Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Comprehensive Annual Financial Report - Metro Transit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

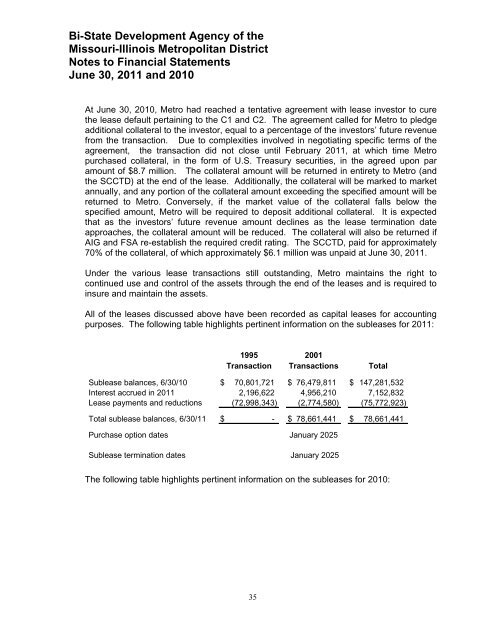

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictNotes to <strong>Financial</strong> StatementsJune 30, 2011 and 2010At June 30, 2010, <strong>Metro</strong> had reached a tentative agreement with lease investor to curethe lease default pertaining to the C1 and C2. The agreement called for <strong>Metro</strong> to pledgeadditional collateral to the investor, equal to a percentage of the investors’ future revenuefrom the transaction. Due to complexities involved in negotiating specific terms of theagreement, the transaction did not close until February 2011, at which time <strong>Metro</strong>purchased collateral, in the form of U.S. Treasury securities, in the agreed upon paramount of $8.7 million. The collateral amount will be returned in entirety to <strong>Metro</strong> (andthe SCCTD) at the end of the lease. Additionally, the collateral will be marked to marketannually, and any portion of the collateral amount exceeding the specified amount will bereturned to <strong>Metro</strong>. Conversely, if the market value of the collateral falls below thespecified amount, <strong>Metro</strong> will be required to deposit additional collateral. It is expectedthat as the investors’ future revenue amount declines as the lease termination dateapproaches, the collateral amount will be reduced. The collateral will also be returned ifAIG and FSA re-establish the required credit rating. The SCCTD, paid for approximately70% of the collateral, of which approximately $6.1 million was unpaid at June 30, 2011.Under the various lease transactions still outstanding, <strong>Metro</strong> maintains the right tocontinued use and control of the assets through the end of the leases and is required toinsure and maintain the assets.All of the leases discussed above have been recorded as capital leases for accountingpurposes. The following table highlights pertinent information on the subleases for 2011:1995 2001Transaction Transactions TotalSublease balances, 6/30/10 $ 70,801,721 $ 76,479,811 $ 147,281,532Interest accrued in 2011 2,196,622 4,956,210 7,152,832Lease payments and reductions (72,998,343) (2,774,580) (75,772,923)Total sublease balances, 6/30/11 $ - $ 78,661,441 $ 78,661,441Purchase option dates January 2025Sublease termination dates January 2025The following table highlights pertinent information on the subleases for 2010:35