MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

MICHELIN - 2008 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

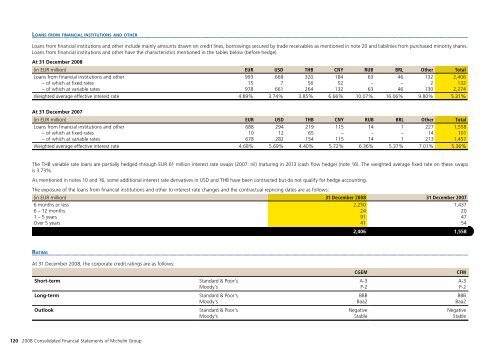

LOANS FROM FINANCIAL INSTITUTIONS AND OTHER<br />

Loans from financial institutions and other include mainly amounts drawn on credit lines, borrowings secured by trade receivables as mentioned in note 20 and liabilities from purchased minority shares.<br />

Loans from financial institutions and other have the characteristics mentioned in the tables below (before hedge).<br />

At 31 December <strong>2008</strong><br />

(in EUR million) EUR USD THB CNY RUB BRL Other Total<br />

Loans from financial institutions and other<br />

– of which at fixed rates<br />

– of which at variable rates<br />

993<br />

15<br />

978<br />

Weighted average effective interest rate 4.89% 3.74% 3.85% 6.66% 10.07% 16.06% 9.80% 5.31%<br />

668<br />

7<br />

661<br />

320<br />

56<br />

264<br />

184<br />

52<br />

132<br />

63<br />

–<br />

63<br />

46<br />

–<br />

46<br />

132<br />

2<br />

130<br />

2,406<br />

132<br />

2,274<br />

At 31 December 2007<br />

(in EUR million) EUR USD THB CNY RUB BRL Other Total<br />

Loans from financial institutions and other<br />

– of which at fixed rates<br />

– of which at variable rates<br />

688<br />

10<br />

678<br />

Weighted average effective interest rate 4.68% 5.69% 4.40% 5.72% 6.36% 5.37% 7.01% 5.36%<br />

294<br />

12<br />

282<br />

219<br />

65<br />

154<br />

115<br />

–<br />

115<br />

14<br />

–<br />

14<br />

1<br />

–<br />

1<br />

227<br />

14<br />

213<br />

1,558<br />

101<br />

1,457<br />

The THB variable rate loans are partially hedged through EUR 61 million interest rate swaps (2007: nil) maturing in 2013 (cash flow hedge) (note 16). The weighted average fixed rate on these swaps<br />

is 3.73%.<br />

As mentioned in notes 10 and 16, some additional interest rate derivatives in USD and THB have been contracted but do not qualify for hedge accounting.<br />

The exposure of the loans from financial institutions and other to interest rate changes and the contractual repricing dates are as follows:<br />

(in EUR million) 31 December <strong>2008</strong> 31 December 2007<br />

6 months or less<br />

6 – 12 months<br />

1 – 5 years<br />

Over 5 years<br />

2,250<br />

24<br />

91<br />

41<br />

1,437<br />

20<br />

47<br />

54<br />

2,406 1,558<br />

RATING<br />

At 31 December <strong>2008</strong>, the corporate credit ratings are as follows:<br />

CGEM<br />

CFM<br />

Short-term<br />

Standard & Poor's<br />

Moody's<br />

A-3<br />

P-2<br />

A-3<br />

P-2<br />

Long-term<br />

Standard & Poor's<br />

Moody's<br />

BBB<br />

Baa2<br />

BBB<br />

Baa2<br />

Outlook<br />

Standard & Poor's<br />

Moody's<br />

Negative<br />

Stable<br />

Negative<br />

Stable<br />

120 <strong>2008</strong> Consolidated Financial Statements of Michelin Group