</strong>, the net amount recognized in the consolidated income statement is an expense of EUR 174 million (2007: EUR 212 million), broken down as follows:<br />

Net amount recorded in the consolidated<br />

income statement<br />

(in EUR million)<br />

Cost of service rendered during the year<br />

Interest cost<br />

Expected return on plan assets<br />

Amortization of actuarial gain/loss during the year<br />

Past service cost recognized during the year<br />

Effect of reductions or liquidations of benefit plans<br />

Effect of asset ceiling limitation<br />

Portion of benefit expenses recognized within the non recurring restructuring expenses<br />

Defined benefit<br />

pension plans<br />

Other defined benefit<br />

plans (including<br />

healthcare)<br />

38<br />

90<br />

–<br />

(3)<br />

(10)<br />

–<br />

–<br />

–<br />

Year ended<br />

31 December <strong>2008</strong><br />

Year ended<br />

31 December 2007<br />

77<br />

302<br />

(330)<br />

–<br />

–<br />

8<br />

2<br />

–<br />

115<br />

392<br />

(330)<br />

(3)<br />

(10)<br />

8<br />

2<br />

–<br />

147<br />

404<br />

(356)<br />

7<br />

59<br />

(31)<br />

2<br />

(20)<br />

Total recorded in the income statement 59 115 174 212<br />

Annual charges are determined by independent actuaries at the beginning of each financial year based on the following factors:<br />

charge corresponding to acquisition of an additional year of rights (“cost of services rendered during the year”),<br />

charge corresponding to annual discount (“interest cost”),<br />

income corresponding to estimated return on assets (“expected return on plan assets”),<br />

income or charge from annual amortization of actuarial gain or loss (“amortization of actuarial gain/loss during the year”),<br />

gain/loss resulting from changes in plan benefits (“past service cost recognized during the year”),<br />

gain/loss resulting from any reduction or liquidation of plans (curtailments and settlements),<br />

gain/loss resulting from the effect of the asset ceiling limitation.<br />

122 <strong>2008</strong> Consolidated Financial Statements of Michelin Group