Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

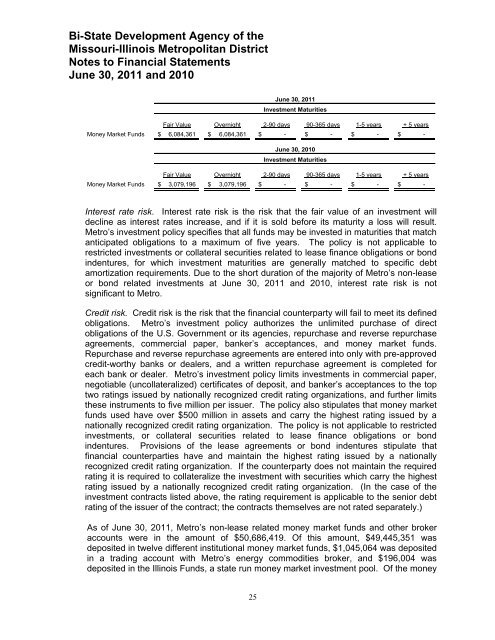

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictNotes to <strong>Financial</strong> StatementsJune 30, 2011 and 2010June 30, 2011Investment MaturitiesFair Value Overnight 2-90 days 90-365 days 1-5 years + 5 yearsMoney Market Funds $ 6,084,361 $ 6,084,361 $ - $ - $ - $ -June 30, 2010Investment MaturitiesFair Value Overnight 2-90 days 90-365 days 1-5 years + 5 yearsMoney Market Funds $ 3,079,196 $ 3,079,196 $ - $ - $ - $ -Interest rate risk. Interest rate risk is the risk that the fair value of an investment willdecline as interest rates increase, and if it is sold before its maturity a loss will result.<strong>Metro</strong>’s investment policy specifies that all funds may be invested in maturities that matchanticipated obligations to a maximum of five years. The policy is not applicable torestricted investments or collateral securities related to lease finance obligations or bondindentures, for which investment maturities are generally matched to specific debtamortization requirements. Due to the short duration of the majority of <strong>Metro</strong>’s non-leaseor bond related investments at June 30, 2011 and 2010, interest rate risk is notsignificant to <strong>Metro</strong>.Credit risk. Credit risk is the risk that the financial counterparty will fail to meet its definedobligations. <strong>Metro</strong>’s investment policy authorizes the unlimited purchase of directobligations of the U.S. Government or its agencies, repurchase and reverse repurchaseagreements, commercial paper, banker’s acceptances, and money market funds.Repurchase and reverse repurchase agreements are entered into only with pre-approvedcredit-worthy banks or dealers, and a written repurchase agreement is completed foreach bank or dealer. <strong>Metro</strong>’s investment policy limits investments in commercial paper,negotiable (uncollateralized) certificates of deposit, and banker’s acceptances to the toptwo ratings issued by nationally recognized credit rating organizations, and further limitsthese instruments to five million per issuer. The policy also stipulates that money marketfunds used have over $500 million in assets and carry the highest rating issued by anationally recognized credit rating organization. The policy is not applicable to restrictedinvestments, or collateral securities related to lease finance obligations or bondindentures. Provisions of the lease agreements or bond indentures stipulate thatfinancial counterparties have and maintain the highest rating issued by a nationallyrecognized credit rating organization. If the counterparty does not maintain the requiredrating it is required to collateralize the investment with securities which carry the highestrating issued by a nationally recognized credit rating organization. (In the case of theinvestment contracts listed above, the rating requirement is applicable to the senior debtrating of the issuer of the contract; the contracts themselves are not rated separately.)As of June 30, 2011, <strong>Metro</strong>’s non-lease related money market funds and other brokeraccounts were in the amount of $50,686,419. Of this amount, $49,445,351 wasdeposited in twelve different institutional money market funds, $1,045,064 was depositedin a trading account with <strong>Metro</strong>’s energy commodities broker, and $196,004 wasdeposited in the Illinois Funds, a state run money market investment pool. Of the money25