Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial information<br />

Notes to the consolidated financial statements continued<br />

for the year ended 31 December <strong>2011</strong><br />

(all amounts are presented in thousands of Russian Roubles, unless otherwise stated)<br />

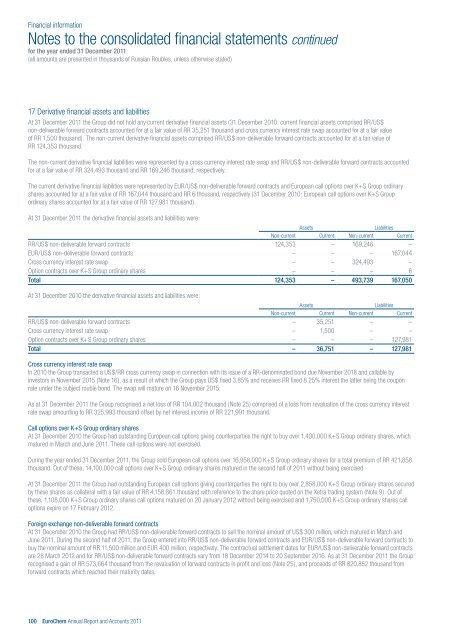

17 Derivative financial assets and liabilities<br />

At 31 December <strong>2011</strong> the Group did not hold any current derivative financial assets (31 December 2010: current financial assets comprised RR/US$<br />

non-deliverable forward contracts accounted for at a fair value of RR 35,251 thousand and cross currency interest rate swap accounted for at a fair value<br />

of RR 1,500 thousand). The non-current derivative financial assets comprised RR/US$ non-deliverable forward contracts accounted for at a fair value of<br />

RR 124,353 thousand.<br />

The non-current derivative financial liabilities were represented by a cross currency interest rate swap and RR/US$ non-deliverable forward contracts accounted<br />

for at a fair value of RR 324,493 thousand and RR 169,246 thousand, respectively.<br />

The current derivative financial liabilities were represented by EUR/US$ non-deliverable forward contracts and European call options over K+S Group ordinary<br />

shares accounted for at a fair value of RR 167,044 thousand and RR 6 thousand, respectively (31 December 2010: European call options over K+S Group<br />

ordinary shares accounted for at a fair value of RR 127,981 thousand).<br />

At 31 December <strong>2011</strong> the derivative financial assets and liabilities were:<br />

Assets Liabilities<br />

Non-current Current Non-current Current<br />

RR/US$ non-deliverable forward contracts 124,353 – 169,246 –<br />

EUR/US$ non-deliverable forward contracts – – – 167,044<br />

Cross currency interest rate swap – – 324,493 –<br />

Option contracts over K+S Group ordinary shares – – – 6<br />

Total 124,353 – 493,739 167,050<br />

At 31 December 2010 the derivative financial assets and liabilities were:<br />

Assets Liabilities<br />

Non-current Current Non-current Current<br />

RR/US$ non-deliverable forward contracts – 35,251 – –<br />

Cross currency interest rate swap – 1,500 – –<br />

Option contracts over K+S Group ordinary shares – – – 127,981<br />

Total – 36,751 – 127,981<br />

Cross currency interest rate swap<br />

In 2010 the Group transacted a US$/RR cross currency swap in connection with its issue of a RR-denominated bond due November 2018 and callable by<br />

investors in November 2015 (Note 16), as a result of which the Group pays US$ fixed 3.85% and receives RR fixed 8.25% interest the latter being the coupon<br />

rate under the subject rouble bond. The swap will mature on 16 November 2015.<br />

As at 31 December <strong>2011</strong> the Group recognised a net loss of RR 104,002 thousand (Note 25) comprised of a loss from revaluation of the cross currency interest<br />

rate swap amounting to RR 325,993 thousand offset by net interest income of RR 221,991 thousand.<br />

Call options over K+S Group ordinary shares<br />

At 31 December 2010 the Group had outstanding European call options giving counterparties the right to buy over 1,400,000 K+S Group ordinary shares, which<br />

matured in March and June <strong>2011</strong>. These call options were not exercised.<br />

During the year ended 31 December <strong>2011</strong>, the Group sold European call options over 16,958,000 K+S Group ordinary shares for a total premium of RR 421,858<br />

thousand. Out of these, 14,100,000 call options over K+S Group ordinary shares matured in the second half of <strong>2011</strong> without being exercised.<br />

At 31 December <strong>2011</strong> the Group had outstanding European call options giving counterparties the right to buy over 2,858,000 K+S Group ordinary shares secured<br />

by these shares as collateral with a fair value of RR 4,158,861 thousand with reference to the share price quoted on the Xetra trading system (Note 9). Out of<br />

these, 1,108,000 K+S Group ordinary shares call options matured on 20 January 2012 without being exercised and 1,750,000 K+S Group ordinary shares call<br />

options expire on 17 February 2012.<br />

Foreign exchange non-deliverable forward contracts<br />

At 31 December 2010 the Group had RR/US$ non-deliverable forward contracts to sell the nominal amount of US$ 300 million, which matured in March and<br />

June <strong>2011</strong>. During the second half of <strong>2011</strong>, the Group entered into RR/US$ non-deliverable forward contracts and EUR/US$ non-deliverable forward contracts to<br />

buy the nominal amount of RR 11,500 million and EUR 400 million, respectively. The contractual settlement dates for EUR/US$ non-deliverable forward contracts<br />

are 28 March 2012 and for RR/US$ non-deliverable forward contracts vary from 18 December 2014 to 20 September 2016. As at 31 December <strong>2011</strong> the Group<br />

recognised a gain of RR 573,664 thousand from the revaluation of forward contracts in profit and loss (Note 25), and proceeds of RR 820,852 thousand from<br />

forward contracts which reached their maturity dates.<br />

100 EuroChem Annual Report and Accounts <strong>2011</strong>